Ad market set to grow in October after 11 months of decline, says SMI

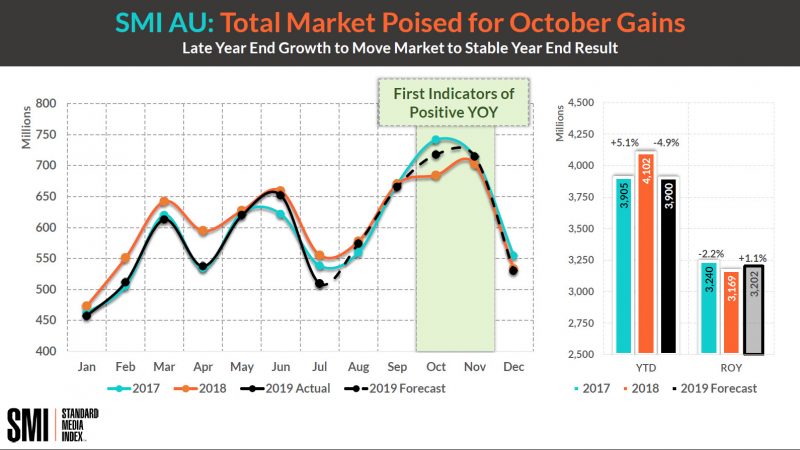

The media agency-funded ad market is set to return to growth in October, according to Standard Media Index (SMI), a positive sign in the face of recent market weakness.

The Australian ad market has experienced 11 consecutive months of decline, and in the 2018/19 financial year, the ad market was down for the first time in six years due to an “unprecedented number of negative events”.

However, the bounce back in October is set to continue into 2020, according to the SMI forecast.

SMI also revealed in its first Trans Tasman Ad Spend report a combined view of the Australian and New Zealand markets, with the value of inventory sold in both countries totalling AUD$8.1bn in 2018/19, a growth of 19%, or AUD$1.28bn, in the past 10 years.

The report was created to mark SMI’s 10th anniversary this month, and as a tool to make it easier for agencies and clients to understand demand and media share mixes across both markets.

“Of all the countries in which we publish ad spend data, the Australian and NZ media markets are the most similar, but at any time there’s never complete uniformity so this report provides a top-line view of the common trends,” SMI AUNZ managing director Jane Ractliffe said.

“It’s clear in our empirical data that extended periods of lower advertising demand are followed by strong bounces as business confidence recovers and pent up demand leads to bursts of above- average advertising expenditure.”

So far this year, the Australian market is back 4.9% and NZ 0.5%. In New Zealand , monthly ad spend fell for 12 consecutive months but has now moved back to growth in the past three months.

“If you look at SMI’s global ad spend data from 2010, in that year the US advertising market grew by 18%, the UK market by 10%, the NZ market by 11% and the Australian market by 17% as they all bounced back from periods of low demand,” Ractliffe said, noting that Australia has recorded 11 consecutive months of decline, with next week’s final August results lifting it to 12.

“So now the only question is when will the bounce-back begin, and our forecasts indicate that will happen before year-end and possibly as soon as October.

“The recent tax cuts, an expected cut in interest rates and the fact that October 2018 was a month of weak demand (back 7.7% on October 2017) all combine with SMI’s own forecasts to deliver a month of higher advertising expenditure.”

SMI’s Ractliffe

The report also shows that, in the past 10 years, the greatest increase in combined Australian and New Zealand ad spend has come from retail advertisers (+$299m) followed by automotive (+$259m) and financial services/ insurance (+$190m).

“The report also highlights the speed of change within the media industries of both countries over the past ten years as advertisers within those categories continue to shift their ad spend across various media,” Ractliffe added.

“But as SMI sources its data from the agency payment systems we’ve been able to keep the market fully informed as demand trends change.”

Can I just make a statement here? This proves that whoever is talking has an agenda here. Set to grow? Clearly wrong.