‘Unprecedented number of negative events’ drive ad market down for first time in six years

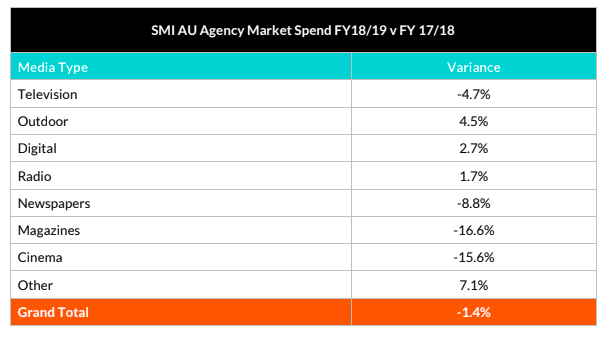

The media agency-funded ad market has ended a difficult 2018/19 financial year, down 1.4% against 2017/18’s record result to end on $6.93bn. According to the Standard Media Index (SMI), the second half of the financial year drove this drop, falling 2.9% to drag down the total financial year’s results for the first time since 2012/13.

The Royal Commission, Commonwealth Games, and various by-elections and state elections were behind last year’s record ad spend. In contrast, the 2018/19 year was plagued by a lack of business confidence, political uncertainty globally and a tighter post-Royal Commission credit market.