Australia flagged among Dentsu’s worst-performing markets

Dentsu's global CEO Hiroshi Igarashi

Australia has emerged as one of Dentsu’s worst-performing markets, with organic growth down 10% in Q3 and for the consolidated nine months.

The Australian market “continued to decline” in the three months ending 30 September 2025, standing out as “challenging” among the wider Asia-Pacific region.

Globally, Australia was grouped with Italy, Norway, and Singapore as the worst-performing markets, all recording double-digit falls in organic growth, while other Asia-Pacific markets, such as Taiwan and Thailand, continued to show growth.

The APAC region, meanwhile, posted A$230 million in revenue for the third quarter, a 12.5% decline across all markets excluding Japan.

The region’s nine-month performance follows a pattern of decline, with organic growth down 4.6% in Q1 and 12.7% in Q2, trends also seen in 2023 and 2024.

Revenue fell 17.9% in Q2 and 4.6% in Q1, with creative and customer experience divisions remaining weak. However, media, Dentsu’s strongest global segment, stayed stable through 30 September.

Overall, APAC posted A$727 million in revenue for the full nine months of 2025, down 12.6% from A$840 million a year earlier.

Given the challenging performance, Dentsu has lowered its full-year organic growth forecast for APAC, though details were not specified. In a separate statement, the company said its international markets outside Japan were now expected to decline by 3%, up from a previous forecast of 2%.

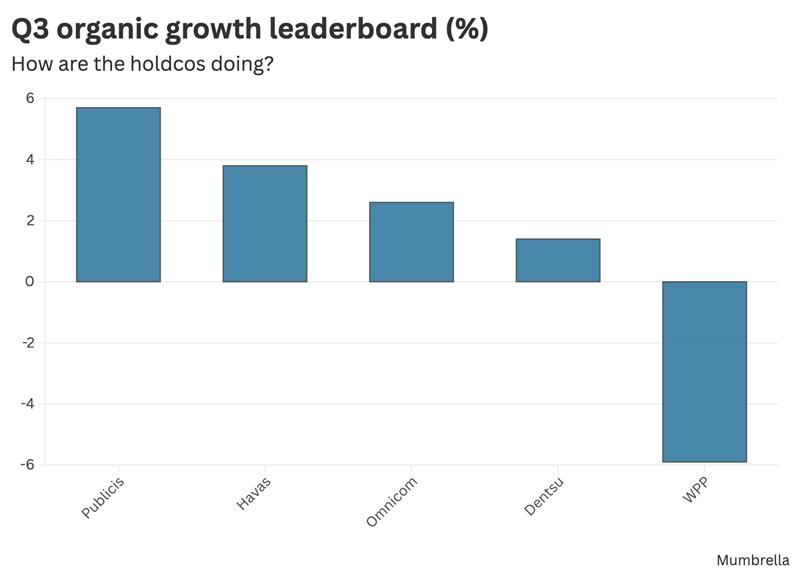

Globally, however, Dentsu’s quarterly results show a turnaround, with overall organic growth of 1.4%, up from 0.3% in the previous corresponding period and a 6.6% decline in Q3 2023.

Global revenue for the quarter reached A$3.27 billion, a 4.4% fall from A$3.42 billion a year earlier.

“We will continue to explore and implement strategic alternatives for our international business, including forming comprehensive and strategic partnerships,” global CEO Hiroshi Igarashi said of the results.

During the call, he noted that the Japanese market “continued to perform well … with high organic growth exceeding 5%” for the third quarter, helping to offset weakness internationally.