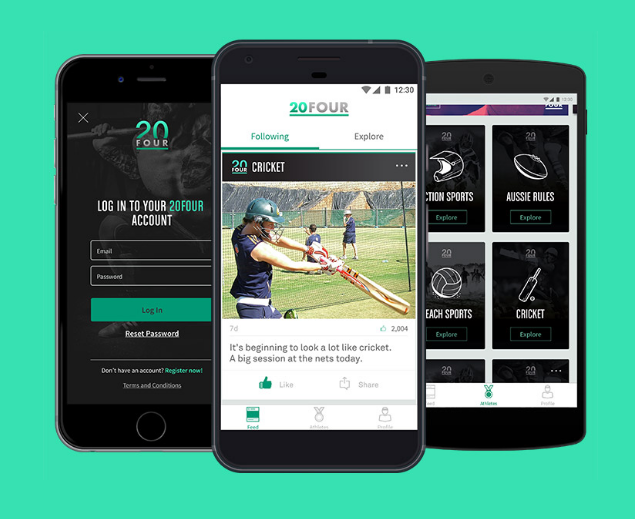

Digital sports platform 20Four goes into liquidation

Digital sports business 20Four has gone into liquidation less than two years after launch.

The business was originally started by Scott Briggs, Anthony McConville, Anthony Dunlop and former Carlton player Adrian Gleeson, and led by CEO Chris Haigh, and was created to show what life is like as a professional athlete in competition and everyday life.