‘Disappointing result’ for Ten as EBITDA plunges by 45.5%, redundancies to follow

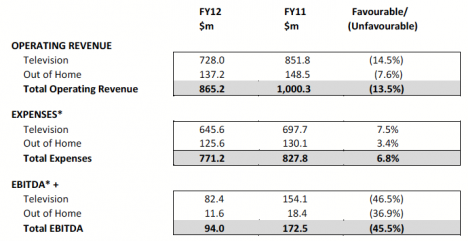

Ten has released a “disappointing” set of full year financial results that saw operating revenue fall by 13.5% and earnings before interest, taxes, depreciation, and amortization slide by 45.5%.

Boss James Warburton, who is ten months into his tenure as chief executive, pointed to Ten’s early-evening schedule performance and growth for digital channel One as highlights for its TV interests in an otherwise gloomy period for the company.

Warburton also said, in an email to staff, that there would be “painful, but unavoidable” redundancies at the network as a result of the company’s performance and tough market conditions.

“This is a disappointing result and we are focused on turning TEN around through improved ratings, revenue and cost management.”

“Undoubtedly we are operating in challenging market and competitive conditions, which have impacted our revenue performance. We have responded and secured significant cost savings in the year. We are now undertaking a Strategic, Operating and News Review to further reduce costs.

Worth looking back to this time in 2011 – and Murdoch’s comments after he’d cut costs and set 2012 strategy

“Ten is now ”well-positioned”, he said, and the market seemed to buy the pitch: its shares were up almost 9 per cent to close at 92.5¢.”

Worth noting that today, shares are at 32 cents. No digital strategy. No sale of Eye. No improvement in local programming. No real improvement at breakfast. No real improvement 6-7pm

http://www.smh.com.au/business.....z29bcAQ8ba

What’s the audience decline vs revenue decline?

The other important thing is that they made a loss.

You know, it helps to have TV people running a TV network……..

A dramatic introduction of James Warburton’s ego to reality.

But with mates like Lachlan Murdoch, a dulsitory performance needn’t mean any risk to his job. Just ask Sarah Murdoch.