‘Almost double’: Advisor wants mutiny over Nine CEO Matt Stanton’s pay

Matt Stanton's pay will be the subject of a heated AGM on November 7

Nine’s upcoming annual general meeting is likely to be a fiery one, as proxy advisor CGI Glass Lewis advises investors to vote against a proposed remuneration report, after CEO Matt Stanton’s fixed pay almost doubled in less than two years.

First reported by Capital Brief, CGI Glass Lewis issued a recommendation that investors vote down resolutions that would see Stanton financially rewarded at a rate higher than previous CEO Mike Sneesby “despite the company’s weaker earnings performance and challenging trading conditions.”

Stanton was appointed Nine’s CEO in March, after acting in the role since September 2024. He negotiated a $1.6 million fixed salary, plus a maximum of $2.4 million in Nine shares as short-term incentives, with a further $2 million a year in shares on offer as possible long-term incentives.

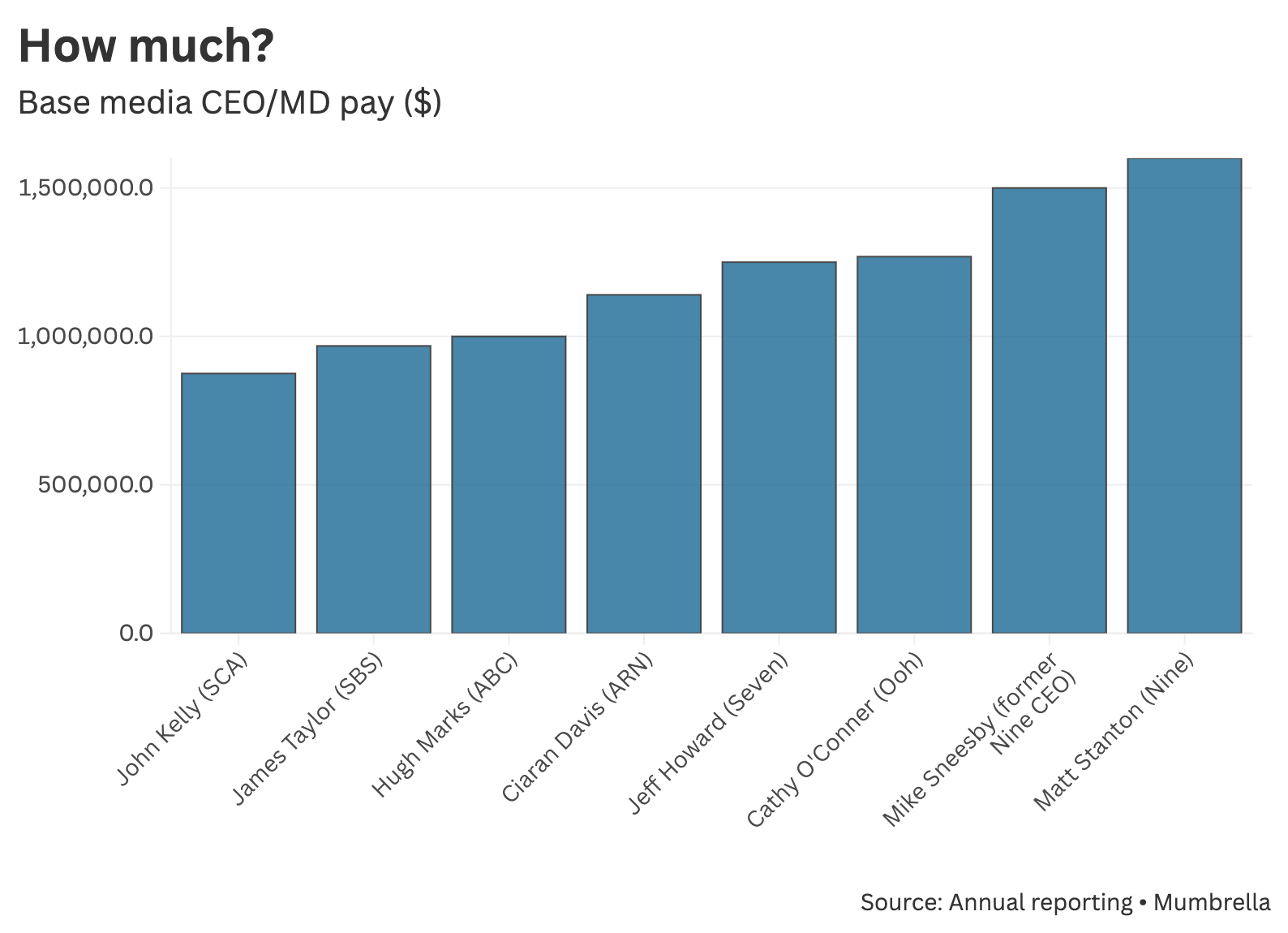

CEOs stand to make much more than base (this graph), but guaranteed income means a lot in tough times (note Hugh Marks’ salary is estimated)

“We note that following his appointment as Chief Financial and Strategy Officer in August 2023, Mr Matthew Stanton’s fixed remuneration was A$830,000,” the CGI Glass Lewis report reads.

“The Company has since decided to offer Mr Stanton a fixed pay of A$1,600,000 in his role as MD/CEO, which is almost double the pay in his former role.

“His maximum STI opportunity has also been increased to 150% of fixed remuneration, compared to the previous MD/CEO’s STI opportunity of 125% of fixed remuneration. Accordingly, Mr Stanton’s total potential pay package is approximately 14% higher than that of his predecessor, despite the Company’s weaker earnings performance and challenging trading conditions.”

Nine’s AGM will be held on November 7. Last year’s AGM saw 37.4% of shareholders vote against its remuneration report, mere weeks after a company wide probe from third-party Intersection found “a systemic issue with abuse of power and authority; bullying, discrimination and harassment; and sexual harassment.”

The report noted a litany of failures: “A lack of leadership accountability; power imbalances; gender inequality and a lack of diversity; and significant distrust in leaders at all levels of the business.” This marked the first strike against the board.

Outgoing Nine chair Catherine West has rebutted CGI Glass Lewis’ claims, in a letter that said, “under Mr Stanton’s leadership, Nine is repositioning to realise our competitive advantages across our substantial cross platform signed-in user base, spanning Streaming and Broadcast, as well as our masthead assets including The Age, The Sydney Morning Herald and AFR.

“Accordingly, his remuneration should reflect this.” West also noted that Stanton oversaw the $3b sale of Nine’s controlling stake in Domain.

West will be replaced by new chair Peter Tonagh following the AGM. Tonagh has deep media experience, including having led both News Corp Australia and Foxtel as CEO.

If Nine’s remuneration report is rejected by at least 25% of shareholders, the board will receive a second strike, which then allows a motion against the company directors. If at least 50% of shareholders vote in favour of this, it will trigger a board spill.