Despite a $575m loss, Nine is ‘weathering many of the recent storms facing the Australian economy’

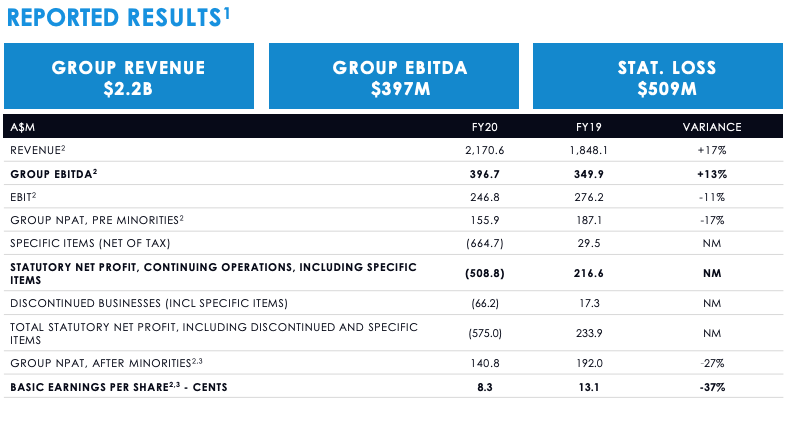

Nine’s results this morning saw it post a $575m loss for the 2020 financial year, but CEO Hugh Marks says the business is performing as well, if not better, than should be expected during COVID-19 and its economic impact.

The loss was largely related to a $665m write-down of goodwill relating to real estate business Domain and Nine’s TV broadcast assets. Excluding the write down, profit was $155.9 million.

Good result by Nine and the publishing business. Domain has had a write down, produced no dividend, still on Jobkeeper and staff on 25% pay cuts. I wonder how long this can go on.

It would be interesting to find out how The Age and SMH were travelling. Bearing in mind you can get a fair bit of what they publish for free on the website.

Hi Rick,

Nine don’t breakdown their print revenue by title, but the Metro Media business, which includes the SMH as well as the AFR, saw a 9% increase in subscription revenue and 4% rise in digital advertising revenue, as well as an 11% drop in retail circulation for print and a 19% drop in print ad revenue. Total revenue was down 6% to $426.3m and EBITDA was $88.2m

Thanks,

Hannah – Mumbrella

That’s a pretty good result in the circumstances

I don’t know how long the newspapers can survive, they have moved so far right in their reporting that they are now competing with News Ltd for the same audience. I really think they now need to drop the “Independent Always” tagline because the reporting has changed so much.

Pretty solid numbers here.

Stan growth is very healthy, and it has more than held its own against Disney+ launch as well as a more assertive Amazon Prime.

Metro Media numbers are very robust, and the product is firing at the moment.

Can’t really compare nine to the other domestic media businesses anymore – it’s nothing like either swm or nws.