SCA’s Grant Blackley on ‘historically low’ debt and the power of digital

Media business Southern Cross Austereo (SCA) was able to point to a ‘historically low’ debt on its balance sheet during its results presentation yesterday and a sizable cash reserve, providing it with liquidity during a time when that’s never been more important. CEO Grant Blackley spoke with Mumbrella’s Hannah Blackiston about how important that financial confidence is for SCA and the future of audio.

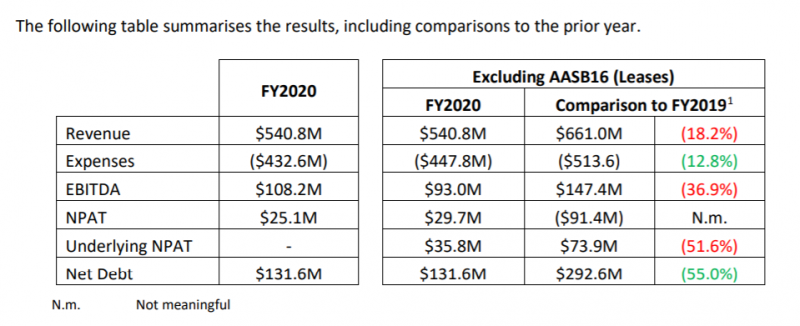

Earlier this year, Southern Cross Austereo paused trading to announce an equity raising round. The $169m it looked to raise would be used to boost liquidity and pay down its debt, then sitting around $292.6m.

Fast forward to its FY20 results and the company is holding firmly to the $160.8m it raised, giving it a total of $272m in cash and reducing its debt to a ‘historically low’ level of $131.6m. But SCA CEO Grant Blackley isn’t planning on splashing the cash anytime soon.

“We’ve reduced our debt by around 55% following the capital raising in early April which was to provide liquidity for us, given the unchartered waters we were about to go through. Pleasingly, with all the initiatives we’ve implemented across the business, while there’s been a dramatic decline in revenue, particularly across April, we actually managed the business through without utilising those capital raising funds,” he told Mumbrella.

“No question that’s put us in a better place as a business which is why we haven’t formally retired the debt. We haven’t used those funds across the quarter and we’re not expecting to use those funds in the future, but we’re just holding them to see how the economy opens up and recovers more than it is today, then we can retire the debt.”

SCA has also benefitted from the Government’s PING program which provided assistance to regional broadcasters, as well as undergoing several rounds of stand-downs and job cuts which have helped it reach that comfortable place financially. Its investment in regional is part of what is helping the business weather the COVID-19 storm, says Blackley.

A few weeks ago, the business returned to heritage brands in South Australia and Brisbane for its Hit Network, pointing to a sense of familiarity and loyalty those names hold. Yesterday, moments after the results were released, it cut regional breakfast shows to replace them with state-wide programming. This juxtaposition of a focus on regional and the continuation of cost-cutting shows just where the business currently sits – it knows what its strengths are, but it’s aware the market isn’t likely to magically turn around tomorrow.

Blackley says the next six months will still be focused on the operations of the business and maintaining its new ‘lean business and operating structure’.

“We have a considerable breadth of assets in both TV and radio across hundreds of markets. We know them intimately, we are the largest regional operator in media in this country and we take that obligation very seriously. We lean into that. In return, they provide us with a steady source of income and through this period we’ve actually seen the regional markets have been less impacted than the metro markets. National advertisers are also continuing to be educated and spend more in regional markets and all of that is underpinning our continued investment into the regions.”

Blackley says regional and digital are two of the strongest aspects of the SCA business

In its results, SCA saw the full-year revenue fall 18.2% to $540.8m, down from $661m the previous year and its underlying net profit fall 51.6% to $35.8m. Podcasting was one shining light for the business – its PodcastOne Australia arm is now cashflow positive and Blackley says the business will continue to focus on the future of audio in the coming months and years.

“We’re investing into digital audio assets which is continuing to pay increasing dividends. Our podcast revenue was up 96% this year. Instream, our addressable advertising asset, grew by 110%. We think with more time, more investment those assets will pay very strong dividends for us in the future.”

SCA is also focused on IP-enabled devices and linear live streaming, allowing audiences to listen wherever they are but also giving the business more power over data and advertising.

“I think there’s been a misconception in recent times by advertisers and marketers that if you weren’t in your car, you weren’t listening to radio, but that’s not true. What we’ve seen over the course of this is radio listeners across the board are going up. People who may have spent less time in their car are spending more time consuming more radio working from home, or in an office, live streaming.

“We’re going to spend a lot of time improving, nurturing and growing those assets because we think that is a very strong feature of our future moving forward.”

So why then did SCA bank 10m as a commitment to regional radio and a further 16m in Job Keeper? They blame the pandemic but their plans were made in advance of March this year and still cashed in.