Snap’s shares drop after latest earnings show a year-on-year loss

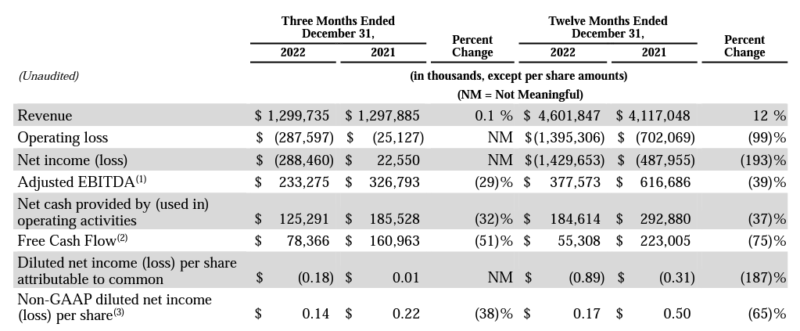

In its latest earnings, Snap Inc. posted US$4.6 billion (A$6.5 billion) in yearly revenue for 2022, an increase of 12% compared to the previous year. However, the yearly net loss widened to US$1.4 billion (A$1.9 billion).

The yearly net loss figure included restructuring charges of US$189 million (A$267 million). In the previous year, the net loss was US$488 million (A$691 million).

In its fourth-quarter ending 31 December 2022, the revenue reached US$1.3 billion (A$1.8 billion), in line with forecast. The adjusted EBITDA (earnings before interest, taxes, depreciation, and amortisation) exceeded expectations and sat at US$233 million (A$330 million), while the forecast was US$200 million (A$283 million).

The adjusted EBITDA for the full year was US$377 million (A$534 million), a decrease of 39% compared to US$616 million (A$873 million) in the previous year.

CEO of Snap Inc., Evan Spiegel, said: “We continue to face significant headwinds as we look to accelerate revenue growth, and we are making progress driving improved return on investment for advertisers and innovating to deepen the engagement of our community.”

The number of daily active users (DAUs) of Snapchat in Q4 has maintained a growth trend and sat at 375 million, a 17% increase year-over-year (YoY).

Total time spent watching Spotlight content grew over 100% year-over-year, and 17 content partners were said to have reached over 50 million global viewers each in Q4 2022.

Its subscription service, Snapchat+, reached over 2 million subscribers. Snapchat launched its first-ever Bitmoji Drop in partnership with Adidas, and a monetisation program for AR Lens creators in Australia and New Zealand.

In the letter to investors, Snap said it would not provide guidance for next quarter due to “uncertainties related to the operating environment”.

Snapchat was one of the first tech companies to see mass layoffs. In August 2022, it let go of 20% of its workforce or nearly 1,300 employees.

The company’s share plunged after the market close but was trading at US$11.56 (A$16.39) on 31 January. The market capitalisation currently sits at US$18.65 billion (A$26.44 billion)