Tuesdata: The numbers behind the SCA-SWM merger

Welcome to a Tuesday edition of Unmade on the day that Southern Cross Austereo and Seven West Media announced their plans to merge.

Today’s post is for our paying members. Everyone else will hit a paywall further down.

It’s your last chance to sign up to a paid membership of Unmade and lock in all of the current benefits. Next month, we’re going to stop accepting new paying members of Unmade. Instead we’ll be offering membership of an expanded Mumbrella Pro as we bring the two brands closer together.

All Unmade membership perks will be carried across, including complimentary tickets to REmade, Unlock and Compass for our annual paying members. These won’t be available to anyone else as part of the new Mumbrella Pro membership.

Your paid membership also includes exclusive analysis, like the piece below, and access to our content archive, which goes behind the paywall six weeks after publication.

Your voucher code for our events is available at the end of today’s post.

Upgrade today.

A merger of two fading broadcasters, or a portfolio of complementary media brands?

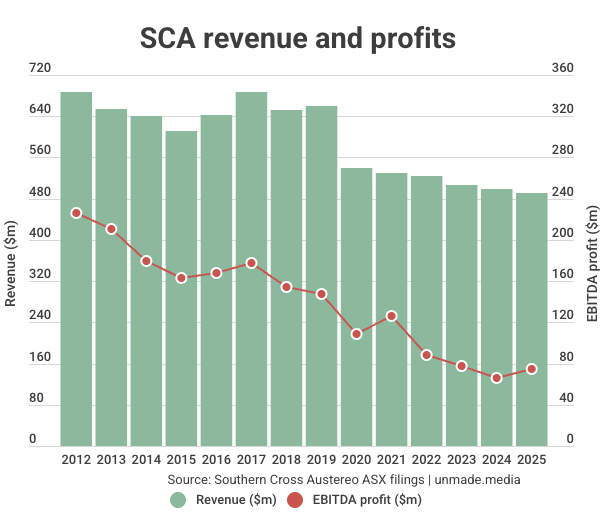

So here we go again. Some 16 months after the collapse of ARN Media’s proposal to acquire Southern Cross Austereo, a new deal is on the block – SCA plus Seven West Media.

There are few genuine mergers – there’s almost always a senior party. In 2018, the coming together of Nine and Fairfax Media was presented as a merger but in truth it was a takeover. Nine was the stock that stayed on the ASX, and became the dominant culture.

In this case, SCA will be the survivor on the ASX, acquiring the shares in SWM. SCA shareholders will get 50.1% of the company; SWM shareholders the other 49.9%.

The combined board will initially consist of four SWM directors and three SCA directors. The announcement that Seven proprietor Kerry Stokes will be the first chair looks like a face-saving device. Stokes will retire at the end of February, which would likely only be weeks after the proposed deal completes. SCA’s current chairman Heath Mackay-Cruise will then become chair of the new business.

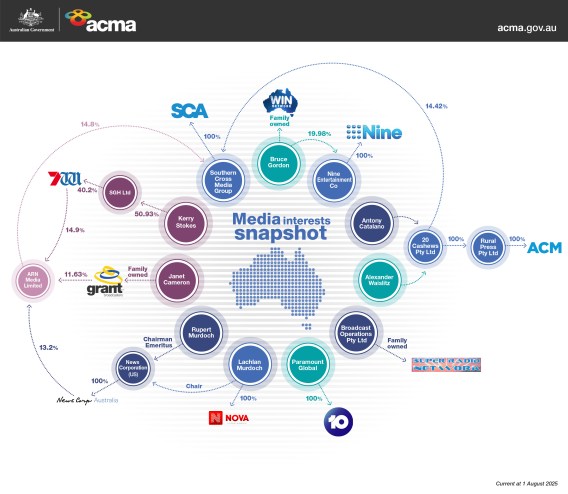

Under the deal, the Stokes family holding will drop from proprietor level –

the Stokes family currently control 51% of industrial conglomerate Seven Group Holdings, which in turn owns 40.2% of Seven West Media – that’s enough to control the business. But that SGH holding would drop to about 20% of the new mergeco. By my calculations, the Stokes family’s economic interest in the new organisation will be about 11.9%.

Seven’s CEO Jeff Howard will be boss of the new company with SCA’s CEO John Kelly in charge of the audio division.

The depressing logic behind the deal is mainly that of cost savings, with combined sales teams and shared office space etc. But perhaps it holds off opportunist investors like Sandon Capital who have seemed intent on some kind of spill of the SCA board.

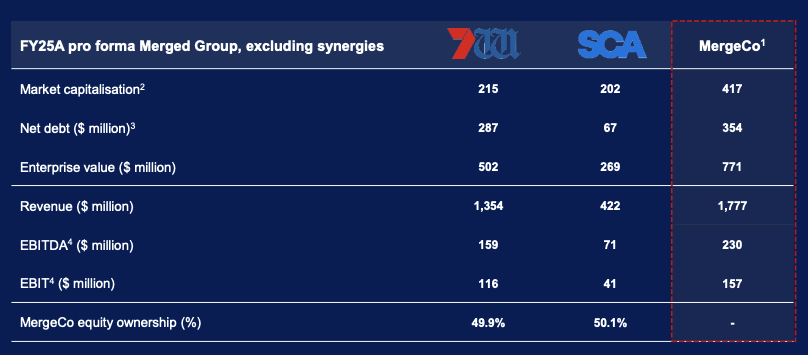

However, SCA’s shareholders in particular would be entitled to wonder what has changed to justify the new strategy. It’s only three months since the company got out of television, selling its fast-fading regional TV licences in order to finally be pure play audio.

Yet Seven West Media is mainly a TV company. Admittedly that includes ad-supported streaming, which SCA had lacked alongside its regional licences. But from Western Australia, SWM is also a player in publishing – including The West, The Sunday Times and The Nightly.

Similarly, Seven only got out of radio in 2019 when it sold its WA radio network Red Wave to – you guessed it – Southern Cross Austereo.

Among the strong strategic fits on the SCA side is that sport-loving Triple M makes for a good bedfellow with Seven, which hold rights to AFL and cricket.

At its heart, this is the merger of two disrupted, old media companies. Yes SCA owns Listnr, but most of its revenue still comes from radio. Similarly, although 7+ is growing, most of SWM’s revenue still comes from broadcast television. I don’t think the market will reassess the new company’s prospects and see it as fast growth.

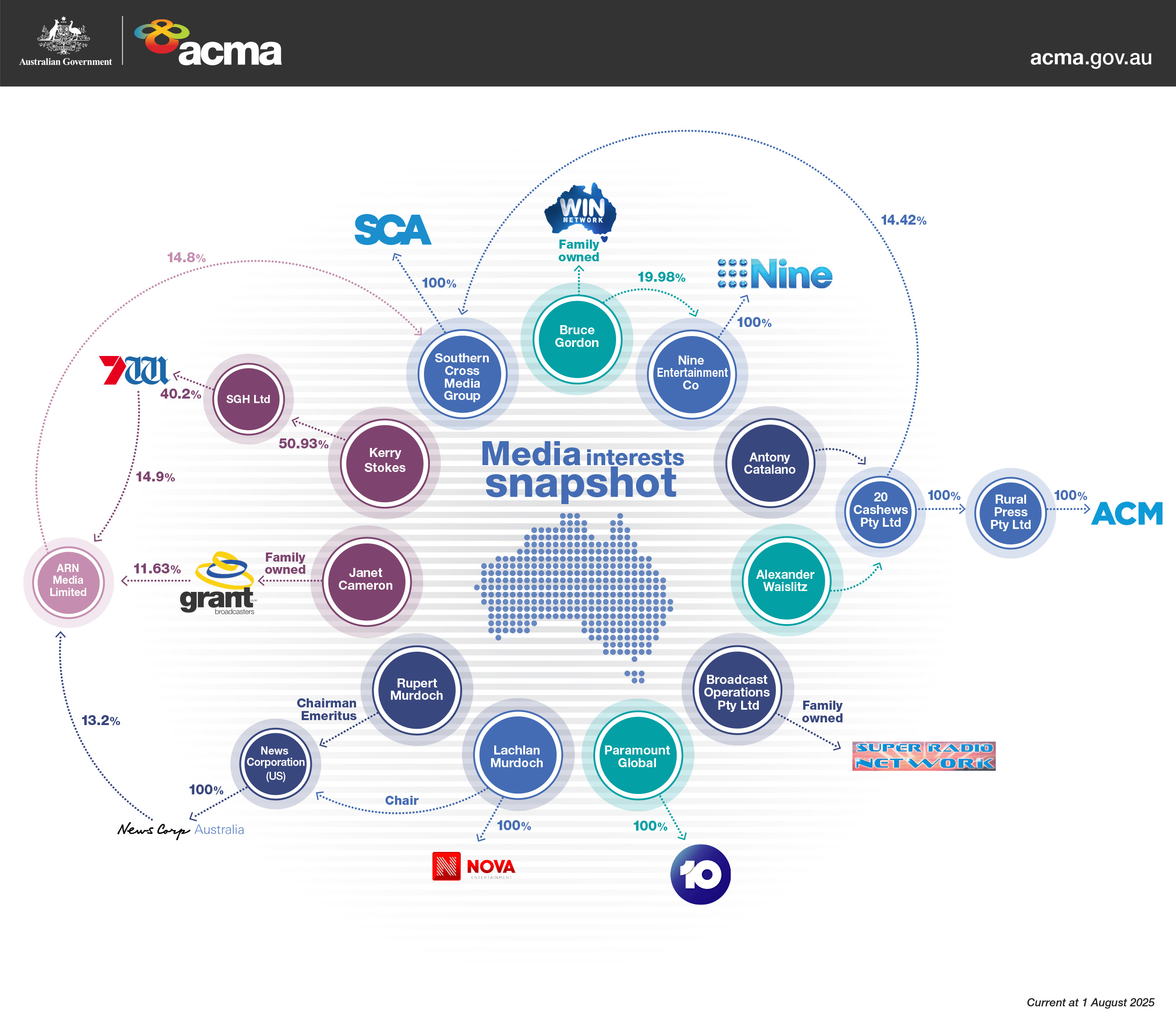

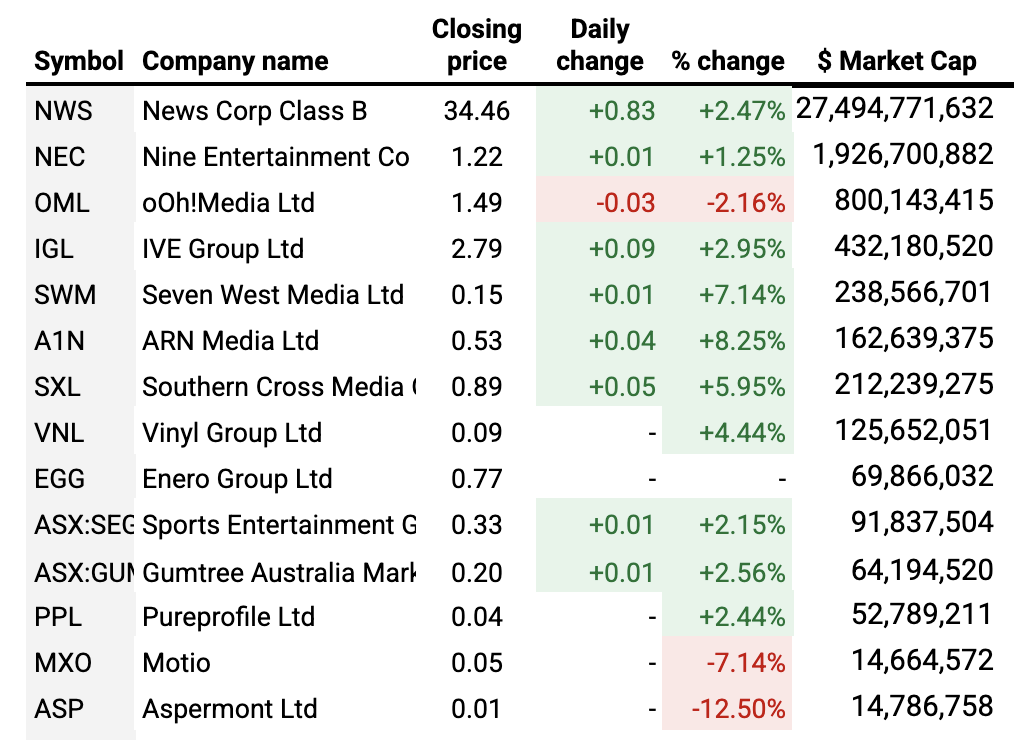

Before the announcement, Seven West Media’s market capitalisation of $215m was just ahead of SCA’s $202m. At one moment on Thursday of last week they reached parity.

At the time of writing both companies’ share prices have surged, with SCA now worth $212m and SWM $239m. That takes the combined value up to something like $450m.

The Seven side of the deal also comes with a chunky debt – currently $287m compared to SCA’s $67m.

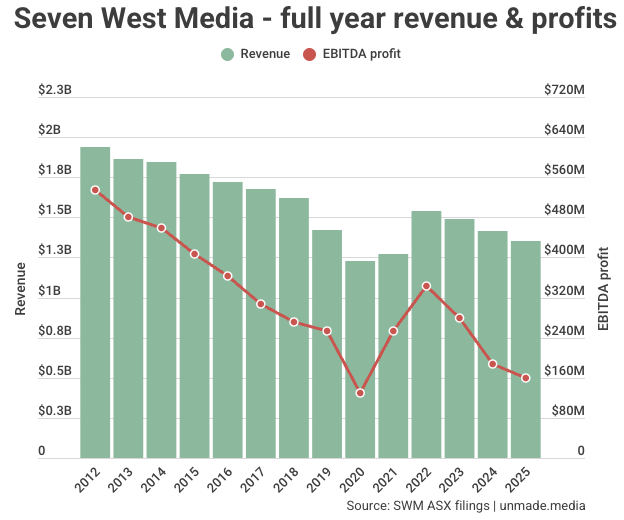

Seven writes a lot more revenue – $1.4bn to SCA’s $0.4bn. But it only delivers about twice as much EBITDA profit – $159m to $71m.

In theory, that combined profit of $230m will rise above $250m thanks to $25m to $30m being taken out of duplicated costs.

So who will create the culture in this new business? I suspect while the radio business operates out of World Square in Sydney, and the TV business out of Seven’s Eveleigh base, there will be two parallel cultures.

I assume the World Square lease has less time to run, and the plan in time would be to move everything into Eveleigh. In Melbourne, moving everyone together may be harder to justify. SCA’s South Melbourne office space is full of beautiful state-of-the-art podcast and radio studios. It would feel a waste to abandon them for Seven’s Docklands.

And which side of the country will be the company’s centre of gravity? SWM’s spiritual mothership is Perth. SCA might be run from Sydney, but its content is often driven out of Melbourne.

As the bigger company by headcount, I suspect that the culture will be more Seven than SCA. Until now, it felt that Seven was an extension of Kerry Stokes.

The company you keep: What the Bruce Lehrmann affair says about Seven's culture

And one other thing to weigh up. If the deal happens, it may not be the last of the activity involving the business. Without Kerry Stokes in the mix, the justification for owning the publishing interests becomes even less. Would News Corp be interested in picking up the Perth news mastheads, and once again owning a newspaper in every state? For the right price, probably.

Merger maths on the Unmade Index

Most media stocks had a storming day after the proposal for Southern Cross Austereo and Seven West Media to come together set off merger mania.

ARN Media was the biggest beneficiary, gaining 8.3% presumably as a takeover target. Seven West Media rose by 7.1%, while SCA was up by 6%. Sports Entertainment Group, owner of SEN Radio, rose by 2.2%.

Nine, which has been slow to show its hand after the sale of Domain, rose by 1.3%.

The Unmade Index closed on 489.6 points, up 1.41% for the day.

More from Mumbrella…

Industry bodies confirm redundancy crisis is real as creative layoff rates double

Opinion: Seoul’s unique culture offers a marketing masterclass

New study finds loyalty programs don’t necessarily breed customer loyalty

Time to leave you to your Tuesday. Thanks as ever for your support as a paying member.

And remember – our annual members get free tickets to Unmade events. Your voucher code is: MEM25

We’ll be back with more soon. Have a great day.

Toodlepip…

Tim Burrowes

Publisher – Unmade + Mumbrella

tim@unmade.media