Plain packaging could wipe billions off the FMCG sector

Five years on from Australia’s cigarette branding ban, Brand Finance’s Mark Crowe considers the impact plain packaging would have on the FMCG industry.

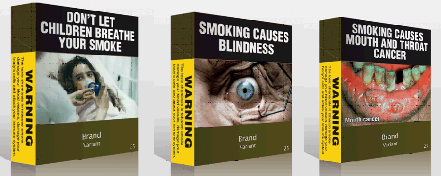

Plain packaging laws require producers to remove all branded features from external packaging, except for the brand name written in a standardised font, with all surfaces in a standard colour.

This month marks five years since Australia implemented plain packaging on tobacco. Since then France and the UK have fully implemented plain packaging for tobacco products and Ireland started implementing the regulations in September this year. Other countries, including Norway, Georgia, Slovenia, Hungary, and New Zealand have legislated for it.

Bad idea. Puts consumers at the mercy of retailers, leading to consumption primarily based on price. Not to mention sucking life and vitality out of shopping.

Puts consumers at the mercy of retailers, leading to consumption primarily based on price. Not to mention sucking life and vitality out of shopping.

Helps to reduce diabetes and other health ailments because people drink this poison.