BVOD now FTA’s ‘growth engine’, SVOD offsets subscription TV decline, finds PwC

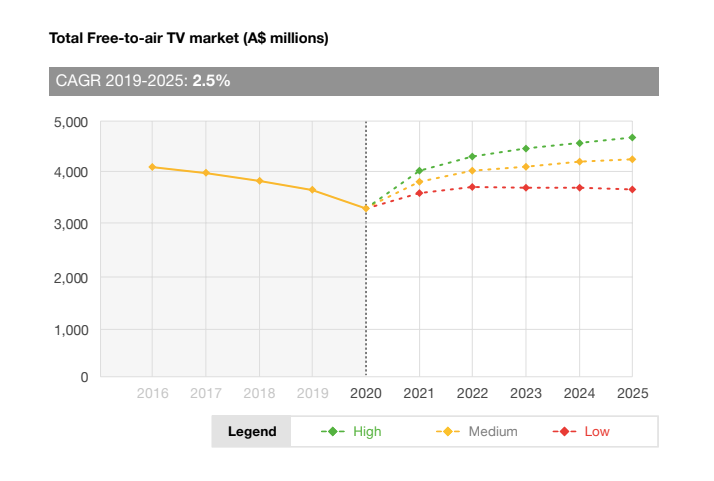

Growth in ad spend across Broadcast Video on Demand (BVOD) went some way to offsetting the 9.8% decline of the Free-To-Air (FTA) advertising market in 2020, according to PwC’s latest Australian Entertainment and Media Outlook.

A significant contraction in marketing budgets led to a fall in ad spend across FTA, with linear TV revenue dropping 12.1% to $3.1 billion. Meanwhile, BVOD experienced a 38.8% growth in revenue, hitting $229 million