Facebook no longer worried about ‘offending’ people as it reveals financial results

Facebook’s average revenue per user (ARPU) has climbed to US$8.52 across the globe, a climb of 15.6% from the same quarter one year ago.

And with the company facing multiple headwinds, including around regulation, privacy concerns and platform changes, founder and CEO Mark Zuckerberg has flagged the company no longer wants to be ‘liked’, and is less concerned about offending people.

During the results, Zuckerberg was keen to spruik the company’s efforts and progress on privacy and foreign election interference.

“There will still be debate about what kinds of political speech should be allowed, especially as the 2020 elections heat up, but by any objective measure our efforts on election integrity have made a lot of progress,” he said.

He did, however, reiterate his stance that the onus was not on him and his company to fix the problem.

“When it comes to these important social issues, I don’t think private companies should be making so many important decisions by themselves. I don’t think each service should individually decide what content or advertising is allowed during elections, or what content is harmful overall. There should be a more democratic process for determining these rules and regulations. For these issues, it’s not enough to make principled decisions – the decisions also need to be seen as legitimate and reflecting what the community wants. That’s why I’ve called for clearer regulation for our industry. And until we get clearer rules or establish other mechanisms of governance, I expect we and our whole industry will continue to face a very high level of scrutiny,” he said.

Zuckerberg also flagged a shift in the company’s philosophy and outlook, noting it no longer wants to be ‘liked’, it wants to be ‘trusted’.

“We’re also focused on communicating, more clearly, what we stand for,” he said.

“One critique of our approach for much of the last decade was that because we wanted to be liked, we didn’t always communicate our views as clearly because we worried about offending people. This led to positive but shallow sentiment towards us and towards the company.

“My goal for this next decade isn’t to be liked, but to be understood. In order to be trusted, people need to know what you stand for. So we’re going to focus more on communicating our principles – whether that’s standing up for giving people a voice against those who would censor people who don’t agree with them, standing up for letting people build their own communities against those who say that new types of communities forming on social media is dividing us, standing up for encryption against those who say privacy mostly helps bad people, standing up for giving small businesses more opportunity and sophisticated tools against those who say targeted advertising is a problem, or standing up for serving every person in the world against those who say you have to pay a premium in order to really be served.

“These positions aren’t always going to be popular, but I think it’s important for us to take these debates head on. I know that there are a lot of people who agree with these principles, and there are whole a lot more who are open to them and want to see these arguments get made. So expect more of that this year.”

He claimed Facebook goes beyond what the law requires on privacy, and said there were over 1,000 engineers working on privacy-related projects.

“So it’s going to take time, but over the next decade I want us to build a reputation for privacy that’s as strong as our reputation around building good, stable services,” he said.

The results showed a vast majority of Facebook’s revenue still comes from advertising. US$8.38 of the worldwide ARPU of US$8.52 comes from advertising – over 98%. US$40.50 of the US and Canada’s US$41.41 comes from advertising.

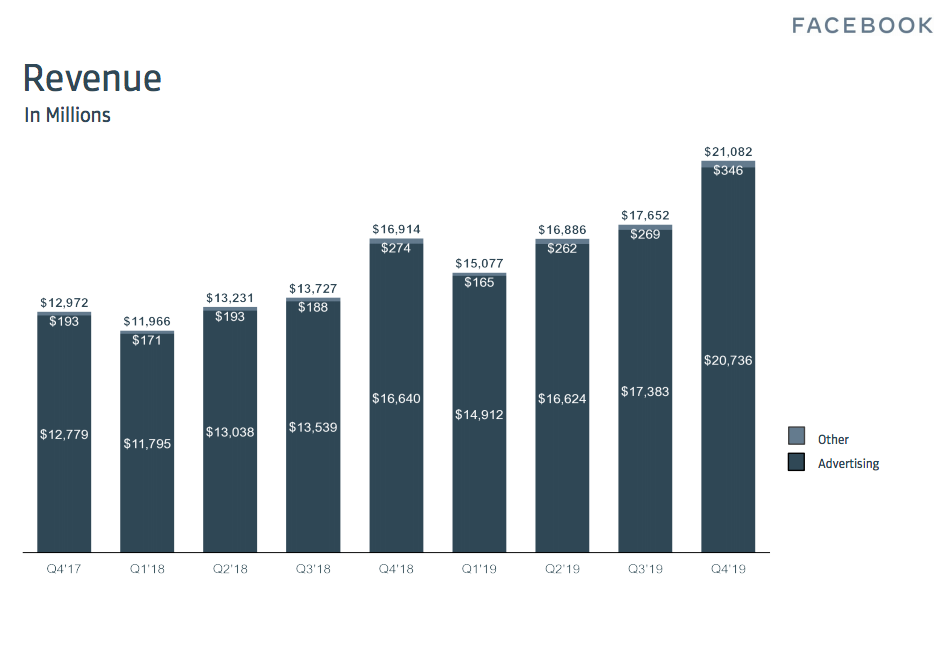

Overall, Facebook’s revenue soared to just over US$21bn for Q4 2019, over 98% of which was from advertising. This quarter’s revenue figures were up 24.6% on the same period in 2018, and 62.5% up on Q4 2017.

The internet giant is still largely reliant on the US and Canada for its revenue, with US$10.428bn (49.46%) coming from the region. Europe accounts for US$5.159bn (24.47%), followed by Asia Pacific’s US$3.665bn (17.38%), and the rest of the world on US$2.010bn (9.53%).

For the full 2019 calendar year, Facebook’s advertising revenue was up 27% from US$55.013bn to US$69.655bn. Overall revenue for the full year was up 27% to US$70.697bn.

Total costs and expenses for the year, however, soared 51% to US$46.711bn.

The company now employs 44,942 people, up 26% year on year.

In the follow-up call with investors, the company’s chief financial officer Dave Wehner was reluctant to be drawn on the make-up of Facebook’s advertisers. One caller asked for a more specific break down of the size of the businesses which advertise on its platforms, and the extent to which Facebook relies on smaller businesses.

“We really haven’t broken out how much is coming from large versus small and medium advertisers,” Wehner said. “In general, over the last several years, we’ve seen our business diversify more, so we’ve seen our – we’ve seen the higher – the largest advertisers grow more slowly than the next tiers. So our business has gotten a little bit more diversified over time. But obviously we still have a number of large advertisers.

“And when you start to get out into the long tail of the 8m advertisers, the vast, vast majority of those are very small, in terms of their contribution to revenue. But we haven’t really given any specifics on that.”

Wehner also flagged the company’s growth is likely to slow as it faces headwinds, largely around regulation and browser platform changes.

And despite emerging e-commerce opportunities across its properties including Facebook and Instagram, Wehner said traditional ads remain the company’s revenue focus.

“I would say overall, the big revenue opportunity for commerce across all of our apps for the near and medium terms is ads. And so we’re seeing a lot of customers discover and purchase through Instagram and Facebook. E-commerce and retail are amongst our largest verticals. Now as we build out additional services, like Checkout and Instagram Shopping, there will be the potential for some additional take rate there, but this is very, very small and will remain so for the foreseeable future. So I think I would really point towards this helping power our overall ads business and making more seamless – you know, seamless and more valuable ads by making transactions easier,” he said.

Facebook now reports an average daily active user (DAU) count of 1.66bn for December 2019 (up 9% year-on-year), and monthly active users (MAU) of 2.50bn (up 8%).

It spent US$511m on sales and marketing for the 2019 calendar year, down from US$569 in 2018.

More money was poured into research and development, however, with US$3.488bn for the calendar year, compared to US$3.022bn in 2018. In the three months to 31 December, 2019 alone US$931m went into R&D, compared to US$675m in Q4 of 2018.