Is the programmatic ecosystem fat, bloated and in need of an efficiency review?

Programmatic was originally sold as a catch-all solution to the problem of efficiency and performance. But after almost a decade of the new ecosystem, programmatic might now be causing the very problems it set out to solve, argues PwC’s Ben Shepherd.

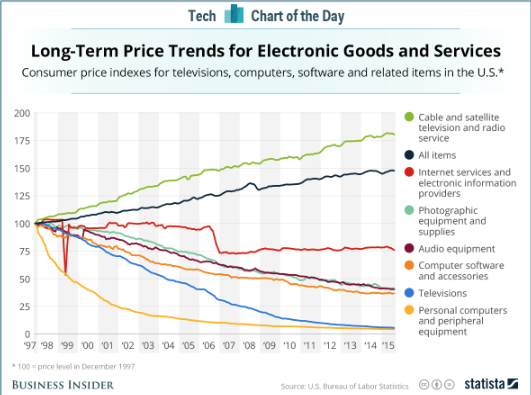

“Technological innovation is great for consumers. As technology gets more advanced, prices drop and products get better.”

So says the World Economic Forum.

Over the past 20 years, this is true for virtually every technology sector. The only exception is cable TV, due to a lack of competition and barriers to entry, which have protected the industry.

Publishers are welcome to save themselves the comms and do direct deals themselves with 3700 or so programmatic advertisers.

So, what is your solution Ben? Or just nothing to do again?

The answer to this is so bloody obvious…fragmentation of consumption of media…this is not rocket science, pretty ordinary form from a consultant not to be able to identify this and understand why costs are higher in one channel over another despite the progress of automation. Shows a lack of experience and depth of knowledge in understanding the media ecosystem. Hope this is not representative of consultants across the media industry.

Lets call this average week, clearly linked to the LinkedIn post this week which which was a lot of words without a lot of substantiation and a lack of a point.

At this rate I’d kill it in consultancy world

It is possible that this piece might be biased based on the heading. Maybe…….