TV networks to lose ad share in next five years due to ‘missing audience’ claims PwC report

Free-to-air TV’s share of the advertising pie is forecast to drop by 7% by 2020 in the face of increased competition from streaming services and other media, according to the annual PwC Australian Entertainment and Media Outlook report.

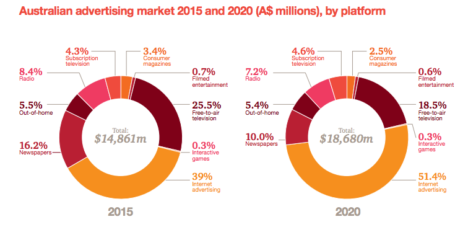

In all PwC expects the total Australian ad market to grow from $14.861bn in 2015 to $18.680m in 2020, a 4.4% compund growth rate.

The report predicts the sector to have a negative compound growth rate of 1% per year until 2020, taking its share of the ad market from 25.5% in 2015 to 18.5% by 2020, which it says will happen because of declines in TV audiences.

TV is on a long decline. It’s ceasing to be relevant, other than as a public service. The ads are horrible, their spending is high. Things like Freeview are the biggest waste of time ever imagined.

Only future, tighten their belts, give people what they want, like up to date programming.

Where’s piracy mentioned?

Time and again, I try to use paid methods, only to be stumped by horrible interfaces, patchy streaming or some other experience breaking issue.

Against that torrents are always available, download fast and provide a high-quality viewing experience.

How the so-called modern players can’t match decades old technology for ease of use and experience is beyond me.

It’s not a question of cost, it’s a massive service problem.