Foxtel admits subscriber figures include Presto users but claims cable still biggest growth driver

Pay-TV provider Foxtel has admitted it has begun including subscribers to Presto in its subscriber numbers, after the company attempted to trumpet what it claims is record growth today.

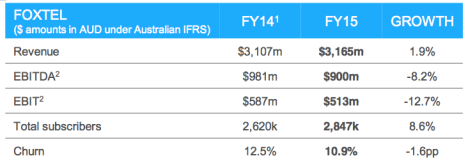

CEO Richard Freudenstein heralded an 8.6 per cent year-on-year surge in subscribers this morning, however it appears the company has changed its reporting to include its half-owned video streaming service Presto in its subscriber figures, raising questions over how much of the growth is in the high margin cable and satellite product as opposed to the much lower-margin TV and movie streaming service.

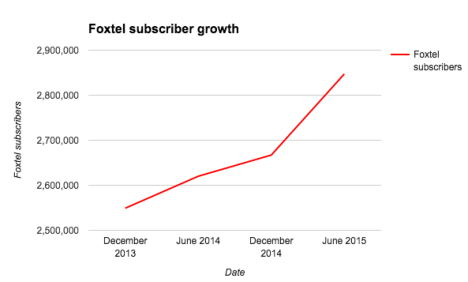

Financial results released today by Foxtel’s 50 per cent shareholder Telstra showed total subscriber numbers grew to 2.847m as of June 2015, up from 2.667m a year ago. Much of the growth has come in the last six month as the streaming video battle ramped up, while Foxtel’s earnings before interest and tax has fallen 12.7 per cent to $513m.

Asked whether Foxtel was now including its low margin SVOD service in its subscriber numbers Freudenstein told Mumbrella: “I’m pretty sure that Presto is included in the numbers, but I have been focused on the cable and satellite numbers because that’s where our most profitable product is.”

The company declined to reveal how many subscribers Presto has, but a Citi report last week issued a report that estimated Presto had 80,000 paying subscribers and 193,000 active subscribers.

Freudenstein denied that 180,000 subscriber surge was built on Presto arguing that much of the pay-TV operator’s average revenue per user (ARPU) still came from the more lucrative side of the business cable and satellite.

“Cable and satellite is very strongly in that number,” he said. “This has been our biggest year in that space for many many years.”

“Cable and satellite is very strongly in that number,” he said. “This has been our biggest year in that space for many many years.”

“The way we count Presto is as a subscriber equivalent, but the ARPU of Presto is so much lower it is not really a (major) factor in our numbers. They are very much driven by cable and satellite and things like that.”

Freudenstein also defended the drop in profit noting: “Our revenues were up. It’s been more about cost increases in growing hiring staff etc. but what you will see going forward is our profit go up.

“This drop is exactly where we anticipated to be, by the way, but you will see our profits rise in the next fiscal year.”

Foxtel’s public statements today sought to trumpet the surge after a drop in entry pricing and a huge recent marketing blitz, as it seeks to push pay-TV penetration above the 30 per cent figure which it has been stalled at for a number years and curb the threat of the arrival of Netflix.

Questioned on whether the pay-TV operator was inflating its growth figures through the inclusion Presto Freudenstein directed further comments to a spokesman, who later clarified: “The numbers do include Presto but the bulk of new subscribers are cable/satellite.

Questioned on whether the pay-TV operator was inflating its growth figures through the inclusion Presto Freudenstein directed further comments to a spokesman, who later clarified: “The numbers do include Presto but the bulk of new subscribers are cable/satellite.

“We don’t think we have artificially inflated them but Presto is in there. As I said we have had stronger growth in cable and satellite than the last couple of years put together.”

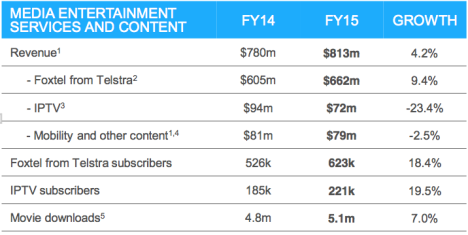

Telstra’s results also show Foxtel has a growing reliance on the telco for subscriber growth – with well over half of the new subscribers (97,000) coming from Telstra.

Telstra has recently flagged that it will move into the streaming space with the Roku2 device, launching the Telstra TV service aimed at the lower end price point of the market.

Asked about its growing reliance on the telco and the risk of its 50 per cent shareholder becoming a competitor in the space, Freudenstein said: “I think Telstra TV is an opportunity to continue to grow our IPTV customers through Presto and Foxtel Play.

“Telstra have made commitments to us around continuing to drive cable and satellite because it is where there is a lot of value for them and a lot of value for customers.

“It is indicative of the number of people willing to pay for television which is rapidly increasing. People paying for quality services like Foxtel which is increasing, but you are also seeing the SVOD and IPTV space grow as well but certainly not at the expense of Foxtel.”

Nic Christensen

tick tock

Hahahaaa! Wait for the media release where Foxtel redefines the term “subscriber” as anyone who has ever viewed an advertisement for Foxtel or picked up a brochure from the Foxtel booth in the mall.

Fudged and smudge the figures all you like, Foxtel: karma is a bitch.

a decade of contempt for customers is coming home to roost.

But I trusted everything a company affiliated with Murdoch says? 🙁 #saidnooneever

Couldn’t write comedy better than this. An unprecedented surge of 200 000 subscribers. The exact same number as the amount of Preston users.