Why I’m bringing back The One Centre

The One Centre was one of the Australian marketing industry’s biggest victims of the GFC. In this guest post, founder John Ford explains what went wrong and why he’s giving it another go

The One Centre was a fantastic company hit by the perfect storm during the GFC.

In August 2008 we were one of Australia’s largest project-based creative companies with over 60 staff. Our clients included Audi, McDonald’s, Coca-Cola, Woolworths, Mars, IAG, PricewaterhouseCoopers, GE, The Red Cross, Freedom Furniture, Jetstar and Nakheel.

Growing at an average of 50% year-on-year for nearly a decade, we posted our best-ever trading month in September 2008 – just as the GFC struck.

And as it happened, our biggest client that quarter, Dubai government developer Nakheel quickly got into financial difficulty and couldn’t pay us.

And as it happened, our biggest client that quarter, Dubai government developer Nakheel quickly got into financial difficulty and couldn’t pay us.

The combination of a A$1.25 million bad debt – our first ever – sharp downturn and high cost of downsizing created a cashflow crisis.

And this came at a moment when all the normal capital lifelines disappeared. Nobody would – or could – help us.

Investors, banks and government agencies were worried about the recoverability of the Dubai debt, we were losing money, and there was just so much fear and panic in the economy. Banks had stopped lending. Potential investors were themselves reeling from market loses and had no cash.

Our export success, which I’d viewed as a risk management strategy, ended up biting us. In a normal year 40-50% of our revenue was from international clients. That GFC quarter, over 80% of our revenue was from Dubai.

The One Centre product was great, people highly talented, clients blue chip – it was simply a financial catastrophe that took us out prematurely in the darkest days of the GFC.

I had pushed the agency hard; we were completing a major round of new infrastructure investment to support our growth – a new office floor, technology, traffic system, satellite office in London for Audi and in Dubai to support Nakheel and Audi and emerging clients in Abu Dhabi.

But this had all been done as everything was about to radically change in the world economy.

I am deeply saddened by what happened to our staff, clients and suppliers and hope to rebuild those relationships and trust with time.

I am also very grateful to many friends inside and outside the industry who have witnessed the reality of the last two years and encouraged us to keep going.

The lessons learned from this experience are so many. At a business level the most obvious being if you have variable project-based revenue you need a flexible cost base. We had too bigger fixed overhead.

We had became so successful at new business, and had such a high-quality client portfolio with reoccurring business, we began to insource all our multi-disciplinary talent needs to support demand.

However, during the GFC clients could – and did – switch off projects, or slash budgets, while an employee base isn’t as flexible, structurally or culturally….

To illustrate, our revenue in September 2008 was around A$1.27 million. By December it had dropped to $300k, 30% of what we had resourced for.

I also learnt a lot about human behaviour in a crisis, the weakness of what was ostensibly a centralised structure, the need for partners and backing, the balancing of vision with strong financial controls, the need for an external advisory team to challenge thinking, how a good network can save you, and never going overseas without capital and local contacts. Most of all I learnt about the importance of relationships.

My wife and I decided to restart The One Centre in April 2010.

I’d written a business plan for a new multi-disciplinary branded arts and entertainment business, but while the space felt right, the idea wasn’t resonating. It was evident it was the next evolution of The One Centre.

I went for a coffee with my now financial backer to get his opinion on the business direction and brand and his response was immediate and positive – resurrect The One Centre.

We poured ten years of our lives into building the original business, and lost everything trying to keep it alive, but knew its death was premature. Securing the trademarks and IP twelve months after the business was voted by creditors into liquidation was a major victory over an impossible situation.

The new One Centre will be positioned as an arts and entertainment company developing unique branded properties, platforms and programs for clients everywhere.

The arts is the most exciting space I can see. It offers our clients a whole other world of creativity. Our distinctive capability will be ‘strategy + artistry’.

Flexibly structured, with a core team of strategists and producers and global network of artists, the company will work from concept to public release, strategising, conceptualising, producing, distributing and promoting its arts and entertainment properties across media.

It’s multi-disciplinary approach will include graphic arts, digital arts, film and video, performing arts, architecture (exterior and interior), industrial design, fashion, photography and music.

Concepts will include combinations of films, shows and documentaries, artworks and installations, theatrical events, exhibitions and experiences, retail concepts, buildings, digital interfaces and experiences, music, identity, collateral, publications, products and merchandise.

There’s a lot of work to do but the brand has incredible equity and potential and I believe the new One Centre will be a better business for what’s happened. I feel I have all the necessary experience, and I know what it takes to build a great company.

My focus now is on developing a great team and producing excellent work.

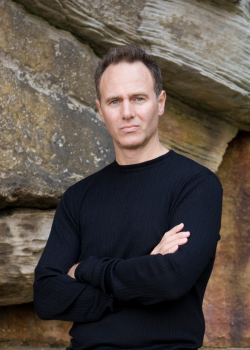

- John Ford is the foudner of The One Centre

Congratulations John, may you find the success you deserve.

Hey John,

I wish you the best of luck. I too see the future, but i feel the scope of your ambition is what crashed you last time. Leaving many casualtiies, many who may not have had the backing or capital to jump back in supersonic mode, as you clearly say you are.

Go slow, start on one thing at a time, just be happy you are able to make each one a success and be able to pay your people, and re invest the profits into more, dont try and be SKG all at once, and be humble.

Today you don’t need lavishly branded offices with original Jacobsen Egg chairs to have the prestige. It’s the work and the results from it, that give you the prestige.

Today all you need is talent, wisdom, and a wifi connection. In fact your corporate offices could be in any Macca’s.

Pace yourself. There is time.

Mr.Ford says the thing he learnt most was about ‘the importance of relationships’.

That would be a surprise to many who dealt with TOC.

Then Goldmember suggests Mr.Ford be ‘humble’. That too would be a surprise.

Let me see if I have this right.

According to Mr.Ford, TOC had 10 consecutive years of 50% growth. That’s 50% growth year on year for 10 years.

According to Mr.Ford revenues reached $1.27m by Sept 2008.

Then TOC was hit by a $1.25m debt [TOC’s first ever according to Mr.Ford].

However, we know TOC reached an agreement with the bad debtor agreeing to pay back 50% of the debt, reducing the debt to $612.5K.

So, a company with 50% growth year on year for 10 years, with monthly revenues of up to $1.27m goes broke over a $612K debt?

Is it me, or does something just not add -up?

It would mean revenue after year 1 would be $22k, after year 2 $33k, and after year 3 $50k etc. So yes, it would be possible, but I’m not sure it means it was anywhere near a profitable business

As one who has first hand knowledge of the modus operating model of the TOC: “….strategising, conceptualising, producing, distributing and promoting,,,”

Left out the blindingly obvious ‘-ing’ methinks.

Still bull****ing!

Calc is exactly right.

There’s an old Italian saying, ‘A fish dies by it’s own mouth’.

If people studied the words that come out of Mr.Ford’s ‘own mouth’ they’s soon discover the real reasons TOC died.