The data is finally in. Newspapers aren’t going to get enough digital subscribers

Friday’s audit numbers are the strongest signal yet that paywalls will not make up for lost print revenues, argues Mumbrella’s Tim Burrowes.

We’ve been talking about it for five years, but there is now finally enough data on paywalls to call it. Digital subscriptions will not save the newspaper business model.

While this has been the view of the pessimists for some time, it feels that only now is enough evidence dribbling out to reveal what those inside the publishers must have been seeing for the last few months. Most likely, they are never going to get there; at best it’s going to be a long, hard road.

Back in 2009, PHD boss Mark Holden (now the media agency’s global strategy director) reframed the question at Mumbrella Question Time.

“If the question is will people pay for online content, the answer is yeah – of course. The most important question is how many people will pay for online content?”

https://www.youtube.com/watch?v=pSNeuXZgUUY

Despite a lack of transparency from the major newspaper publishers, that question is now starting to be answered within the scraps of information they are sharing.

And it now seems likely that while paywalls are going to bring in some dollars – they will be nowhere enough to make up the shortfall. And they will probably be the hardest earned media dollars out there.

The pattern is beginning to look like an initial surge of loyal subscribers when a paywall is first activated, but then growth quickly stalls. It suggests the market size is far smaller than publishers would have hoped.

The clearest part of the picture comes with News Corp’s The Australian, which was first to move to a paywall model, initially as a freemium (some content free, premium stuff for subscribers only) offer, then as a metered (a certain number of free articles per month) model.

As we reported on Friday, it is starting to look like The Australian has hit a natural level of digital subscribers of less than 60,000.

The Australian M-F digital sales (including print and digital bundles)

- December 2012 – 39,539

- March 2013 – 45,869 (+16%)

- June 2013 – 51,213 (+5.3%)

- September 2013 – 55,991 (+4.8%)

- December 2013 – 57,282 (+2.3%)

Most relevant, of course, is that the rate of growth has slowed in each quarter – and at too low a level to be a game changer. The numbers above feature both pure digital and digital plus print subscription bundles.

Within that, the digital-only subscriptions actually slowed down (or in the case of The Herald Sun, went backwards) even more dramatically in the last three months of 2013.

The Australian digital-only sales

- December 2012 – 35,987

- March 2013 – 42,719 (+18.7%)

- June 2013 – 47,784 (+11.9%)

- September 2013 – 52,181 (+9.2%)

- December 2013 – 53,019 (+1.6%)

So in the final quarter of last year, The Oz only picked up 838 more digital subs.

Clearly, it is dangerous (and foolish) reading too much into quarter-by-quarter results, when seasonal factors always have an impact on newspapers. But equally, paywalls are too new for year-on-year comparisons to be particularly meaningful.

Given the lack of available information about the average revenue per subscriber, it’s also hard to get a realistic picture on how much revenue these digital-only subscribers are bringing in. There’s a hugh difference whether these are people who do the month-for-a-dollar trial and then drop out, or whether they stick around for the $4 a week digital offer.

But even if every one of the 53,109 are indeed paying $4 a week, that only equates to just over $200,000 a week in revenue. Or $11m a year.

Which is fine if it was simply a new revenue stream. But if this is the main route to replacing the lost print dollars, it’s not. Regardless of whether you like its editorial direction, The Oz is a well resourced, high quality product that would cost perhaps ten or even 20 times that amount to run.

And as the print side of the business shrinks, the digital base needs to be big enough to start picking up the slack so that subscribers can gradually be persuaded to pay more. Or that’s the theory, at least.

For me, the most meaningful part of the latest numbers is not that they are not there yet, it’s that they may never get there. That’s why the slowing growth number is so significant.

What if the proportion of readers who can be converted to digital is too low?

There are a number of things that still make the picture murky, to say the least.

For starters, News Corp is not yet releasing digital sales data on The Daily Telegraph and Sunday Telegraph in New South Wales, or on the Courier Mail and Sunday Mail in Queensland.

And on Fairfax Media’s side, educational and tertiary sales may be distorting the digital picture in the same way they used to bulk out the print subscriptions.

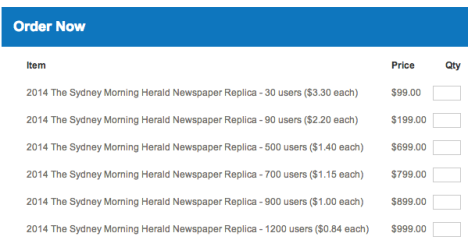

The Age reports 11,282 sales in the school category. And a further 1,763 tertiary education sales. For the Sydney Morning Herald, it’s 4,001 and 10,995.

Until you realise that each of those users of the digital replica might be worth just 84c a year.

Even with that said, Fairfax’s two metro mastheads do seem to be coming out a little ahead of The Australian, although their paywalls launched more recently.

The Age M-F digital-only and digital-plus-print sales

- Dec 2012 – 37,162

- March 2013 – 41,381 (+11.4%)

- June 2013 – 47,951 (+13.7%)

- September 2013 – 97,788 (+51%; after paywall launch)

- December 2013 – 117,892 (+20.6%)

Sydney Morning Herald M-F digital-only and digital-plus print sales

- December 2012 – 37,162

- March 2013 – 44,697 (+20.3%)

- June 2013 – 43,191 (-3.5%)

- September 2013 – 98,177 (+127.3%; after paywall launch)

- December 2013 – 120,043 (+22.3%)

But again the big question is, are these mastheads following the same path the Oz did before then – an initial surge of loyal readers and then stalled growth? Given that the paywalls launched much more recently, it will take another quarter or two to tell.

There are a couple more clues in their digital-only sales (although do bear in mind the caveat around the educational numbers):

The Age digital-only sales

- December 2012 – 16,599

- March 2013 – 19,989 (+20.4%)

- June 2013 – 26,359 (+31.9%)

- September 2013 – 60,546 (129.7%; following paywall launch)

- December 2013 – 77,220 (27.5%)

SMH digital-only sales

- December 2012 – 28,069

- March 2013 – 24,020 (-14.4%)

- June 2013 – 22,589 (-6%)

- September 2013 – 63,989 (+183.3%; following paywall launch)

- December 2013 – 83,558 (+30.6%)

So what does this mean in revenue terms? Taking out the 28,041 school and tertiary sales which are likely to be of negligible revenue, The Age and the SMH boast 132,737 digital-only subscribers between them.

The maths gets complicated here. We don’t know howe many of these users are on the $1 per month trial, how many are on the $15 per month website deal, or how many are on the $25 digital and tablet deal.

Best case though means revenue of about $3m per month for both papers, or just under $40m a year. Given that the actual number is (I reckon) likely to be less than half that, again the evidence points to digital being a long way from making up the print shortfall.

Which leaves us with News Corp’s Herald Sun. Its digital and digital-plus-print sales:

- March 2013 – 26,436 (First publication of data)

- June 2013 – 33,714 (+27.5%; after paywall launch)

- September 2013 – 37,564 (+11.4%)

- December 2013 – 39,380 (+4.8%)

And the Herald Sun’s digital-only sales:

- March 2013 – 24,318

- June 2013 – 30,624 (+25.9%)

- September 2013 – 33,203 (+8.4%)

- December 2013 – 33,106 (-0.3)

So in the final quarter, the number of Herald Sun digital-only subscribers actually went backwards by 97. That’s pretty disheartening.

And in revenue terms, even if they were all on $4 a week rather than the offer price of $1 a month, that’s only $130,000 a week or less than $7m a year.

To give context, if you add up the digital-only subscription revenues from The Australian, The Herald Sun, The SMH and The Age, they come to $58m at best. And I reckon they are more likely to be around half of that or less. Let’s call it $30m. Best case scenario, the unreleased numbers from The Tele and Courier Mail might take it up to $40m (although I doubt it).

To put that $40m a year in digital-only subs for the newspaper industry in context, it’s the same revenue that Australia’s three major commercial TV networks bring in in a single week.

In numerical terms, even if nobody was duplicated, there are only about 250,000 digital-only subscribers out there – or about 1% of the Australian population. That suggests digital offerings behind paywalls will be niche rather than mass reach.

But there are, by the way, a number of levers that could yet be pulled.

News Corp’s British tabloid The Sun has had a degree of success, reporting 117,000 paying Sun+ subs driven in major part by its video rights to Premier League football highlights. Locally, News Corp is only now beginning to tap into its ownership of Fox Sports and the content rights that come with that.

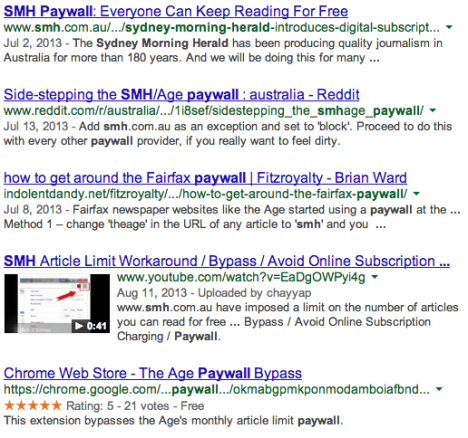

And, at present it is incredibly easy for users to easily get around the paywalls.

And, at present it is incredibly easy for users to easily get around the paywalls.

Google “SMH paywall” and four of the top five articles explain simple ways to beat the metered article limit.

In part this is because publishers don’t want to lose all of their traffic because of the need to also sell display ads. But the moment may come where they have to choose between a tougher paywall and display advertising traffic. Given that they have other display ads, and that display CPMs continue to fall, they may choose the option of the higher paywall.

All of the evidence is not yet in. The next quarter’s numbers for Fairfax will tell us a lot. And if News Corp ever shares its Tele and Courier-Mail numbers, there will be more clues there.

But five years on, the question of how many will subscribe is finally being addressed. And it looks like the answer is not enough.

Tim Burrowes is content director of Mumbrella

Linkedin

Linkedin

It’s hard to feel any kind of pity for the Main Stream Newspapers. Perhaps if they hadn’t practiced the art of almosty seamlessy merging reporting with opinion, they might be better respected and patronised. RIP

User ID not verified.

Murdoch losing money? Oh how my heart bleeds for him and his bunch of hatchet-wielding hacks.

User ID not verified.

2 things need to happen before we can get a good handle on whats happening.

1. newspapers have to market their online subscriptions heavily. ie large full frontal campaigns

2. To do that they need to let go of their legacy business model.

This switch will I imagine happen sometime late this year, or early next. When it does – it will be an aggressive advertising land grab.

User ID not verified.

That is thorough. Almost too thorough. This is analogous to automotive in au. The maths just doesn’t support paying much for news. Forget the mechanism. It just isn’t worth much when the consumer pays.

User ID not verified.

First of all, they charge way too much. Secondly, online newspapers aren’t the same as paper; true journalism is dying with paper and all we get are essentially bloggers stating their opinion (often vacuous, combative and unnecessary articles).

User ID not verified.

Nice analysis. And all good. It’s time we moved on from these stale institutions.

The Australian runs at a loss and has always run at a loss. It’s not really a business, it’s a propaganda sheet. Fairfax may have been ‘independent’ once, but now, sadly, they write for their advertisers, not their audience. I’ve long since given up on The Age but drop in to read real-estate data yarns for a chuckle from time to time.

News and Fairfax will collapse, or get bought out by someone else with an agenda and a bag of cash to waste. Either way, neither will produce what could be classed as journalism anymore, if they ever actually did.

User ID not verified.

For so many years the traditional print media was in the business of deciding what news was published, and what bias it had. So it’s hardly surprising they believed their own assessment that the newly rising internet based media – often provided freely or for a token advertising revenue – was never going to threaten them.

A wise man once said that competition never improved anyone’s performance, it just eliminated the under-performers.

User ID not verified.

It may get harder and harder for Rupert Murdoch to justify the Australian newspaper division to his shareholders without fessing up to the real reason for keeping them (in my opinion): maintaining political power and influence to ensure decisions favourable to News Corp continue to be made.

User ID not verified.

“News Corp’s British tabloid The Sun has had a degree of success, reporting 117,000 paying Sun+ subs driven in major part by its video rights to Premier League football highlights. Locally, News Corp is only now beginning to tap into its ownership of Fox Sports and the content rights that come with that.”

Hmm not sure I’d describe 117,000 subs as particularly successful given the size of the UK population (63m) and the Sun’s circulation (2.3m). Proportionately,that’s actually a lot worse than the numbers achieved by, for example the fairfax papers.

User ID not verified.

I’m wondering if Fairfax’s lead in the digital market is in some way due to the ease of getting around its paywall. Clearing cookies occasionally to keep it free is no real impost. By the way, if you go the Canberra Times instead of the SMH, it’s virtually the same content – and no need to clear cookies.

User ID not verified.

the biggest problem with newspaper companies is they’re too fat – too many costs, expenses, people, inefficient.

paywalls will never help as they’ve been built to be bloated. and the audience has been conditioned to get a product that has been over resourced.

the answer to survival is the art of cutting fat without cutting bone for both news and fxj.

User ID not verified.

‘…By the way, if you go the Canberra Times instead of the SMH, it’s virtually the same content …’

Fairfax are well aware of this loophole, which is why Canberra Times was kicked out of the ‘metro’ big boys club (comprising SMH, The Age and token Brisbane, Perth digital offerings).

The plan is to revert CT CMS to rural press style and, presto, no more back door, while simultaneously ditching the pint edition, merging CT with the local free rag, selling off the expensive Fyshwick plant and sacking most of the remaining staff.

In a year or two the Canberra Times will be a tiny digital outfit of very few staff run on the smell of an oily rag. Which sounds kinda sustainable considering the above.

User ID not verified.

@Dan – “I’m wondering if Fairfax’s lead in the digital market is in some way due to the ease of getting around its paywall.”

Erm… Anyone else spot the flaw in this logic? Given the article is about sales.

User ID not verified.

It might help the SMH’s online subscription figures if they found a way of closing the free backdoor into their online content from Google Chrome’s “incognito” mode.

User ID not verified.

As you say, they may have to choose between digital subscriptions with a tougher paywall or display advertising traffic.

I would like to see the display advertising revenue by comparison.

Whilst you can still read 30 articles for free (or more as you pointed out) digital subscriptions will remain low. If you read SMH/The Age, once you hit the 30 article limit on one you can just switch to the other. A lot of the articles go across both.

I

User ID not verified.

If you assume the advertising funded model is now dead (classified revenue migration and falling margins on online inventory due to trading desks), and that the user pays model is struggling as well, it will be interesting to see the reaction of the Australian public in the event that a masthead bites the dust, particularly if it’s a single paper city.

Losing a paper might be the catalyst the Australian public needs to realise that if you don’t pay, you might not get.

User ID not verified.

Publishers have not adopted the digital reality. The products are, more than ever, products designed for the past. It’s not just the print paradigm, but the pathetic assertion of superiority implied by their over-dosing on opinion writers.

When people have the choice of a quality news product that applies digital technology effectively then it is likely the money will flow. Unfortunately, few publishers have so far had the confidence in their product to invest and charge for it. In Australia, most of them seem to be hanging on to their comfortable jobs, cutting costs to justify their existence. But that’s not a strategy.

User ID not verified.

It’s trivially easy to circumvent the Fairfax paywall. Delete your cookie for that site, here’s another 30 articles for free. Or go into Private Browsing mode.

It’s so simple that it makes me wonder who the 160,000-odd people are that actually pay for a digital pass to The Age/SMH?

User ID not verified.

Does Fairfax know you can get around its paywall easily and simply? The very simplest of web technology is used by Fairfax to enforce the paywall, it is so easy to get around I cannot believe they use it. So there is simply no reason at all to ever buy the newspaper online or off.

User ID not verified.

A bit too Australian focused Tim. New York times is in top 30 of most profitable sites and has a paywall !!. Issue is that Australia is too small for an economy of scale for national newspapers.

User ID not verified.

I find it amusing/frustrating when people comment ‘well they should close the back doors then’ as if somehow Fairfax are the last to know about this. Of course it’s part of their longer term strategy ( get ’em hooked before we shut it down) but I think it could be used to better effect. I’m a subscriber, for now. But I’m growing tired of TV recaps and opinions from fringe dwellers appearing on the front page. I can get that from anywhere. It’s not a unique benefit. Some good old fashioned journalism wouldn’t go astray…short form on website, linking to long form and images for iPad. It will attract fewer clicks of course, but should generate a more valuable reader profile, which would be a unique territory vs your Buzzfeeds and DailyMails et al. Not every Advertiser is after cheap eyeballs. Some still see power in context.

Meanwhile of course the brands are in terrible shape and recent marketing efforts by the newspaper brands have been awful (remember the woman dressed like some Robin Hood character jumping around in space….ick). Be a brand people want to associate with and put some effort/money into it. Readership and circulation auditing shows that newspapers do have the eyeballs, so in theory should be able to open wallets given the right offer to consumers.

User ID not verified.

@Press Room – maybe people who pay want to support the future of the company and the sustainability of a product they enjoy.

I don’t get the mentality of trying to circumvent the paywall. The effort expended in doing so implies you value the content, but at the same time you will do nothing to ensure its sustainable which means it’s likely you will not be able to access it in future. It makes no sense.

User ID not verified.

The most important fact in all this is that advertising dollars have paid for quality journalism. Cover price was a sweetener for sure but advertising in print was the business model. Advertising online has not replaced it. Paywalls vs no paywalls is beside the point. How to get advertisers to fund journalism online is the real challenge.

User ID not verified.

A Non – point taken – brain in neutral! However, would sales improve if it were more difficult to circumvent the paywall?

User ID not verified.

I’ve just started subscribing to the SMH digital plus weekend papers. Very happy with what I’m getting so far for the money. Newspapers still set the agenda in this country and will continue to for the foreseeable future. That’s why the NYTimes is making money. As far as The Australian is concerned maybe you should consider that more people are avoiding putting dollars into Murdoch’s pocket because of his papers’ bias and blatant political manipulation.

User ID not verified.

Dreamers.

The newspaper business is dead.

Sure, as they hurtle to the ground they can claim they’re still alive – but as surely as gravity, their end cometh.

My Dad had the Herald delivered every day (“and three on Sundays”). I’ve hardly ever had home delivery nor bought papers. My son has never had papers delivered and doesn’t buy them.

Anyone else see a pattern here?

Television won’t be far behind.

Nobody, in the horse-and-buggy days could predict how the internal combustion engine would completely transform transport.

Nobody, in those jolly sing-a-long days, could predict how radio, then cinema, then television would put an end to musical evenings at home, gathered around the pianola.

Yeah, some people still do that, but how’s the sales of sheet music right now?

Sales of sheet music used to be the big money earner for songwriters – today it’s ringtones.

No wonder the Press Barons are trying to stifle the NBN.

Like Henry Ford once said “if I had asked people what they want, they’d have said faster horses”

User ID not verified.

2020 – Itll be over, sad days for the Australian media and the thousands employed within it.

Even sadder news for the Australian public.

The question is, what comes next, the bloggers and citizen reporters arent going to give us the facts or investigate the detail.

The government in its treatment of Assange and Snowden etc has shown that whistle blowers will not be accepted, and our current governments policy of “tell them nothing” is just the tip of the iceberg.

Unless something fills the place left by decent reporting, we are headed to sad, dark times.

User ID not verified.

‘Unless something fills the place left by decent reporting, we are headed to sad, dark times..’

Said the scribe monk of the printing press.

User ID not verified.

John Hollands nails it. The other interesting point was that when radio and TV arrived on the scene, it took ages for people to work out how to make money out of them.

No-one’s cracked online yet. One day, someone will. And then watch the value of the online eyeball rocket – because it needs to. As the tsunami of information that swamps us every day gets bigger and bigger, so the value of actually getting someone’s attention should rise, not fall.

As for the dying mainstream media, I’ll dance on their graves. They brought this on themselves, by their arrogance and their complete lack of morality. Oh how the mighty have fallen.

User ID not verified.

Solution: Change copyright laws to charge google for rehashing print media stories and headlines in their searches, and to stop websites from stealing entire articles and reposting them for clicks and ad revenue.

User ID not verified.

‘Solution: Change copyright laws to charge google for rehashing print media stories and headlines in their searches, and to stop websites from stealing entire articles and reposting them for clicks and ad revenue.’

More copyright law? We need most of it scrapped and the rest limited to five years maximum.

Copyright is one of the most constraining, useless laws on the books.

And who’s going to enforce this new regime? And how? So much fail.

User ID not verified.

I’d pay good money for an online publication sourced solely from SMH; Age/FinReview/Canberra Times. They would have one back room; one parl. bureau in Canberra; one economics desk etc etc…cutting duplicated costs. All the time giving me an outstanding paper with relevant news, well informed opinion, local content and great sport.

Instead the old MSM stick to the old model – if I want all that I have to subscribe to three or four papers. I wont do that.

User ID not verified.

@Dan – Good question, and I’m not sure. I have a feeling most of the people who are prepared to pay for content are already paying for it.

User ID not verified.

The reality is that quality journalism never paid for itself, either through cover price or display advertising. For example the Australian has never, ever made money. The classified rivers of gold were the only thing that ever made Fairfax profitable – and the inevitable delinking of classies from journalism, plus their unutterable incompetence in losing first mover advantage online in both real estate and cars has left them with nowhere to go. It is a very sad state of affairs, but it was always an artificial construct – basically an accident of history.

User ID not verified.

Good to see someone with some authority in the industry calling it for the elephant in the room.

One thing I’d like to point out – it’s a fair point Tim makes that regardless of the “dislike” people have for the Oz’s editorial direction it is at least well-resourced and “quality”.

It’s a fair point but it also comes down to the definition of well-resourced. I personally think it would be more accurate to say “well-resourced relative to the competition” – As the Oz has gotten rid of a lot of journalism positions over the years too.

The topic has been written about in great length by a lot of people and usually the answer is “The Internet killed the business model” – but there’s more to it than that. I think of it more as “The internet started killing the business model and then getting rid of journalists finished it off”.

I genuinely believe that part of the reason no-one buys the paper anymore is the lack of stories of any depth – which is a natural result of under-resourcing. A time-poor journalist pressured to produce unrealistic amounts of copy is not going to break the next Watergate.

So the situation snow-balled: more journalists numbers were cut – the product suffered more – less people bought it – even more journalists were cut – the product suffered even more – less people bought it …..on and on until you get the numbers like in the article above.

Its probably too optimistic to think that if the papers had been brave and tried to put journalism first they’d still be healthy – but I don’t think its silly to say they’d be “healthier”. Focussing on journalism first wouldn’t have saved the papers – but the failure to do this accelerated the decline.

User ID not verified.

Where is the journalism? I’m not paying money for opinion and intrusive advertising…

User ID not verified.

I think there’s two historical reasons that have significantly contributed to News Ltd mastheads poor performance. First is that they simply jumped so late into the web space. Masthead web operations were initially staffed by early adopting geeks in the papers but they were regarded with near derision and any predictions were ignored – as were requests for resources.

When there was finally some realisation that the web was getting too big to ignore the corporate resources were directed at a special digital arm, News Interactive. It became the most pernicious and corrosive force in the organisation and actively worked against every masthead.

NI quickly centralised all programming into its own staff and over time shut the masthead staff out of making any changes to their own sites architecture, organisation or strategic direction. The most basic and minor changes took months of requests and negotiations. NI actively sabotaged attempts by masthead staff to innovate and improve their products. NI’s leadership were your classic corporate smiling assassins.

As strategic control shifted to NI, online masthead readership actually declined after years of rapid and consistent growth. Masthead editors couldn’t see (and couldn’t be told) that their own power was being leeched away.

That structure is so firmly in place that even now the mastheads are constrained. It’s a ludicrous situation where an internal corporate rival has deliberately held back masthead products. News Ltd often complains about bloggers using their content, yet it’s the exact model that the corporation itself operates under: an internal operation bleeding off content for no return.

It’s a power struggle that has never been resolved and continues to hamstring the mastheads. A more profound internal change is needed before the woes of News Ltd are fixed. Either NI needs to get out of the online news business, or the mastheads do. News.com.au may claim to be Australia’s number one news site, but it’s at the expense of the mastheads. Meanwhile the mastheads struggle for subscribers when the corporation favoured child, NI, white ants them at every opportunity.

News Ltd set up the wrong model and have backed themselves into a corner. A sale or takeover would probably be the only event of enough magnitude to break their deeply flawed model.

User ID not verified.

For many years papers were available FREE online. Usually a parred down version without much depth. If you wanted depth you paid for it in the printed version. Then the quality and depth of the printed version was stripped back as solid journalists who were a pleasure to read were given the flick.

It’s no surprise that the parred back printed versions lost their appeal and circulation and revenues dropped. As financial alarm bells rang, the paid model for online was seen as a saviour of a financial train wreck and we were told that you get nothing for nothing and you should have to pay for what turned out to be vacuous news.

This is of course was accompanied by annoying over the page corny advertising executions that you hurried to delete and continual pushes to sign up and pay for other titles in their stable that were experiencing the same sorry state of affairs.

There are of course a few loopholes to get around the paywalls which are all too easy which I’m not about to reveal for obvious reasons. But just like any poor quality product where the marketers have misunderstood the consumer, it soon loses its appeal; be it free or otherwise.

User ID not verified.

For heaven’s sake, all you types leaping in glee all over the grave of ” mainstream media”.

The big metropolitan newsrooms of the SMH and the Age exposed Craig Thomson, Eddie Obeid, Ian Macdonald, and crime and corruption in the building industry – to name but a few. These stories only get broken by seasoned journalists toiling for weeks, months or years, working contacts and painstakingly checking and putting evidence together.. not the kind of stuff that bloggers and smell-of-an-oily rag operators are trained or funded to do. So be careful what you wish for.!

User ID not verified.

@scoop: Even if the Fairfax desks did that all by themselves (which they didn’t), they also knifed the Gillard government (which was a good one despite what the press barons wanted), and continue to distort the news to suit their agenda on a daily basis. The demonisation of asylum seekers, the focus on personalities above policy, the distortion of markets, the oxygen given to the lunatic fringe on climate change and the crass sensationalism of reporting at every level have distorted and corrupted our democracy and undermined our social contract. John Pilger warned us not to confuse media with information and he’s right. The mainstream media act in their own interests and nobody else’s. A bit of slavering over a few corrupt corpses doesn’t excuse the wholesale destruction they have left in their wake.

User ID not verified.

‘These stories only get broken by seasoned journalists toiling for weeks, months or years, working contacts and painstakingly checking and putting evidence together.’

Agreed.

But we don’t have any of these folk left, just celebrity bobble-heads interviewing each other endlessly.

User ID not verified.

The mainstream papers offer nothing to the reader that they can’t get anywhere else (usually cheaper and with better coverage).

Instead of finding something new to report on, their sites are stuffed full of sports and entertainment news that is at best a few days old, though I’ve seen lots of stories slip through claiming things that happened months ago as new – particularly in the technology sections.

There are literally hundreds of websites out there making money off these topics because they do a better job of it than the big boys. In trying to dip their snouts into that trough, FFX/News is killing the only thing that made their papers worth reading: the actual news.

User ID not verified.

I think it’s a shame that people are so willing to pronounce journalism dead and then jump up and down on its grave. Who will unearth stories like The Fiona Nash affair, the Craig Thompson affair, the Eddie Obeid affair, if not journalists?

User ID not verified.

Bob says in relation to investigative reporting: ‘But we don’t have any of these folk left, just celebrity bobble-heads interviewing each other endlessly.’ Um, the Obeid stuff was broken by Kate McClymont, and she’s still around. Meanwhile, the union/building industry scandal was revealed by Fairfax only a couple of weeks ago. So, you know, investigative reporting is alive and well (at Fairfax)

User ID not verified.

Whoa Vae Victus. Clearly you are a disgruntled ex news staffer still nursing the same grudges and blaming everyone else but the mastheads for their lack of success. News interactive doesn’t even exist any more.

User ID not verified.

The paywalls of the major dailies are so lame it’s hard to believe that anyone would bother to pay for a digital subscription. The Age and the Hun rely on using cookies to count page views. My cookies belong to me and I’ll do with them what I wish. If the dailies choose to control what I can read from their end then so be it. But if they try and use MY computer to keep track of me then they will be sorely disappointed. All it takes is a little armory in the form of ‘No Script’, ‘Ad Block Plus’, ‘Cookie Manager +’ and ‘Self Destructing Cookies’. Free little gems that stick it up Murdock.

User ID not verified.

If mainstream media were able to curb the relentless ATTACKS on Labor, Unions, everything Labor THEN perhaps they might be able to RESTORE some of the readership they have lost.

The Daily Telegraph and Australian are banned from our house as are all online Murdoch owned sources.

They INTERFERED in Australian democracy in an unconscionable way and HAVE paid the price. The others DID and are still doing the same to a lesser degree and these msm sources are no longer bought either.

I believe that I represent a percentage of middle Australia who are FED UP.

TIME for the mainstream media to CHANGE and stop overstepping your authority. It is the responsibility of media to REPORT news and FAct and to present balance not PROPAGANDA or POLITICAL ATTACK.

User ID not verified.

I, for one, would celebrate the demise of the Murdoch papers. They are so crassly and openly biased in their reporting, they are no more than Murdoch mouthpieces, casting aside open investigative journalism to give deeply flawed opinions instead.

As Andrew quite rightly said :” The mainstream media act in their own interests and nobody else’s”.

User ID not verified.

“Losing a paper might be the catalyst the Australian public needs to realise that if you don’t pay, you might not get,” says Simon Lawson. Well, Simon, one might also say, if you don’t offer what your readers want, you might not sell! I remember the departure of the Daily and Sunday Mirror and the Sydney Sun, all of which had a golden age before suffering from trashy terminal decline. The newly tabloid Sydney Morning Herald is now well down the same track. It’s been a long decline, getting worse and worse ever since the paper left the hands of the Fairfax family. When the new management cleared out Column 8 and features like Churches and Churchmen, put ads on the front page, and developed a line of celebrity smut (today’s example, “Stop talking about ‘cleavage trends’, Amy Adams on the red carpet”), they lost me. As Professor Bunyip has often said, both the SMH and the Age have turned their backs on their traditional readers, then wonder why they’re going broke!

I’d rather read the Trove replicas from the fifties and sixties. In fact, I do (“In the Dominions list, four new Australian knights are created”, Monday, 2 January, 1950).

User ID not verified.

Shamma, the point of a paywall is to FORCE people to pay to get past it mind after decades of free access to the paper. If the paywall goes up and proves easy to penetrate, it might as well not be there. It ha no effect on the status quo ante.

East Germany called the Berlin Wall the “Anti-Fascist Protection Barrier”. In reality, it was there to keep its own people from leaving. But either way, it was a wall that compelled most people to behave the way the rulers wanted. How long would East Germany have lasted if its wall had been easy to cross? The same applies to permeable paywalls.

User ID not verified.

Thanks for the tips to avoid the paywall. When I reach my article limit I just switch to free sites like The New Daily. No one I know pays to read news online.

User ID not verified.

Newscorp has just been given $900m cash – that should keep Pravda going for a few more years.

Just compare Gumtree with any newpaper classified. On the latter you have to define a dozen different terms, each time the page reloading painfully slow, before you can actually see and ads. You can’t “browse” advertisements like a real newspaper. On Gumtree you just set your address and then browse through the categories.

Until the newspapers get their fingers out of their backsides, sack the 1980s educated computer science graduates still writing code suitable for PDP-11s and get a proper, modern, intuitive classified interface they will never make money.

User ID not verified.

Magazine’s are looking very expensive all of a sudden. Take a look at the latest sales numbers. I think the market has spoken. I expect a push for cheap subs across the board in the face of falling retail sales just to prop up an already very weak business case for advertisers.

User ID not verified.

You have to wonder whether the real problem of publishing is it’s management culture. Just this week we have revealing examples of hubris, aggression and refusal to face facts. Mitchell at the Oz is not denying his business is a money loser. Yet he is bashing everyone who says so, using the pages readers are supposed to read news in. Hywood at Fairfax, with perhaps Corbett in the lead, appears to have tried to avoid the embarrassment of the Fairfax radio acquisition – a total debacle and one it had no reason to have done – by using his papers to cover up another screw up in dealmaking with Singleton. Whittaker at the Tele caps it off with a blast at what is a totally pliable regulator over one of his more OTT “campaigns” that was found fauilty.

God knows what these managers are thinking but one thing is clear – they are not thinking about readers.

User ID not verified.

Reading the comments there are loads of very switched on, digital minds who state very valid observations, recommendations and predictions. The problem with Fairfax is, if you look who is at the helm; It isn’t a digital person, it is an overpaid, old school, suit.

The Guardian eased into Australia, their timing could not have been better for them.

The Australian / Telegraph (Murdoch press / tripe) have no credibility whatsoever and are, indeed, a propaganda machine for a very biased regime.

What will the landscape look like in 5 – 10 years time and will there still be a force, in media that can swing elections, by hoodwinking the greedy / vulnerable and ill-informed knee jerk brigade?

User ID not verified.

How funny is this Oz v Media Watch stoush?

Media Watch: “The Oz loses 40 to 50 million a year”

The Oz: “Balderdash, utter tripe, lies and penicous lies.”

Media Watch: “we were told 40 to 50 million”

The Oz “competely wrong, irresponsible, we’ll sue! Damn fools”

Media Watch: “well, how much WAS it?”

The Oz: “not much over thirty million”

People of Australia: “Ooooh. Thirty million. No worries then. Whew, could have been serious losses, but thirty million. Ha. How wrong was the lefty ABC, eh?”

Disclaimer: in fairness, the Oz said its losses this year would likely be more in the fifteen to twenty million range.

User ID not verified.

Shareholders of Australia: do not under any circumstances buy stocks in media companies. If you have any, sell them or give them to a charity. No, give them to a waste recycler.

The evidence is in: this industry has no leadership.

User ID not verified.

I’m unlikely to start a paid subscription to the website of any metropolitan daily newspaper in Australia till at least one of them hires a decent team of copyeditors.

One myth that I’m waiting for Adam and Jamie to debunk is the myth that says world-class copyeditors are prohibitively expensive.

The copyediting team that assembles the website of The Washington Post is equal to the world’s best. That’s why, a few days ago, I started a paid subscription to WaPo.

User ID not verified.

Another way of looking at it is that newspaper content is too poor to compete with other time opportunities. Subscriptions of the paper content are falling, so it’s not surprising that offering the same content online is struggling.

As for people talking about the costs of “real reportage”, it isn’t that much. Compare the performance of the SBS with the newspapers. You have to wonder if the Australian press really *wants* to do reportage or if it feels that opinion is the best way to create a class of rusted-on customers (which is obviously the strategy of The Australian).

User ID not verified.

Dear Fairfax. Today is the last day that I look at The SMH.

The first two headlines when I looked today:

“Truth Behind Ellen’s selfie” and “‘Possibility I will revoke parole’ Corby backlash”

If I wanted to read OK magazine, I would subscribe to / but it…

The Guardian it is then. decent, informative journalism. It is my only option in Australia that is credible and reports the ‘news’ and not tabloid fodder.

User ID not verified.

buy it*

User ID not verified.

Copyright News? Is that the answer TerryG? The propaganda is working.

So now you want peoples misfortune to be an asset owned by publishers and hawked around like some looters booty.

Maybe if they added some “colour” to manufacture a hero or demon out of any unfortunate soul that is profitable for them they could have some pyrrhic ownership.

Hell why stop there just go for a work of fiction and use the facts to seed the creative work.

News organisations are valuable and honest organs which…..Continued on page 94

User ID not verified.

I don’t understand why any of this is a surprise? The newspaper media model is retracting. It won’t disappear, but the days of multiple tabloid / broadsheet options at the newsagent are over. Printing costs are huge and increasing. Credible online media outlets (Huffington Post, Mamamia, Allure etc) with a much lower cost base provide what newspapers and magazines once did any time, any place. But the death knell is the fact that these new media outlets have started lean and don’t have shareholders screaming for 8 figure margins, so they’ll always beat out attempts by the old guard to modernise because running backwards from the finish line will always mean you end up behind the person running forwards from the starting line…

User ID not verified.

I just signed up to News Ltd for their digital 28 days, cost me $1…. oh and i got a $40 Rebel sports voucher.

That should help the numbers shouldnt it?

I will of course be cancelling upon receipt of the voucher 🙂

User ID not verified.

@offalspokesperson

You only get the voucher if you remain a subscriber for 12 weeks. So after your first 28 days for $1 you’ll be up for eight weeks at $4.00 per week. Your $40 Rebel voucher will end up costing you $33.00.

Better value is a free little Firefox addon like Self Destructing Cookies. Then every time you leave the Hun web site your page views return to zero and away you go again next time. Magic!

User ID not verified.

What ‘Goodbye Print’ said sir!

User ID not verified.

As the 66th comment-maker on this article, it seems many of us have moved on from “quality journalism” (which Tim’s article very much was, as well as exceptional value for money) to creating news ‘selfies’.

What was the truth behind Ellen’s selfie anyway?

Tim, if you want your pages views to go up, a little OK magazine-style journalism will work wonders, and no one wants to pay for it on the Sydney Morning Herald.

User ID not verified.

Surprise, surprise! The dummies who run these subscriptions obstinately refuse to respond to customer concerns around privacy.

They stick to the (now failing) model of looking over your shoulder as you read the articles, and recording it.

The solution is so obvious. Sell prepaid subscription cards at outlets. They get the subscriptions, and readers enjoy the privacy they have had for centuries, and demand now.

User ID not verified.

@smacker,

Actually i got in before they changed the terms to a minimum 12 weeks, got the card today and cancelling the account next week 🙂

nevertheless thanks for the Ffox add on tip.. does chrome have one too?

User ID not verified.

Can’t believe the ego those speakers have.

Idiotic to assume online sales will be a viable model. Face it, the internet is in and the paper is out. Why is the internet successful? Because it’s free. It’s so left-wing it hurts.

There are practically zero barriers to entry online. If these companies want to compete they need to focus on web traffic not subscription fees.

Subscription up, Fee revenue up. As a result – Web traffic down, advertising revenue down, market share down

stupid

User ID not verified.

‘There are practically zero barriers to entry online.’

Untrue, there are significant costs to the user – equipment, connections, etc. It’s disingenuous to say that file-sharing or viewing content online is free, it costs a lot of money.

But because we pay to support all this communications infrastructure, we are able to benefit from things like infinite copies of digitalised material. Some industries see this as a problem and attempt to respond by creating artificial scarcity – kind of like legislating against the laws of physics.

To restate, the internet isn’t free – it’s costly, but different. And nobody is getting anything for nothing – we’re paying significant amounts for a new type of infrastructure.

User ID not verified.