Photon: $100m plus write-off; Owes banks $271m; Chairman Tim Hughes quits; Earn-outs to total $176m; Up to 50 jobs cut

Photon Group, once Australia’s biggest media and marketing group, this afternoon came clean to the ASX about the disastrous state of its finances.

It admitted that the awful performance of its Internet & E-Commerce division will see it write off “$90 million in non-cash intangible impairment charges”.

And on top of that, it said that it is also expecting to write off “approximately $28 million – $31 million in one-off costs relating to losses on discontinued or divested businesses, provisioning for restructuring, impairment of working capital and other items”.

Executive chairman Tim Hughes has stepped down from his role although he will remain as a director. The company is starting the search for a new chairman. Brian Bickmore will be the interim chairman.

Photon’s agencies includes BMF, BWM, Naked, C4, CPR, Be Interactive and Frank PR.

The EBITDA (earnings before interest, tax, depreciation and amortisation) will be dramatically less than the company had previously indicated.

The company said that “the decline” in the Internet & E-Commerce division would lead to the EBITDA being $16m less for 2010 than anticipated. Much of the blame for this has been laid at the door of its failed get-rich-quick Internet school Geekversity. The update is the second time in four months that Photon has cited the failure of Geekversity as a major reason for its woes.

And foreign exchange rates failing to go the way the company had hoped will account for another $5m.

Photon also came clean for the first time on the bill it faces for earn outs from those who have sold agencies and companies to the group.

It said: “The Company estimates total future deferred consideration payments to be approximately $176 million”. Most of that is due over the next 15 months.

Photon revealed that agency founders still in their earnout period are under pressure to renegotiate terms including accepting shares instead of cash. It said:

“Photon has commenced discussions, which are confidential and incomplete, with vendors of some operating entities with a view of restructuring the deferred consideration arrangements. The restructure of these deferred consideration arrangements is designed to cap the potential liability and convert some portion of the deferred consideration payments into Photon shares for those arrangements that are restructured.

And it revealed that the group expects that as of the end of this month its bank debt will be $271m. When trading in Photon shares on the ASX was suspended three weeks ago, its market capitalisation was $181m.

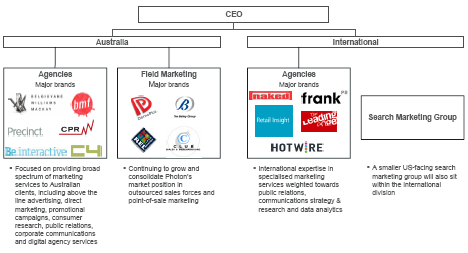

Photon has also ripped up its old operating structure, effectively shutting its Internet & E-Commerce division with the loss of up to 50 jobs. It will now have three divisions:

- Australian Agencies

- Australian Field Marketing

- International

There has been no announcement yet on who will head each division, although that is expected within the week.

The companys aid that one option it is pursuing is a capital raising. Market speculation is that this might price Photon Group shares at about 25c, compared to the $1.02 they were before it went into the trading halt. The company said it woudl remain in a voluntary suspension from the ASX until the review is completed.

The company also signalled – if it wasn’t already obvious – that its days of acquiring companies are behind it. It said: “Growth via acquisition will not be the focus of the Company.”

The company said that agencies BWM and BMF had performed well: “Robust growth across existing and new client wins” but Naked had has a “softer” second half.

The downbeat announcement comes just weeks after Jeremy Philips took over as CEO.

Linkedin

Linkedin

“Photon revealed that agency founders still in their earnout period are under pressure to renegotiate terms including accepting shares instead of cash”

Yeah, of course they’re going to accept shares that are going to be worth 4/5 of fuck all in lieu of millions in cash….if they’re insane! Lawyers at dawn I would suspect.

User ID not verified.

Owwwccch!

User ID not verified.

Woah,

I know how the conversation will go though – “If you don’t accept shares, the company will go bust, then you’ll get nothing…”

User ID not verified.

Anonymous

Yeah of course you’re right. it’s absolutely insult to injury though. As an ex-Photon-er I saw them decimate the company culture, rape and pillage etc with no regards to the people who helped build the companies they bought…many of which evolved from groups of mates doing handshake deals. And now, not even the owners are getting paid.

User ID not verified.

What a kick in the balls for anyone expecting an earn out in the next FY

User ID not verified.

This is interesting reading too – http://www.photongroup.com/inv.....09fins.pdf – especially around payment to the ‘executives’ who have steered the ship so well.

At least the Directors were all handsomely paid. Imagine what they would have been paid had their decisions been sound ones!

User ID not verified.

These comments are hilarious and show the ignorance of most in advertising.

User ID not verified.

Earn-outs and badly purchased companies that failed will kill this group.

I blame the people around the board room table.

User ID not verified.

Good timing once again from Jamie Packer buying into Photon a week before their shares are suspended … he’s the kiss of death to just about everything he touches but boy are they a match made in heaven! Anyone who did an ounce of research could see Photon was a time bomb so his analysts should be ashamed of themselves.

User ID not verified.

“Photon’s agencies includes BMF, BWM, Naked, C4, CPR, Be Interactive and Frank PR.”

– I watched a news piece about greedy advertising exec’s on the UK’s Channel 4 network. It was about the fact that ad exec’s are second to investment bankers in terms of doing nothing for society.

They drive around in their BMW’s, not giving a blind mans fart about anything else. if they were truly interactive with their responsibilities they might not need CPR right now. To be frank, they want everything for nothing and are not prepared to strip off and get stuck into some real hard graft to deliver clients what they want.

Perhaps merge all companies together and call the new big business: ‘Greedy Bollox’?

User ID not verified.

Touche Silly Name

User ID not verified.

I hear that local offices and digital divisions at the larger agencies are being prepared for sell off to meet earn out payments

User ID not verified.

Sounds very familiar. I know many people who would never work for a Photon agency again. Unsound calls on business strategy in order to appease their shareholders…

User ID not verified.

“Photon has also ripped up its old operating structure, effectively shutting its Internet & E-Commerce division”

This is factually not true. Photon will not shut down Internet & E-Commerce, but instead restructure all of its 5 division into 3. Jobs will be lost, but the only company that will close down is Geekdom!

User ID not verified.

Interesting comment in today’s CBD column in the SMH by Scott Rochfort. As he says, ‘lucky timing’.

http://www.smh.com.au/business.....-zf66.html

User ID not verified.

Today’s press includes comments such as: Photon “one of the weakest companies on the ASX…lucky to be alive and listed”. And Jeremy Philips’ acknowledgement that Photon needs to be “a little less opaque”.

I hope Precinct’s CEO, Sean Langdon, is paying attention – he wrote me a letter with a threat of legal action should I ever say anything against his company. All I had done was press Precinct for settlement of my company’s overdue accounts.

Photon and Precinct apparently took themselves to be a fiefdom, rewriting the rules on free speech. This is comeuppance.

User ID not verified.

Using legal threats to stop bad press when Photon companies did not pay their bills has happened in another Photon company I know of. Maybe it’s standard operating practice?

User ID not verified.

Looking at those agency assets, i am very surprised the company is worth $181m.

Rumour of the share price dropping 75% sounds about right … would put Photon value around $45-50m which seems about right considering the state of it all.

Blue Freeway: the sequel. Even more brutal than the first

User ID not verified.

As an ex-Photon employee (with shares) wasn’t this obvious to everyone involved from day one? What assets do Photon actually have?? Apart from a few company names, and these companies keep getting ‘restructured’!!

When has profitability ever won over sustainability??

User ID not verified.

We have seen this happening time and time again…this is nothing new

Consolidation as a business model and the notion of growth via acquisition should be laid to rest once and for all and disbanded altogether.

Promises of “synergy”, “cost efficiency” and “harmonisation” are often deployed in the sales pitch but have been rarely successful.

I am only sorry that like me, so many entrepreneurs with sound businesses have succumbed and joined a fundamentally weak and inferior business model and will likely get nothing for the pleasure.

User ID not verified.

..oh , and how can Tim Hughes stay as a Director after overseeing both strategic and financial blunders? can anyone PLEASE EXPLAIN?

User ID not verified.

See ya Photon, it hasn’t been nice knowing you.

User ID not verified.

Hopefully the corporate regulators will take a look at this.

User ID not verified.

Saw this coming

Not many companies make a success of aggregating internet companies.

And in a small mkt like Aust.

Recipe for disaster

User ID not verified.

Deja vu perhaps?

http://www.smartcompany.com.au.....wrong.html

User ID not verified.

There are four fundamental issues that kill these consolidation deals:

1) Almost all of the profit from the initial IPO always goes to the dealmakers that put it together, rather than into funding future acquisitions, so you need to fund future deals through debt…does anyone else see this as a fundamentally bad idea?

2) There is hardly ever any proper due-diligence – it is always assumed that any ‘issues’ will be caught later by the auditors, but it’s too late by then – the money’s already gone.

3) Over-paying for good assets and over-valuing shit ones

No-one can argue that BWM,BMF and Naked are not good brands and businesses, but they are low-margin, high-cost models, that work when the principals have their nuts on the line, and Photon massively overpaid for them (exp Naked if the nos reported are correct). They are also prepared to over-pay for crap assets, knowing that, once they have in the fold, they will never have to ultimately pay their final earn-out anyway, and the cash upfront is just funny money anyway, isn’t it????

4) Having CEOs and Boards who do not properly understand digital media

No. 4 is to my mind the key issue. We see it time and time again – it’s easy to say that these CEOs just need to understand business fundamentals, and don’t need digital knowledge, but it trips them up every time – Imega, which became Geekversity, never had a proper business model, and earned millions in revenue, and earnouts, before crashing. Wouldn’t it have made sense to understand the business properly before buying it?

I love that Warren Buffett, despite being buddies with Bill Gates, doesn’t invest in digital businesses, but sticks to what he knows – this could be a message for lots of advertising and media Big Wigs – if you don’t understand how it works, or where the money is coming from, don’t buy it.

m

User ID not verified.

How can a company acquire so many small businesses without achieving any economies of scale or at least culling the non-profitable ones? And what company on this earth would have all their major payouts happening in the same year? More costs layered over more costs – who’s getting a return??? Like 50 tiny islands tied together by spaghetti wire floating aimlessly in the dark. Now marooned 🙂

User ID not verified.

So many stories shared and so many of them exactly the same. Sucked in Photon, comeuppence indeed.

User ID not verified.

Sounds like a repeat of Blue Freeway

User ID not verified.

The ‘con’ circle:

Admen cons the consumer into something they don’t need/want

Investment bankers con admen into something that is not needed

Admen con shareholders

Con goes to lunch with investment bankers

User ID not verified.

As a former photon employee I was in a position to see a lot of the deals that were done. Particularly in the area of internet, photon at a senior level had absolutely no idea what they were buying or even why. Due diligence was never done beyond whatever fudged numbers appeared on that company’s balance sheet. From a technology audit point of view, there was nobody at photon head office that knew anything beyond how to turn on their computer.

We all questioned and mocked companies like imega and their dodgy search arbitrage business model – but photon’s ignorance, arrogance and short term view resulted in the handover of $30m plus (the founders famously posed for photos with their multi million dollar cheques in the photon boardroom).

The ONLY asset geekdom ever had was the senior execs. They (edited by Mumbrella for legal reasons), destroyed the company and got away with it.

User ID not verified.

What do you expect with Photon management being paid salaries in excess of $1mil each PA not even our PM gets paid that

Their excessive disregard for other people is absolutely frightening and they should be held responsible for all the money they have wasted

a lot of little people have been hurt by their excess’s and yet they wil still live their million dollar lifestyles laughing all the way to the bank why isnt there an accountablility imposed on people who start companies like this and then run them into the ground either because they are incapable or dont care as long as they get their fat pay check at the end of each month

User ID not verified.

It’s called karma people…. Hughes has treated many people with so much disrespect over a long time….. and now it is coming back to bite him on the arse….. i am loving it.

User ID not verified.

Oh, and just another point on Hughes, i decided to stay Anonymous as (removed by Mumbrella for legal reasons)

User ID not verified.

Interesting, Hughes seems to leave a trail of poor dealmaking behind him, spending other people’s money and then burdening young entrepreneurs with the ROI pressures. The Internet division appears to have been growing rapidly but collapsed when new ventures were pushed too hard too quickly. Good businesses collapse, hard working people loose jobs, shareholders lose millions and the Hughes Show keeps on rolling, where is the accountability? Hughes often said “Photon does not rely on any one client, business or employee”… so how does a 3 month startup called Geekversity, collapse a multi-million dollar group? Maybe it was a ticking time bomb that Hughes created & covered up for years? Maybe a house of cards built on Hughes BS? Didn’t Macquarie Media recently do acquisition write downs also? Is there a common element? Ah yes, a common Chairman, Tim Hughes!!

User ID not verified.

Let’s hope that all the changes at Telstra’s marketing team don’t see BWM lose its biggest client. That would NOT be good for Photon.

User ID not verified.

(Edited by Mumbrella).

User ID not verified.

Yo! Timmy B!

I’m more than happy to disclose that I’m a former photon, and Tim H supporter

Surely comments like this are defamatory and add no substance to this discussion:

“Oh, and just another point on Hughes, i decided to stay Anonymous as (removed by Mumbrella for legal reasons).”

User ID not verified.

Fair point, anonymous – that one slipped past. Now moderated.

Cheers,

Tim – Mumbrella