Two stats about Netflix that should scare Foxtel and Quickflix

With US streaming site Netflix poised to enter the Australian market next year Andrianes Pinantoan from Pocketbook crunched some numbers to see try and ascertain what the local pay-TV market already looks like now.

With US streaming site Netflix poised to enter the Australian market next year Andrianes Pinantoan from Pocketbook crunched some numbers to see try and ascertain what the local pay-TV market already looks like now.

Netflix is set to enter the Australian market, but that doesn’t stop a few enterprising Australians from accessing it now. Actually, it’s more than a few.

The article we linked to said up to 200,000 Australians signed up with the service. There are also many anecdotes about the popularity of Netflix in Australia in the forums and social media. So we decided to look deeper into the subject based on an anonymised study of 21,000 people who use Pocketbook to manage their finances.

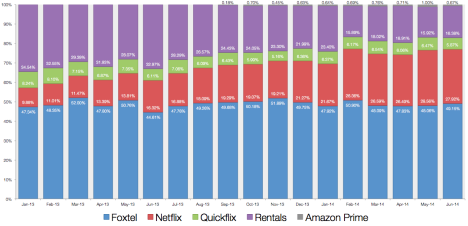

Let’s start with the basics: stat 1 – market share.

Our study found Netflix to be the second most popular paid-content media company in Australia, despite the fact that they are not officially available here and that they are actively geo-blocking Australians. Here’s a breakdown of the market (click on the image to get a bigger picture):

That’s right. Netflix owns 27% of the Australians currently using media subscription or rental services. And as you can see, they’ve tripled in size from just 9.88% in January 2013.

But the growth didn’t come at the expense of the local dominant player: Foxtel. The growth came from the old-world end of the market: rentals and to a lesser extent, local clone – Quickflix.

I should note here that the graph is based on the number of users (popularity) as opposed to dollars spent (revenue). And that means it doesn’t take into account metrics such as:

- The number of transactions per customer. For example, if a person frequents Blockbuster twice a month for a year – we’ll count them only once.

- How long Netflix, Foxtel and Quickflix customers are subscribed for. See below for explanation.

- The fees they charge. Netflix might be growing in popularity in Australia but they charge around $10 a month. Foxtel, on the other hand, can charge more than $100.

So it’s true that Netflix is growing in popularity in Australia, but only among people who perhaps can’t afford (or simply refuse) to pay Foxtel’s fees. For those who are comfortable with paying those fees? They are happy to keep paying for the convenience Foxtel offers (in that they don’t have to go through a VPN service to combat Netflix’s current geo-blocking of our great country).

Another interesting thing to point out are the tiny grey bars at the top. That’s a lesser known alternative to Netflix: Amazon Prime. From what we can tell, it only started to gather momentum in Australia from September 2013, but as you can see, it has also grown – again, despite actively blocking Australians.

And although by number of users Amazon Prime is small in Australia, they charge an annual fee as opposed to a monthly fee. So by dollar amount, it’s actually quite significant. Again, the annual charge is a fraction of Foxtel – around $100 for the year.

How long did the subscribers stay?

The next stat of importance is how long subscribers stay with a particular service? This is a good indicator of how satisfied they are with the particular service.

But there’s a catch with calculating average subscription length.

If Service ABC has been around for 10 years and Service XYZ has been around for one year. Let’s say users of ABC stayed for an average of half the time and users of XYZ stayed for the whole time. ABC in this case would still appear to be doing better than XYZ because ABC would have an average subscription length of five years. Where XYZ would only be one year.

To do the right comparison, we need to do what is called a cohort analysis. That is, of users who start a service (sign up) in a particular month, how long did they stay for?

In the example above, we would look at only people who subscribed to ABC and XYZ with the same time period – to compare the two “cohort”. So what we might see is that ABC only has an average subscription length of six months and XYZ, one year.

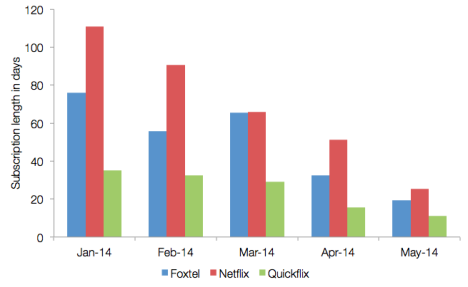

So we did that analysis for Foxtel, Netflix and Quickflix. Here’s the data (our last date in the sample is 31 June 2014):

As you can see, Netflix users stay around the longest and Quickflix the shortest. Australians who signed up to Netflix in January 2014 stayed, on average, for 110 days (roughly 3 months, 20 days). Those who signed up to Foxtel during the same period stayed for slightly less than 80 days (2 months 20 days).

Another point is that given the effort it takes to set up Netflix in Australia, namely the research and setting up of a VPN service, there is more incentive to keep subscribing given the sunk cost.

Quickflix appears way down the list as unlike Foxtel and Netflix, they also offer once-off purchases of premium programmes. And it appears a lot of people bought these once, and never went back.

Market Share vs Growth

This is such an important note, I have to point it out to avoid any confusion. It is absolutely possible for a company to grow, yet have a shrinking market share.

That happens when the overall market is growing. The company is enjoying that growth, but at a slower pace than its competitors. So the fact that you’re seeing Quickflix’s market share decrease in this dataset doesn’t mean the company is in trouble. In fact, it might be subscribing more users than ever.

And the fact that Foxtel has a steady market share doesn’t mean they are not growing in profitability. In fact, what this graphs shows is that the company has consistently grabbed 50% of overall market.

It just so happens that Netflix is getting more of the growing pie than they do, remarkably without any Australian marketing or formal Australian servicing channel.

It will be interesting to see how this develops. Who do you think will come to dominate the industry?

*This study didn’t include iTunes, Google Play, Spotify, Pandora and Xbox purchases. Our sample size is 21,000+ Australians consumers only from the Pocketbook Consumer Spending Series Reports. Foxtel has a lot of business subscribers – company kitchens, meeting rooms and bars – they would be excluded from the sample.

Andrianes Pinantoan is head of growth for Pocketbook.

See the original article here.

Cue Telstra deprioritising Netflix traffic and 10 years of net neutrality argument about it…

I stream Netflix and the only thing that lets it down (as far as I can see) as a substitute to other content sources is its diabolical menu and suggestion system. There’s a kernel of truth to the joke that you spend more time choosing something to watch than actually watching the shows. If they ever manage to get that working so it constantly suggests stuff I’m actually interested in watching, bye bye Foxtel.

Hey Circling sharks….you should try Netflix’s recommendation tool ‘Max’ on PS3 – Cool interactive tool that does a great job of bringing a recommendation tool to life: http://www.theverge.com/2013/6.....mendations

Netflix also does a great job of curating content through its blog activity and general PR – There’s loads of lists on all sorts of places (top NF docos on HuffPost just last week), so if you’re overwhelmed by choice, there’s loads of places across the web to help make it simpler.

I’ve had Netflix in Australia for over a year and love the service, so much great content. Only switch on free2air for probably 1 hour a week.

Comment 1 is rather astute…

One thing that the locals shouldn’t be scared about are the content deals. The Australian Netflix is unlikely to have the same content as the US Netflix. Obviously the Netflix exclusive series, including House of Cards will be available, but I’d wager the total content will be a lot smaller, with QuickFlix / Foxtel already having some content locked up. It’s interesting that QuickFlix has The Wire here, where Netflix in the US doesn’t (It’s on Amazon Prime in the US), so there might be content only on the Aussie Netflix.

I watched several movies over the wkend, which I downloaded through Google Play and watched via Chrome Cast. I prefer the mantra of a company like Google v a company associated with Murdoch. Off the shelf products, no contracts, no roll over renewals at exorbitant amounts, where I still see adverts and 80% of the content is shite…

Goodbye Foxtel

Getting some reddit love, Tim: http://www.reddit.com/r/austra.....re_foxtel/

And those evil kids are sharing all sorts of info, like how to access Foxtel sports for free. So awesome.

Thanks for all the comments guy. @Bec, reddit always have interesting dicussions, don’t they? 🙂

Thats right Tim

Quickflix has HBO content like The Wire that Netflix doesn’t have

@lewis, unfortunately you have to pay extra on top your subscription for many of these premium content at Quickflix (I haven’t checked The Wire specifically) – I think that’s the kicker for many people.

No service will dominate in the future – most people will have multiple services that fill in the gaps of others.

Netflix is cool…until you realise they don’t have a lot of really big series, and when they come into Aus they definitely won’t have as much as in the US.

“study of 21,000 people who use Pocketbook to manage their finances.” What an absolute load of garbage

I mean in sure Netflix is acquiring customers, but there’s no way a sample of users of pocketbook represent anything

qwerty has hit the nail firmly on the head.

What nobody mentions is that research in the US indicates that most Netflix households also subscribe to big cable. It’s a complimentary not a disruptive force until Netflix reaches sufficient scale to purchase and produce enough first run content. Otherwise outside of a few produced titles it’s mainly late window stuff on Netflix. Those who assume Netflix Australia will lead to the downfall of Foxtel might be sorely disappointed.

@garbage (sorry, since that’s your name), I’m happy to answer your questions about our sample – if there’s one. If you’re just making a statement, then of course that’s your right. 🙂

@Dr Dre and @qwerty, this is probably why we are not seeing any drop in Foxtel’s market share despite Netflix’s rise. Rather, it’s more comparable services (rentals and Quickflix) that are taking the fall.

One thing to keep note of is that Pocketbook users are not even remotely representative of the average Australian. Although Pocketbook doesn’t have the data, you’ll probably find that the majority of these people are well-educated young adult males with money to burn.

Nonetheless, it’s good to see that I’m far from being alone in paying for services that exist in the grey area of legality.

In the end, services like and including Netflix will come and go. None will truly succeed in this country until the content owners relax their licensing restrictions and stop treating Australia like a secondary market.

You don’t even need a VPN to access Netflix. A simple DNS service (like unotelly.com) will provide you with a DNS server address to use on any device you want to access Netflix with.

THAT’S IT.

It is that trivial to setup.

The future is people having a la carte digital subscription services with good SVOD options.

If the AFL ever get their act together and wrestle back their online streaming rights from Telstra they could access their customers (the fans) directly – this would be a giant kick in the pants to Foxtel/Seven etc.

I currently have a Netflix/Unblock-US combo ($15) + I use the international AFL streaming site ($25). Total of $40 a month – less than half of what I was paying Foxtel last year for a garbage product (other than FoxFooty). We also use M-GO or Blockbuster on the Roku for digital rentals.

Have a guess how Foxtel could retain their sports customers? Actually provide a solo digital streaming package that is accessible on all devices. They are just going to lose more and more customers when they wise up to the alternatives – and a lot of them aren’t legal.

Telstra, I know you have some marketing monkey reading this: “Digital Steaming” should start with PC! I don’t want to watch AFL on an iPhone or IPhone – your Live Pass is a joke. /end rant

It’s good to see an article which actually talks about the limitations of the methods used (eg: business customers not being included) instead of the usual over simplifications.

Yes, as ‘@garbage’ noted, you might want to ignore the article because of the limitations … but it’s great that the article reveals the limitations so we can make these decisions for ourselves.

(My 2 cents … every data source has major limitations – if we ignored them all because they each have limitations then we’d never learn anything.)

How is 21,000 people who use PocketBook possibly representative of the population? How can you assume market share from such a biased sample?

About time give foxtel a run for their money quick flick is crap this is what we need more competition and not only for TV Australia one of the most expensive places to live why??? Oh yes we are the lucky country

On the weekend I watched a movie from Presto, and via my iPad chromecasted to a Samsung TV.

My point being success is determined often by a prudent device strategy. Will be interesting to see Netflix’s take on how to enter the market.

@sockothesocko and @james – Pocketbook users come from a variety of sources, the majority of our users (more than 50%) have come from mainstream media coverage and word of mouth. Coverage on media such as News.com.au, SMH and Sunrise.

Tech sites and traditionally male-dominated communities like Reddit is actually a tiny portion of our userbase (according to our Analytics).

We also get over 100 emails everyday from our users and that gives us a sense of who they are. Some of them are as young as high school students managing their pocket money to retirees looking after their retirement.

@james Empirically, our sample is definitely broader than young males – we can tell just by looking the amount of expenses categorised as “childcare” and “retirement”, as well as spending in retailers like Sportsgirl and Katies.

We have invested heavily shaping our sample of 21,000. Employing k-means data sampling such that this is representative of the broader consuming population. This is worked from a userbase of over 85,000. As it is significant that we have sample-on-sample historical data for this analysis to work.

I’ve just read this and reckon it does inform me, Luddite that I am, especially as I know I’m paying Foxy way too much for my footy – so please, I’d like to hear more devious ways to go so that even I might feel confident to go there. And thanks Andrianes for making it readable…