You wouldn’t buy a different TV set for each network, so why aren’t they collaborating on mobile streaming?

Seven has launched its live streaming service and Nine will soon follow suit. But Nic Christensen asks whether the TV networks may be making a mistake not collaborating for the benefit of consumers.

Seven has launched its live streaming service and Nine will soon follow suit. But Nic Christensen asks whether the TV networks may be making a mistake not collaborating for the benefit of consumers.

If television was invented today would we have to buy a separate set for each network we wanted to watch?

Maybe they could agree on being on one device but the way things are looking at the moment you’s definitely need different plug-in or channel connector for each one – you know – to help build out and reinforce “the unique advertising ecosystem of the Seven/Nine/Ten/insert name here experience”.

That might sound like hyperbole but in many ways it’s analogous to what the TV networks are doing with the multitude of streaming apps they are making consumers download and what that is doing to the consumer experience.

In the last week, we have seen the bosses of the two biggest TV networks finally cross the digital threshold.

Importantly they have done two things:

- acknowledge traditional TV audiences – while still massive – are falling.

- clearly signal that they believe their long term future is in live video streaming be it to the home TV, mobile, tablet, desktop – wherever the consumer is.

As one senior TV executive told me this week for the likes of TV warhorses Seven’s Tim Worner and Nine’s Peter Wiltshire to make those public declarations it is “a very big fucking deal”.

Why the audience fall in television is important

There is a clear reason why the major free-to-air TV Networks are now pushing live streaming and, despite the rhetoric, it’s not just that they suddenly woke up one day and wanted to be geared to a digital world.

Their TV audiences are dropping significantly – particularly in under 45 year olds, who are moving online.

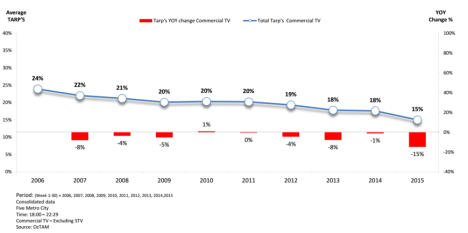

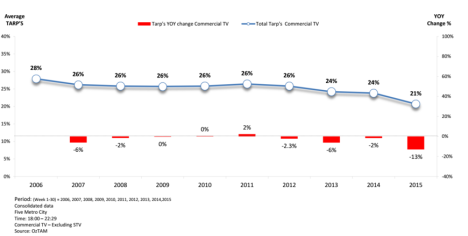

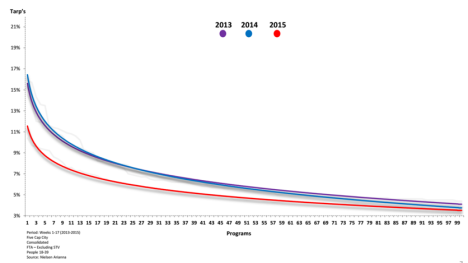

Take a look at this media agency analysis of Oztam audience figures, which shows how the number of people in key advertisers demographic of 18-39s and 25-54s have been falling over a decade. Note the major acceleration in these declines this year:

The key thing to take away from these charts – which show the average audience in prime time for all the commercial channels combined – is the audience decline among 18-39 year olds. In 2006 they were 24 per cent of the viewers -today they are only 15 per cent of viewers.

Among 25-54 year olds the results are similar but the falls are slightly less, down from 28 per cent to 21 per cent.

In both cases it is important to note that by far the biggest falls came this year. That’s no accident.

Has the dawn of video streaming caused that decline?

According to media buyers it’s hard to be certain of the precise cause of these falls but it’s clear the likes of Netflix are having some impact as is competition for eyeballs from a multitude of devices and other services.

A point the major TV networks, by and large, now concede.

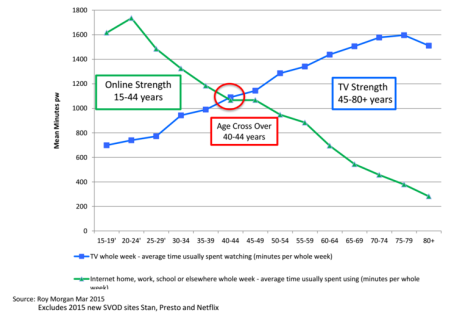

But what is also clear is that television audiences are getting older, as these statistics from Roy Morgan show, there appears to be an inverse relationship between age and the number of hours of TV or online you spend on the respective medium.

Unsurprisingly young people prefer online and TV is strong among over 50s with the crossover mark appearing to be the 40-44 year old range.

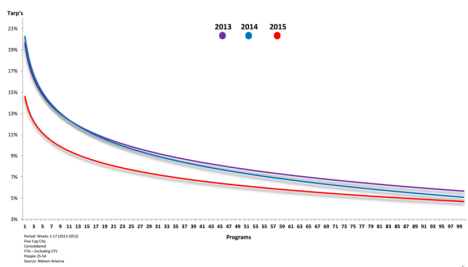

Free to air increasingly has a problem because the key issue issue for media buyers is they are not getting the reach and frequency, important in the context of TARPs (target audience rating points), the measure of a specific target audience viewing a program at a time.

To quote one senior media buyer: “The (TARPs) waterline has dropped and now we have to go to the well more and more (read: buy more TV spots) to get the same results.”

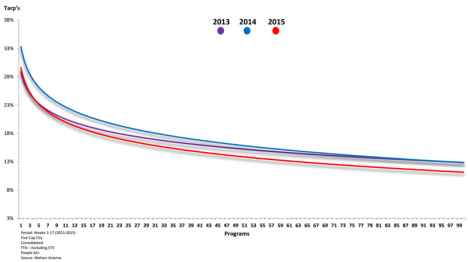

If you look at Nielsen numbers for program stock – which is the top 100 programs ranked from the highest to the lowest – it clearly shows how that waterline drops.

Among 18-39 year olds:

While, surprise surprise, program stock among those aged 65 years old plus is holding up relatively well:

Television’s measurement challenge

Television’s measurement challenge

Nine’s Peter Wiltshire argues that we don’t actually know the size of the falls in TV audience.

“There is no doubt that technology is changing behaviour,” he said this week. “Yes there has to be some audience change – and we have seen some falls in free-to-air this year – but without being able to capture where those audiences are through lack of measurement it has been hard to articulate the change.”

That may be true but I’d also argue that in the immediate term Seven, Nine and Ten needed to do something to cushion the falls and change their narrative to one where they were doing something about the situation, lest the media agencies start moving money out of linear television.

So we suddenly have an industry road to Damascus moment and a new focus on live streaming, across all devices, and you can expect to hear a lot from OzTam soon about cross media measurement to help reinforce this message.

Based on what I’ve heard at the recent Seven and Nine presentations the OzTam cross media technology, isn’t quite there yet in terms of deduplication of audiences – in other words ensuring we actually learn how many actual people watched The Block or X Factor across linear TV, timeshifted viewing, mobile, tablet, desktop etc – but eventually it will be.

Certainly this is something welcomed by the Australia’s top media buyers.

The boss of the Omnicom Group, which has $1.8bn in media billings, Leigh Terry told me: “As viewing becomes fragmented beyond the lounge room, as reading has moved beyond the printed newspaper, the real challenge will be the measurement and then value attributed to eyeballs via different device.”

“All are not created equally,” he warns media owners.

Terry also goes further citing the success of MCN in pushing to programmatic data trading, something Seven and Nine are now rushing to implement too.

“This is an industry-wide challenge but the TV players including MCN are certainly embracing change and stepping up to it, and with agency and advertisers let’s have that debate (about measurement and the value of different video audiences.)

These commercial discussions about the value of online video streaming will be fascinating to watch and will have a major impact on the future of the Australian media – regardless of where you sit in the landscape.

Should the networks work together on live streaming?

If OzTam’s movement on cross media measurement shows anything it is what can happen when the TV networks work together.

If OzTam’s movement on cross media measurement shows anything it is what can happen when the TV networks work together.

TV needed to be measuring audiences on mobile, tablets, desktops and the TV and soon it will.

But when it comes to live streaming increasingly it feels like each television network will go their own way when it comes to consumer experience and the messaging to Australian consumers.

Seven will have Plus7, Nine will have 9Now, plus you can expect Ten and the ABC (who FYI have been in the space for years) to move their channels fully into live streaming soon enough as well.

None of that is good when you simultaneously need to have a conversation with the likes of Leigh Terry and his agencies OMD and PHD about value.

As my colleague Tim Burrowes pointed in his piece on the Nine rebranding often when selling a message the best number of brands is one. But speaking to Peter Wiltshire, Nine’s chief revenue officer on the sidelines of Wednesday’s media presentation, he was clear that he that he expects consumers to be made to download a separate app for every TV network.

“Consumers are getting pretty good finding content when they are after it,” said Wiltshire.

“If they understand where they are, under our channel brand strategy, and know where they can find content and it sits in one destination then I don’t think that’s too much to ask of a consumer.

“I don’t think it’s too much to ask of them to find Seven or Ten or Netflix or Stan.”

The thing is they aren’t being asked to just find or download one or two apps.

I had a look today at my iPad and counted the number of video apps I had. They were: ABC iView, Plus7, 9Jumpin, TenPlay, Foxtel Go plus SVOD services Netflix, Stan and Presto. That’s no less than eight apps just to get my viewing experience.

A quick search of the apps shows that when you factor in the likes of BBC iPlayer and telco streaming services you can easily pass the dozen mark.

Now while Peter Wiltshire is confident consumers will find the content I worry that when you’re asking consumers to get their heads around as many as a dozen different brands then the message is guaranteed to get confused.

Now while Peter Wiltshire is confident consumers will find the content I worry that when you’re asking consumers to get their heads around as many as a dozen different brands then the message is guaranteed to get confused.

More importantly – how can they work out what shows are where and find new things to watch in that eco-system?

On a practical level take a look at how Telstra TV (another brand for consumers to learn) is selling its new proposition by promoting how its service includes no less than: Bigpond Movies, Presto, Stan, Netflix, 9Jumpin, SBS OnDemand and YouTube.

https://www.youtube.com/watch?v=BRi4u6kNteQ

That’s eight different brands plus the actual product Telstra TV – so in reality nine – all to tell consumer that they can get on demand video viewing.

So shouldn’t the industry, when we’re talking TV live streaming and catch up, have a discussion about whether we should follow the lead of the USA, which has Hulu, and the UK which has Youview, and look at bringing all the networks together and simplifying the consumer experience?

Of course there is a data play to think of here – Seven, Nine and MCN are all trying to deliver targeted advertising to consumers. It’s understandable they want that data to themselves.

I can’t help but wonder if that reluctance is more about the failure of 15 month old FreeviewPlus (the free-to-air industry’s IPTV offering which works on HBBTV technology).

I can’t help but wonder if that reluctance is more about the failure of 15 month old FreeviewPlus (the free-to-air industry’s IPTV offering which works on HBBTV technology).

Freeview now finds itself in the comical position of having admitted it missed its 10 per cent penetration target, but also trying to trumpet a claim that 50 per cent of their TVs are connected to the internet, while simultaneous refusing to release the number of TVs.

All the signs are that while Freeview Plus TVs may have been sold they either haven’t been connected or aren’t being used – a point Peter Wiltshire himself conceded publicly only a few weeks ago.

In part I think that’s because Freeview Plus’s star studded advertising focused on selling the Freeview Plus brand rather than the consumer benefits of HbbTV.

https://www.youtube.com/watch?v=sqBmTllDN1M

Which brings me back to the importance of branding and the issue of the TV networks failing to put the customer experience at the centre of their streaming strategies, in the face of falling linear TV audiences.

We are about to see a major marketing push from the various TV Networks each trying to sell their services to consumers.

But I don’t think consumers know or have any particular affinity for the brand of Plus7, 9Jumpin (soon to be 9Now) or TenPlay. What they do understand is the concept of TV, and they’ll get the idea of TV on their mobile phone/tablet.

There are also key industry wide challenges that need to be addressed in regards to live streaming both in terms of the technology (which FYI isn’t cheap) and the challenge of consumer data plans and what this means for the telcos who can expect to see a massive uplift in consumer demand for mobile data.

This week has seen the Australian television networks finally cross the Rubicon and be forced to embrace their digital future.

The question is are the free to air networks savvy enough to come together and they sell their broader consumer experience, in the face of the looming threat of declining audiences, or will they each try to sell their own message and hope that consumers figure things out themselves?

Whichever way this plays out it will be some very interesting viewing.

Nic Christensen is the deputy editor of Mumbrella.

Related content:

Sorry Nic but the BBC Global Iplayer doesn’t exist anymore in Australia, it got shut down months ago which is very sad and stupid of them as they’ve also cut off a revenue stream and encourages people to use VPNs.

Personally I like all the choices that are being given to me, I just wish Geo-Blocking would come to an end so I can access and pay for content anywhere in the world and not be discriminated against based on where I live.

User ID not verified.

Well researched and synthesised piece Nic. I remember when TV started in Oz, and the subsequent technology battles, e,g, VHS and betamax, but “TV” distribution is further evidence of disruption and giant transformations ahead. Nevertheless, the ease and quality of customer service is the focus of your piece in appreciation.

User ID not verified.

Well put Nic. Despite the best efforts of two CEO’s and chairman cum chief cheerleader Kim Dalton, Freeview has never really been embraced by the networks. More than two years ago I and others pointed to the patent failure of having separate ‘second screen’ apps – most people kept using Facebook or Twitter. We tried to convince them all to create a common VOD platform (with separate front ends, but one access point). They should all now pull out their dog-eared copies of Ken Auletta’s 1992 classic “Three Blind Mice: How the TV Networks Lost Their Way”.

User ID not verified.

I don’t think the commercials could ever agree on a single catch-up or streaming app. They wouldn’t be able to agree on whose content sat where on the screen as they would all be paranoid one of the other networks was getting better prominence.

User ID not verified.

Dear csh…The concept was for a common VOD platform with separate “front ends”. Entirely feasible, except that back then they all wanted to build their own “engine”. Two years later and it looks like Seven, Ten and Foxtel will all share Presto. Nine will perverse for a while with Stan, but will have to seriously look at the logistics / economics of a go it alone strategy. The ABC and SBS will gaze at the respective navels for a while yet. Meanwhile Netflix has been let in the door to a fragmented market, which they must love.

User ID not verified.

ATM the networks are in control via their individual apps. It won’t be long before an EPG based aggregator app appears with “Watch” and “Record” icons. There will a nice long Lawyers Picnic and hopefully, sense will prevail.

User ID not verified.

You can delete quickflix from your device. That’s 1 gone!

User ID not verified.