66% of young Australians earn more than a year ago: Urban List survey reveals

New research from lifestyle media house, Urban List, has revealed two in three young Australians are earning more than they were a year ago, displaying significant shifts in their attitudes toward their finances and careers.

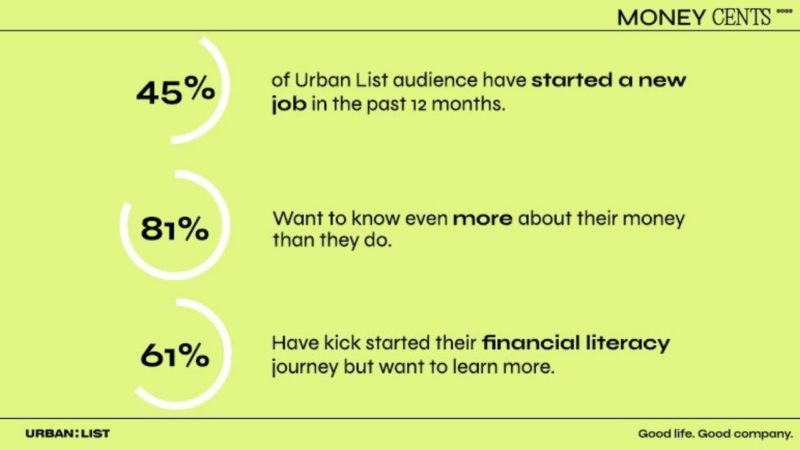

The third annual report — Money Cents: Keeping Up With Australians’ Attitudes Toward Money — showed 45% of the Urban List audience have started a new role within the last 12 months, a significant contributor toward their growth in income; with their new wealth more than twice as likely to be channeled into establishing long-term financial security.