Ad spend continued to slump in November, says SMI

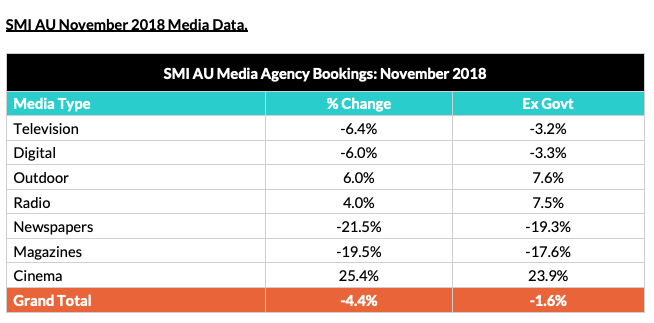

The 2018 second-half ad slump continued in November with a 4.4% fall in agency bookings, compared to the same month in 2017, however Standard Media Index is confident the year is on track to record the highest ever ad spend overall.

October’s collapse, which saw all sectors fall and 10.2% drop in overall spend, wasn’t repeated on the same scale, with the radio, outdoor and cinema channels all reporting growth during November.

Cinema reversed its dramatic 40.9% fall with a 25.4% jump in November, while radio reported 4.4% growth, somewhat reversing the previous 10% decline, and outdoor ticked up 6.0% after an 8.0% drop a month earlier.

Digital media, however, reported its second consecutive month of negative demand despite strong growth on video sites, with a 6.0% fall compounding last month’s 12.7% drop on the back of programmatic advertising placements continuing to decline.

TV bookings also continued their softness with a 6.4% fall following October’s 7.3% retraction.

Advertisers continued to turn away from print with newspapers reporting a 21.5% fall and magazines dropping 19.5%. In October, the two channels saw ad spend declines of 20.8% and 16.4% respectively.

November’s year-on-year booking figures were distorted by the Victorian state election in November 2018, against the same-sex marriage plebiscite and Queensland poll a year earlier.

The effects of the elections were felt in all the categories and, ahead of the federal and NSW elections this year, SMI has introduced a new category of Political Parties/Industry Associations/Unions to cover campaign spending, which showed 19.1% year-on-year growth to $11.14m due to the Victorian vote.

SMI managing director Jane Ractliffe saw some bright spots in the automotive and retail spending figures for November

SMI AU/NZ managing director Jane Ractliffe noted that retail and automotive brand advertising, the the two largest advertising industries, had jumped in November, saying: “Both of these categories have reported record levels of November ad spend, with retail advertisers growing their total spending by 13% and the automotive brand category liftings its spending by 17%.

“In retail, the most growth came from the food/alcoholic retail sub category where bookings lifted 10%, but spending by chemists also doubled and department stores grew their ad spend by more than 20%. And in the auto category, the light commercial sub category more than doubled its ad spend and advertising of SUVs has again picked up.’”

Despite the falls in October and November, SMI is confident 2018 will still be record year for Australian ad spend with the 5.5% growth in the first half of 2018 making up for the weaker second half.

Currently the market remains at record levels on a year-to-year basis with total bookings from January to November up 2.0% at $6.73 billion.

SMI measures bookings reported by the major media agencies, excepting IPG Mediabrands which dropped out of the index in 2016.

Wouldn’t have anything to do with the data being weekly and therefore some months have five weeks and some have four weeks?