Ad spend declines across every major media for the first time since SMI records began

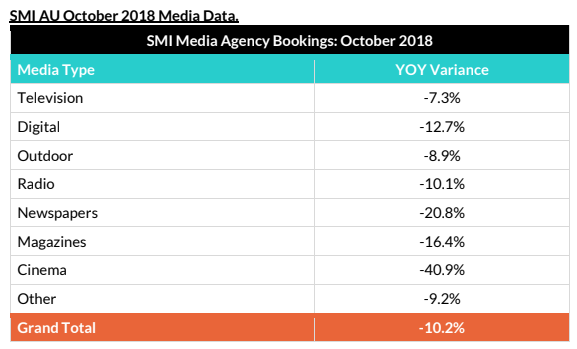

Ad spend in every major media was down year-on-year in October, for the first time since Standard Media Index (SMI) records began in January 2007.

The figures show media agency bookings were back 10.2%, and are at levels which have not been seen for at least three years, according to the latest SMI figures.

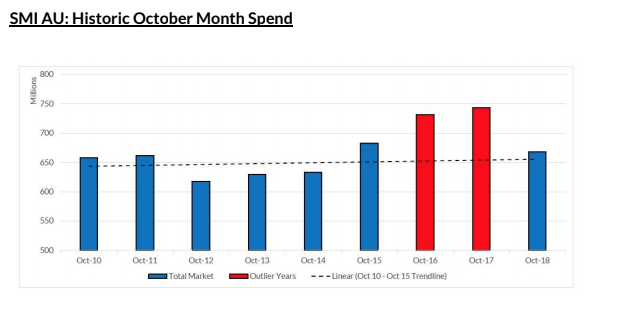

SMI attributes the decline to an abnormally a high comparative period, thanks to last year’s same sex marriage debate and the AFL/NRL Grand Finals.

Cinema saw the largest decline, with a 40.9% fall compared to the previous year. Outdoor and digital, which have largely seen positive year-on-year comparisons throughout 2018, fell by 8.9% and 12.7% respectively.

Newspaper ad bookings were affected by there being one less weekend in October than the previous month.

Losing that extra Sunday – the most lucrative advertising day for newspapers – saw agency bookings fall 20.8% for the month after August’s 2.7% uptick.

“Ad spend in the month of October 2016 was abnormally inflated by the football finals for both major codes occurring in that month, when usually those finals are held in September”, SMI AU/NZ managing director Jane Ractliffe said.

“So while the lower bookings seen this month are disappointing, the reality is that the market has returned to normal growth trend levels as seen in the SMI over at least the past nine years.”

When government category bookings were removed, given the recent removal of the Federal government’s ad spend from the data, the story remained the same, with the total market back 9.1%.

Ractliffe said SMI’s product category data also underscored the dry spell, with only 11 of SMI’s 40 product categories delivering ad spend growth this month.

“The October month was noticeable for large declines in ad spend from the food, produce, dairy and domestic bank advertisers, with the only positive news coming from a surge in spending by retailers, the home furnishing / appliance sector and utilities,” Ractliffe said.

The first half of 2018 saw ad spend grow 5.5%, but in the current financial year, that figure went back by 1.8%.

However the earlier growth means for the calendar year to date (Jan-Oct) period, the market remains at record levels with total bookings up 2.4% to a record $6.0 billion.

SMI’s report was released on the same day Zenith and GroupM’s made public their Australian spend forecasts with both expect ad spend to rise for the year, with Zenith’s estimates sitting at 3.3%, and GroupM’s at 5.6%.

Group M and Zenith’s spending estimates for the total Australian advertising industry were around $16.5bn for the year. SMI’s are lower and than the other two surveys as its measures bookings by the major media agencies, excepting IPG Mediabrands who dropped out of the index in 2016.