Avoiding ‘siloed, orphaned digital products’: Inside Seven’s digital strategy

It’s no secret that publishers and broadcasters have struggled to reinvent themselves for the digital age. With a restructure of Yahoo7 and major cost cuts underway, Mumbrella’s Zoe Samios sits down with Seven West Media’s chief digital officer, Clive Dickens, to map out Seven’s digital plans.

Five months ago, Seven West Media’s boss Tim Worner stood up in front of an audience in Melbourne and told them the year just gone had been Seven’s “toughest” in recent history. The cost cutting plan he later announced could only be described as inevitable.

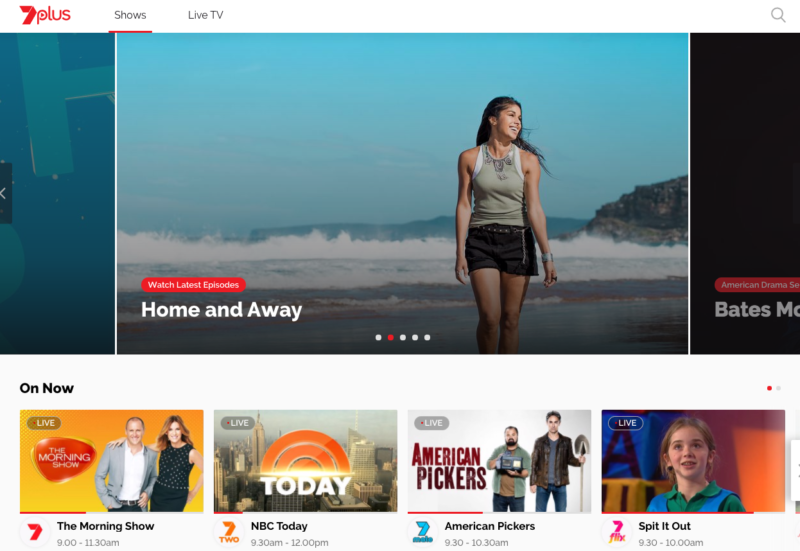

But on that same day in October, something else was clear: Seven would hone in on its digital strategy, improving its ability to deliver audiences for advertisers across multiple platforms.

Great to see the networks finally catching up and Clive is one of the smartest operators in the field. Just a shame they took so long to understand what was happening… https://www.smh.com.au/business/companies/how-telstra-tried-to-unite-broadcasters-against-netflix-with-project-thunder-20151218-glr8du.html

Always lots of blue sky with Clive.