Domain grows revenue by 10.7% to $289.6m, but print declines 33%

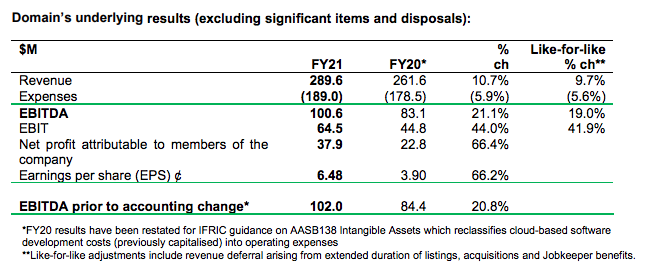

Domain Holdings Australia Limited (DHG) has delivered its results for the 2021 Financial Year, revealing a significant boost in net profit after tax, which grew 66% to $34.3 million year-on-year.

Domain, which is majority owned by Nine Entertainment Co, reported a 10.7% increase in revenue to $289.6 million, and declared a $0.04 per share dividend to be paid to shareholders.