Finance marketers told ‘get your head out of your arse’ as extent of perception gap with consumers is revealed

In the wake of the Royal Commission, 6.54m Australians are open to switching banks, according to a study conducted by Yell Creative in partnership with Ipsos.

But that’s at odds with the industry’s perception of itself, with 70% of financial services marketers trusting the industry they work in, compared to just over 20% of customers, and more than half of marketers believing customer trust has increased since the Royal Commission, when in fact the opposite is true.

The State of Financial Marketing Report, the 2019 findings of which were presented by Nigel Roberts, co-founder and strategy lead of Yell, at Mumbrella’s Finance Marketing Summit, is in its fourth year. The survey involved more than 200 senior finance marketers (who were asked 16 questions) and 1,000 financial services customers (who were asked eight questions).

Roberts speaking at Mumbrella’s Finance Marketing Summit

The Royal Commission has left a lot of Australians open to switching banks

“We asked consumers: ‘Have you changed banks as a result of the Royal Commission?’ 87% said no. So you could say, as a headline, that it hasn’t had much impact,” Roberts said.

“But there’s 13% of Australians that said ‘yes’, or, ‘I’m considering it’. 13% of Australians have said that, as a direct result of the Royal Commission, not just ‘Have you thought about changing banks?'”

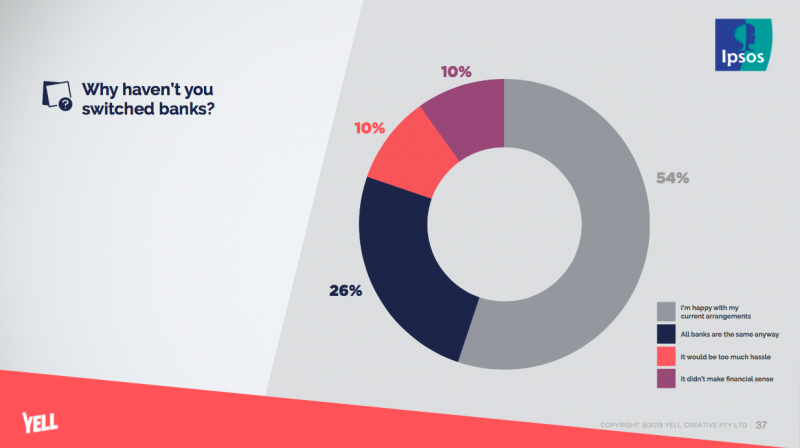

The survey asked the 87% of people who haven’t switched banks why that’s the case. And while 87% seems like a high number, Roberts explained why there’s still a lot of people within that group who aren’t certain they’ll stick with their current bank.

“Only 54% of the 83% are happy with their current arrangements. 10% said it didn’t make financial sense. Now that makes sense to me, they looked at it, they considered it, and they decided that it wouldn’t make financial sense for them. It’s a rational decision,” Roberts noted.

“But 36% of people gave a different kind of answer. 26% said all banks are the same anyway. … But what that says to me, is that if they were shown another option, that they would be open to it. If you could show them that all banks aren’t the same, if you can show them that all product providers aren’t the same, there’s another 26% of this 83% who would be open to switching.

“There’s also another 10% up there that said it would be too much hassle, they can’t be bothered, they can’t be arsed to do that, it’s too much hassle. So what if you make it easy for them?”

“Get your head out of your arse”: Marketers think their banks are better than customers do

The report also notably highlighted an enormous perception gap between financial services marketers and their customers.

More than 70% of marketers working within financial services organisations trust financial services organisations, compared to just over 20% of customers. And marketers believe that trust in their institutions has increased over the past 12 months when it hasn’t.

“Over half of you believe that customer trust has increased over the last 12 months. I don’t know why, I don’t know why. I’m not sure why there’s this perception from marketers in the industry,” Roberts told the room of financial services marketers.

“My hypothesis is you guys know what you’re doing. You guys know what you’re doing to try and correct this, to try and change perceptions, to try and build stories that connect with your customers in better ways, to try and talk to your customers to understand what their needs are, what their drivers are, and how they fill that gap.

“But it is bizarre to me that the industry thinks it’s more trusted 12 months later after … the Royal Commission.”

And 25% of those marketers think their bank is customer-centric, agreeing that “the customer is at the heart of everything we do”, whereas just 3% of customers believe financial companies understand their needs.

Are consumers understood? (Click to enlarge)

Adam Donnelly, chief strategy officer at RXP Group, referred to these results while moderating another session at the Summit, saying that he hopes marketers take note of both the huge perception gap and its message: “Get your head out of your arse”.

Regional and smaller banks, plus credit unions, are delivering better

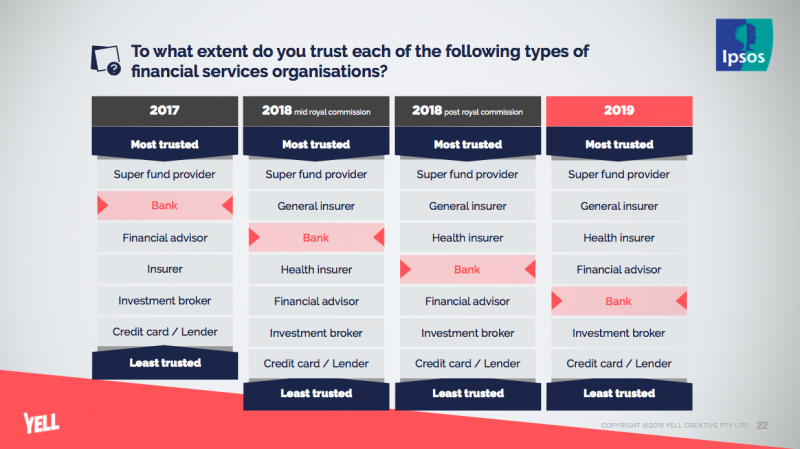

Trust in banks has been trending steadily downwards since 2017, while super fund providers remains the most trusted financial institution.

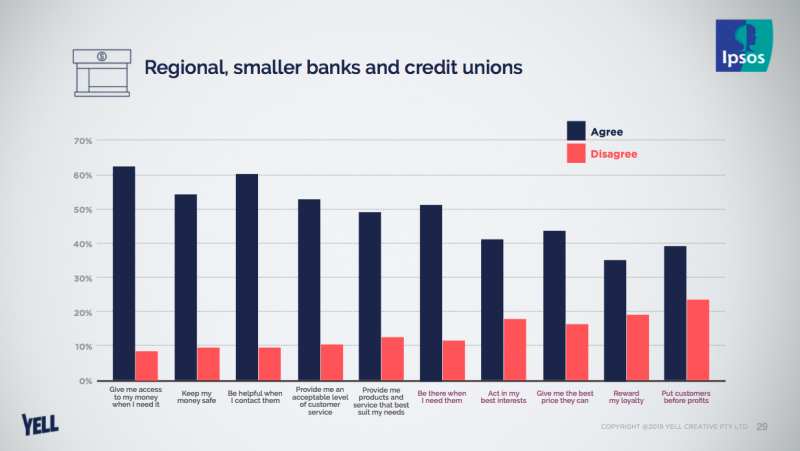

However, customer sentiment towards regional institutions, smaller banks and credit unions is notably better than that towards the Big Four. Customers responded to both practical – “give me access to my money when I need it”, “be helpful when I contact them” – and emotional – “be there when I need them”, “put customers before profits” – statements, and while disagreement is trending upwards for both the Big Four and smaller banks, disagreement with those statements for smaller banks is trending upwards at a much slower and lower rate, and agreement is much higher.

Just over 10% of Big Four customers believe their bank puts customers before profits, compared to almost 40% of customers at regional and smaller banks or credit unions.