Inside CommBank and the CAN campaign

It is nearly two years since Toni Collette appeared on Australian televisions and read the minute-long Ode to CAN, signalling the repositioning of one of Australia’s oldest and largest institutions. Nic Christensen sat down with CMO Vittoria Shortt and her team to talk about the CAN campaign, how it has changed the bank and how much longer it can run.

It is nearly two years since Toni Collette appeared on Australian televisions and read the minute-long Ode to CAN, signalling the repositioning of one of Australia’s oldest and largest institutions. Nic Christensen sat down with CMO Vittoria Shortt and her team to talk about the CAN campaign, how it has changed the bank and how much longer it can run.

Could three simple letters: CAN redefine the perception of a bank in the minds of Australian consumers?

This was the question the Commonwealth Bank, as well as much of the marketing industry, was asking itself amid the post GFC climate of 2012 that had badly dented consumer confidence, particularly in the banking sector. CAN as an idea and campaign, was led by new creative agency M&C Saatchi who had won the prestigious account back from US-based agency Goodby Silverstein, but it was not without risks.

As The Australian’s then marketing writer Simon Canning noted at the time: “‘CAN’ borders dangerously on being a motherhood statement. Members of the public do not want to be told how to live their lives by a gigantic financial institution.

“‘CAN’ is a big idea, simple in form but with huge potential… (but like most bank advertising) it lives or dies on the back of the bank’s behaviour.”

None of this worried then chief marketing officer Andy Lark. Speaking about the teaser campaign CAN’T Lark told Mumbrella it was meant “to put a stake in the ground”.

None of this worried then chief marketing officer Andy Lark. Speaking about the teaser campaign CAN’T Lark told Mumbrella it was meant “to put a stake in the ground”.

“We wanted to cause people to stop, pause and get people to think what is this CAN’T thing is all about.”

Indeed the first ad for the campaign, the bold minute-long “Ode to CAN” read by Toni Collette certainly broke from anything tried by a bank in Australia before, and lodged in the imagination of the public as a manifesto the bank would be judged on.

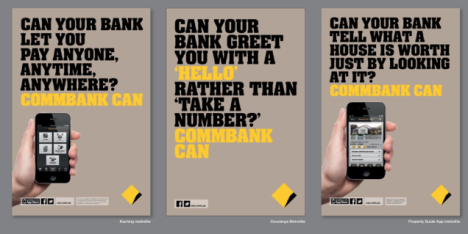

Nearly two-years on, CAN and Commbank are synonymous in the public imagination, thanks to a wide ranging advertising campaign across all platforms, particularly a diverse set of TVCs and smart digital executions.

And despite debate about the strategy and occasional missteps (notably the ill-conceived TV ad from the London Olympics about ‘suspicious packages’ for which the bank was forced to apologise, and questions about the originality of the CAN concept in the M&C Saatchi stable), the campaign is widely viewed as a success.

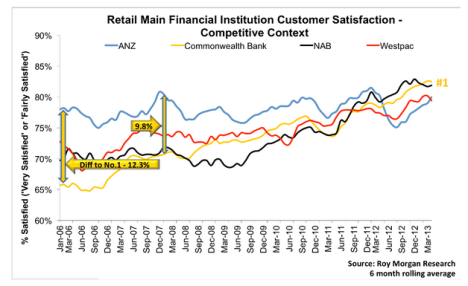

Most importantly the campaign has helped lift the bank up the Roy Morgan rankings to number one in customer satisfaction, a difficult achievement in a sector scrutinised by the media and mistrusted by consumers.

While some viewed Lark’s decision to move the creative account to M&C and commission the pitch idea of CAN as risky, his successor in the role Vittoria Shortt says the gamble was in her view a safe bet.

“When you take something that is new to market there is an element of risk,” concedes Shortt, in a quietly spoken but direct way, adding: “The process that we go through to develop our propositions is very thorough, well researched, tested and so that by the time to take something to market you know that will work.”

General manager of consumer marketing Monique Macleod says that in her mind the biggest success of the CAN campaign is in how it changed the conversation for the bank.

She told Mumbrella: “What we have seen through the research we have done, and what we looked at leading into ‘CAN’ shows that while it is a difficult sector, at the same time there has been significant change over the last few years and customers have really noticed that.”

CAN a slogan redefine a bank?

Shortt says internal buy-in was crucial to ensuring CAN became more than just another advertising campaign.

“CAN really tapped into the internal way which we are going about our business. It is quite different from a (traditional) ‘campaign’,” she says.

“We called the staff brand ambassadors and basically brought them into the fold. It was critical to have their support right across the business, so we went very wide.

“They were there as people rather than someone from legal, for example, coming down with their legal hat on for a legal opinion. It’s about grabbing people from different functional areas and selling them on the fact we want to work with everyone in the business to bring CAN to life. I guess, it’s not their standard job.”

Since CAN launched in May 2012 Shortt says the bank is pleased with the way it has lifted the brand in terms of perception and engagement.

“We know from our tracking that our brand health is in a better position, we know that the sales uplift through virtue of the brand positioning is stronger, so in terms of all the different metrics we look at internally it has really resonated,” says Shortt.

“We also know that it helps with customer satisfaction and we have been leading in this metric.”

Technology as a change agent

While there have been some awards and accolades, including the Mumbrella Awards Marketing Team of the Year in 2013, it has been the technological innovations like the Property Guide and mobile payment app Kaching which have captured the imagination of many in the industry, and beyond.

“With the campaign itself there was the whole launch into market and the shift (in advertising) from CAN’T to CAN. It was quite important in the setup and really signalled a big change for us,” says Macleod.

“It laid the groundwork absolutely. Then for us it was about how do we move into some key messages that make customers understand how we are going to deliver against CAN.

“This meant we very quickly moved into a range of work that really focused on key proof points for the business that looked at both the technology space and the expertise that we want to deliver to customers.”

Shortt explains it was important these “proof points” were unique to CommBank and “market leading”, pointing to apps like Kaching, a transactional app which lets consumers make payments to each other by touching their phones together which has been downloaded more than 400,000 times, or the Property Guide designed to make buying a home easier, even valuing houses by uploading a picture of the exterior on your mobile.

Shortt explains it was important these “proof points” were unique to CommBank and “market leading”, pointing to apps like Kaching, a transactional app which lets consumers make payments to each other by touching their phones together which has been downloaded more than 400,000 times, or the Property Guide designed to make buying a home easier, even valuing houses by uploading a picture of the exterior on your mobile.

In early 2014 CommBank added Kaching’s NFC technology to its main app and is now leading the Australian banking sector in the space of cashless mobile transactions, a move which has been supported with the above the line Can Tap duet campaign.

Says Shortt: “It is about showing that we can live up to something which makes a big difference for small business and consumers, in particular.”

Is there more life in CAN?

Most ad campaigns have well and truly exhausted their lifecycle in less than two years, but when questioned on how much longer the CAN campaign can continue both Shortt and Macleod maintain the concept still has considerable legs.

General manager of brand Macleod told Mumbrella: “When it comes to lifespan you’ve obviously got to keep a read on the market and what is happening but what we are finding is that CAN has a lot of breadth to it, and it feels like there is still a lot of upside and opportunity to it.”

Late last year the bank launched its first ever above the line campaign for its business bank, CAN Business, which “is a very important proposition for us and it is the first time we have positioned the business bank,” Shortt reveals.

“What has been really interesting is that we wanted to position the business bank in market and we had different ideas about it as we went through the creative process. As part of going through that process and interviewing customers — what came out was ‘CAN Business’.

“And of course you sit back afterwards and you go ‘well obviously’, but it is not obvious, and we wanted to make sure it was the right thing to do before you do it.”

Shortt says ultimately, the most important element of CAN is that it clearly differentiates the bank from the rest of the market with a positive and accessible message.

“It is a different positioning. When you look through the different executions there is a positivity,” says Shortt. “I think it is quite different in market, but it is also the strength of the proof points that is the other part that is very important.”

I’m not sure if customer satisfaction is really driven by brand campaigns.

No kidding Stevo… That is a ridiculous suggestion. Surely that came from the mouth of someone in marketing at Comm bank?

But as Vittoria Shortt says Can is much more than just another advertising campaign, it’s internal as much as external with better customer satisfaction one of the outcomes.

Brand campaigns definitely don’t drive customer satisfaction but somehow every CMO in the big banks have managed to convince their board and leadership teams that cust sat rankings and nps is what their bonuses are based on.

Campaigns don’t directly drive customer satisfaction. But campaigns that establish a brand promise that a business actually lives up to certainly help. This post made the call a year a go on the relationship between the ‘Can’ campaign and Commbank’s satisfaction rating: http://brandtruth.com.au/2013/.....isfaction/

Follow the link in it for more on why brand authenticity is critical for customer satisfaction.

Commbank would be mad to walk away from that campaign. It has years of longevity in it…

There was always something so eighties about this lazy campaign idea. You feel nothing when you look at it – it’s so far behind where people are at. Piss it off.

Which bank?

It depends on what area of a brand you focus on. If you take Employer brand, focus the troops and manage to get them embracing “can” and this has a massive effect on service levels for clients, then hey presto…

It would appear that CBA’s different departments (service, sales, marketing, recruitment, HR, finance) speak to each other and are encouraged to do so. Rolling out a campaign that touches employees as much as the customer is the way to go. it certainly appears that CBA are trying and perhaps might have achieved this.

I know some awesome developers who traditionally worked for ‘tech’ companies, now working over at CBA. the culture rocks, they are looking forward and the business, again appears to be aligned…

(For the record, I have never worked, consulted, nor have any affiliation with CBA, other than understanding that this campaign embraces the CBA culture…)