Omnicom posts financial results for 2021 Q2 showing sustained recovery

Omnicom (NYSE: OMC), the holding group for Omnicom Group agencies, TBWA and DDB has posted its financial results for Q2 2021, which has seen a continued recovery following the financial impacts of the pandemic.

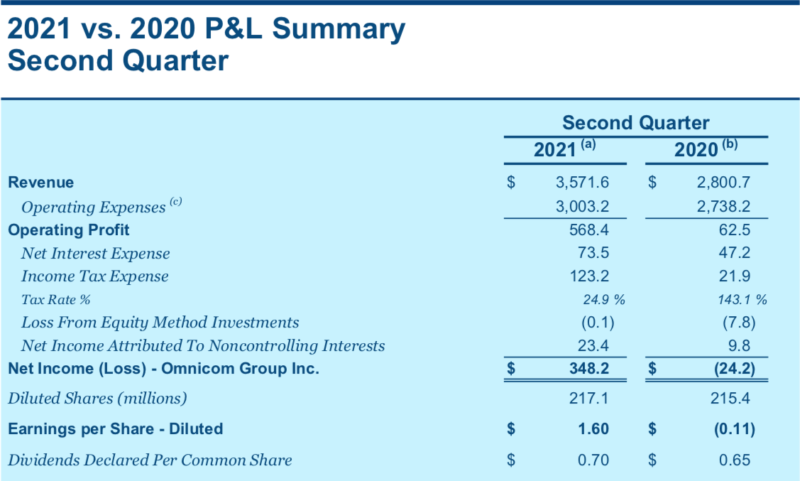

Revenue is on the up, at US$3.5716 billion a 27.5% rise on the corresponding quarter in 2020, US$2.8 billion. The group saw growth across all regions, including positive organic growth in APAC.