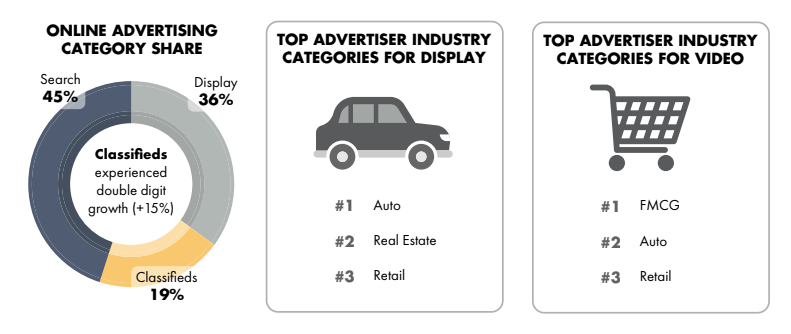

Online advertising spend up 7% year on year, classifieds contribute one-in-five digital ad dollars

Classified advertising was one of the major boosters to Australia’s online advertising spend last year, up 15% year on year to contribute $1.5bn to total revenue of almost $7.9 billion, according to a report by the IAB and PwC.

The strength of the classifieds – which now sees them represent one in five digital advertising dollars – is attributed to companies such as REA Group, carsales.com and Seek.

According to the latest IAB PwC Online Advertising Expenditure Report for calendar year 2017, Australia’s online advertising spend climbed 7% from 2016, with all categories – general display, search and directories, classifieds, mobile and video – up by at least 5% on the previous year.

The smallest growth category was search directories, up 5% on the year previous to $3.6bn. Meanwhile general display advertising contributed $2.8 billion to total revenue, up 6% year on year.

Mobile now contributes $3.1bn to online advertising revenue, up 35% from 2016, while video grew by 43% to contribute a total of $1.1bn to online ad spend.

Gai Le Roy, director of research at IAB Australia, told Mumbrella the year’s results were “strong” but overall it was a “softer year”.

“It’s [the results] a mixture of a bigger base now but it has been a tough year for all media so 7% is strong but definitely not where we’ve been previously,” she said.

Le Roy described classifieds as the “unsung hero” which keeps on growing.

An overview of the categories contributing most significantly to online ad spend. Source: IAB Australia

“It’s a different model, it doesn’t go on a cycle like the traditional ad markets so it makes those businesses really resilient because they’ve got display and listings,” she said.

Le Roy said an area that she was looking into more closely was display advertising. In quarter four, more than 40% of display was made up of video content, while 22% was banner advertising.

To see continued growth in the sector, Le Roy said a combination of ‘hygiene factors’ as well as getting across more sophisticated attribution models would be key.

“It’s tough for a lot of publishers. It has been challenging but seeing that diversification of revenue within display, it’s people realigning their business to growth areas,” she said.