SMI data shows Australia leads the US and UK on agency spend on exchanges

New data shows that Australia is significantly outspending its American and British counterparts in the percentage of dollars being put through programmatic trading desks and demand side platforms.

New data shows that Australia is significantly outspending its American and British counterparts in the percentage of dollars being put through programmatic trading desks and demand side platforms.

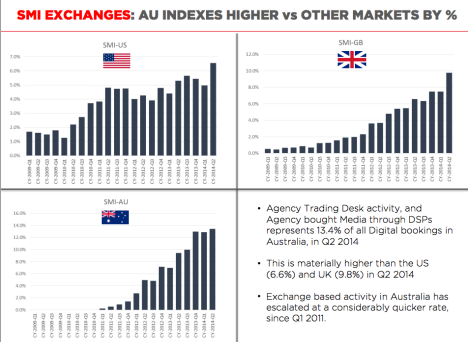

Standard Media Index (SMI), this morning, told the Spends and Trends forum that 14 per cent of all digital dollars spent by Australian media agencies were going through exchanges, a rate significantly higher than other markets the ad expenditure tracking company operates in.

Tristan Masters analytics director for SMI told the joint SMI/Mumbrella event excahanges were a “hot button issue” at the moment, adding: “In the US six and half per cent of all digital dollars are getting piped through these exchanges while in GB (Great Britain) it is slight more with 10 per cent.

“But what we are seeing is, that (exchanges) didn’t even factor until the back half of 2010, now in 2014 are just shy of 14 per cent of all digital dollars.”