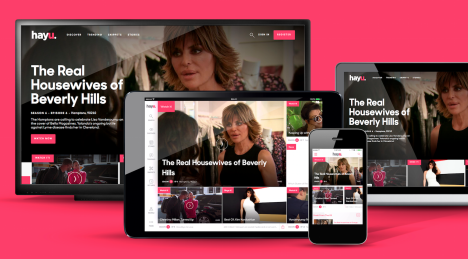

Streaming wars ramp up: Is Hayu leading a new SVOD wave, ahead of Disney and Amazon?

On Friday NBCUniversal held a media briefing for its new reality-focused streaming service Hayu. Nic Christensen looks at the broader global play and how Hayu is really part of a new second wave of streaming players preparing to enter the Australia market.

If you were wondering why someone would launch a local streaming service built around ‘trashy’ US reality TV shows like Keeping up with the Kardashians and The Real Housewives franchises, you’re probably not alone.

If you were wondering why someone would launch a local streaming service built around ‘trashy’ US reality TV shows like Keeping up with the Kardashians and The Real Housewives franchises, you’re probably not alone.

But NBCUniversal’s global executives say they’re confident they know what they’re doing, and Australian-born APAC boss Christine Fellowes makes no apologies for the offering.

Fellowes: Targeting a demographic of women who love a reality TV content.