Programmatic driving resurgence in display ads with mobile to drive most future growth

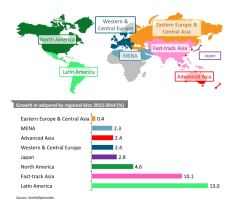

Global ad spend growth by region 2013-14. Click to enlarge

Global ad spend is set to rise by an average of 4.9 per cent per year from 2015 until 2017, with the rise in programmatic trading credited for a resurgence in display advertising, according to the latest ZenithOptimedia Advertising Expenditure Forecast.

Australia is put in the ‘Advanced Asia’ category in the report, along with New Zealand, Hong Kong, Singapore and South Korea, the last of which is predicted to overtake Australia and France to move up to seventh in the table for total ad spend by 2017. There is no individual breakdown for each market on how it is expected to perform on its own.

The media agency predicts for the Advanced Asia category: “We estimate growth here at a disappointing 2.4 per cent in 2014, after weakness in the property market damaged consumer confidence in Singapore. As Singapore recovers we expect growth to pick up to an average of 5.1 per cent a year through to 2017.”