Telstra TV in 75,000 homes, telco insists Foxtel subs base safe despite soft first half growth

Australia’s biggest telco, Telstra says it is happy with the initial growth of its new, low-cost streaming product, Telstra TV, with yesterday’s half-year ASX reporting the number of boxes sold at 43,000.

However, the telco later clarified that this figure is only to December 31 and that it now believes it has sold 75,000 of the Telstra TV boxes, which aggregate streaming access to SVOD and catch-up TV.

However, the telco later clarified that this figure is only to December 31 and that it now believes it has sold 75,000 of the Telstra TV boxes, which aggregate streaming access to SVOD and catch-up TV.

Last year, Telstra stopped selling its popular TBox product which was a major drive of subscriptions to pay-TV service Foxtel, and in October launched the Telstra TV device instead, which uses the Roku2, a device similar to rival Apple TV.

At the time of its announcement media buyers expressed concern about the risk to Foxtel’s subscriber base but Andy Penn, CEO of Telstra, yesterday sought to reassure the market that this wasn’t the case.

Related content:

- Warnings Telstra’s move into video streaming could create a low-cost rival to Foxtel

- Why Telstra TV will eat Foxtel

“No, we don’t see cannibalisation from Telstra TV,” Penn told the Australian Financial Review.

“We’re really pleased with how Telstra TV is going, it’s getting great NPS (net promoter score – a measure of how willing customers are to recommend Telstra to others) – results, great usage – the amount of time our customers are using as well, and it’s not effecting cannibalisation, we don’t have a Foxtel broadcast service on Telstra TV at the moment.”

Foxtel’s latest numbers showed year-on-year growth but the pay-TV operator continues to bundle low-margin streaming video on demand (SVOD) service in with its total subscription base. Presto is thought to have somewhere between 200,000 and 250,000 local streaming subscribers.

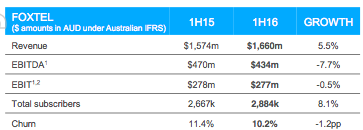

Total Foxtel subscribers is at 2.884m – up 8.1% from a year ago, when it was at 2.667m. However, that growth appears to have flatlined, with the number of subscribers down marginally on the 2.847m subscribers it reported six months ago.

Source: Telstra half yearly financial report.

Foxtel yesterday reported a 5.5% rise in first-half revenue to $1.66bn; however, its earnings before interest tax and amortisations (EBITA) was down 7.7% to $434m due to what Foxtel said was increases in the cost of programming, costs around driving subscriber growth and “continued investment in Triple Play and Presto.”

Freudenstein: Presto not a big factor in the growth of Foxtel

With investments in key programming churn was down from 11.4% to 10.2%

Back in August, at the full year reporting, Foxtel CEO Richard Freudenstein was forced to concede the pay-TV operator had begun bundling in low-margin Presto SVOD customers with the much higher-margin Foxtel customers.

At the time he played down the impact of this, telling Mumbrella: “The way we count Presto is as a subscriber equivalent, but the ARPU of Presto is so much lower; it is not really a (major) factor in our numbers. They are very much driven by cable and satellite and things like that.”

Back in 2014, Foxtel did a major shake-up in its product offering, lowering the entry price and ramping up the content offering while also launching a major marketing blitz aimed at driving new customers.

Telstra recorded a $2.1bn net profit for the first half, a figure which was up by 0.8% on last year.

Nic Christensen

Related content:

Foxtel hardly ramped up it’s content offering, it remains one of the the flimsiest Pay TV providers in the world…..

User ID not verified.

And only two generations behind actual Rokus (now up to the Roku 4) that you can’t get in Australia!

User ID not verified.