Dentsu Japan admits ‘inappropriate operations’ straining relations with Toyota

One of the strongest relationships in advertising has been complicated by the revelation that Japanese agency giant Dentsu has been overcharging its client, Toyota, for digital media in its home territory.

The news is unprecedented for a market known to be a black box for media buying, where marketers are often left in the dark about how and how much they pay their agencies, and comes as a time when transparency is an increasingly serious issue for the media industry globally.

A Dentsu spokesman declined to confirm the individual brands involved citing client confidentiality, but told Mumbrella Asia that “inappropriate operations” regarding digital media trades have been going on, and that the agency is working with clients on “further steps that may be required” to resolve the issue.

Mumbrella has requested more information on how Dentsu plans to clean up its digital trading processes, and approached Toyota for comment.

Dentsu, which enjoys a peculiarly powerful position in Japan as both a media owner and a media agency, counts Toyota as probably its closest and longest standing account. The car maker has been a foundation client in many of the 140 markets where the 115 year-old agency has a presence outside of Japan.

In Australia however independent The Media Store holds the account, although Toyota’s imminent relocation of its offices to Melbourne had made many fancy DentsuAegis, headquartered in the city, to take over the account.

Though details of the nature and scale of digital misdealing have yet to emerge, it is likely that clients other than Toyota, particularly multinationals with headquarters outside of Tokyo, will want answers at a time when the tremors of a report into client-media agency transparency in the US, released four months ago, are beginning to be felt everywhere.

The ANA report found that practices that advertisers are increasingly intolerant of, such as kick-backs, credits and value banks, are “pervasive” in the US.

That report came out just over a year after an audit in Australia revealed that one of the country’s largest media agencies, Mediacom, had faked campaign reports for its biggest clients, and had sold back to clients free air time given to it by TV stations.

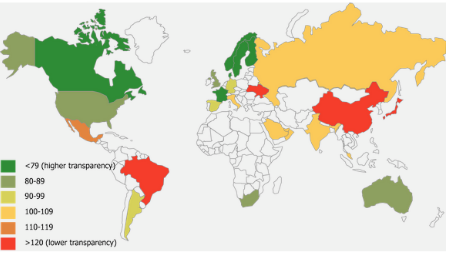

While the implications of the ANA report, and the kerfuffle in Australia, have been downplayed as an irrelevance for Asia’s big markets such as Japan, China, India and Indonesia, where clients have traditionally accepted low transparency as a trade off for good service and cheap media, Dentsu’s admission that there is a problem could change that.

In an interview with Mumbrella Asia in Tokyo last month, Takeshi Miyazawa, who worked for Dentsu for 13 years in Japan, China and India before joining IPG Mediabrands’ UM agency a year ago, responded to a question about the local implications of the ANA reporting by first describing Japan as the world’s most opaque media market.

A report by the World Federation of Advertisers in 2014 found that up to 75 per cent of rebates in Japan, which ranked close to bottom of the study, are retained by agencies rather than passed back to clients. Media trading deals in Japan, he said, are not based on scope of work as in the West, but “a gentlemen’s agreement” involving a fee or commission agreed upfront, and no questions asked about mark-ups or margins made on trades.

However, Takeshi said that market dynamics are “slowly changing” as best practice from other markets begins to influence the status quo in Japan.

A regional client-agency relationship consultant told Mumbrella today that his firm has received a growing number of requests to audit media negotiation deals in recent months, but that this sort of auditing is “a genuinely new thing” in Japan.

Another industry observer suggested that while the relationship between Dentsu and Toyota – one of almost unrivalled strength and depth developed over many decades – is unlikely to be uprooted by this incident, it goes to show that even the longest relationship does not protect a client from paying more than it should for media.

The news, though exposing the lack of transparency of a rival, may sit uncomfortably with the numerous advertising agency bosses who have criticised the ANA report, such as WPP’s Sir Martin Sorrell, who accused its auditor of a conflict of interest, and Publicis Groupe CEO Maurice Lévy, who said the report was “unfair and an unwarranted attack on the entire industry”.

It may also make for some awkward conversations with clients for Jerry Buhlmann, CEO of Dentsu’s overseas operation Dentsu Aegis Network, and the former boss of the British media agency Dentsu acquired in 2013. Buhlmann was asked about the implications of the ANA report in the context of digital trade desks just over a fortnight ago.

He told Adexchanger: “Most clients are much more sophisticated than they’ve been given credit for. You establish a working relationship with clients in a contract [that] formalises exactly how you operate in a very transparent way. A lot of the issues raises by the ANA are marginal to the business. They’re not a reflection of modern contractual relations. Following that report, we didn’t get any feedback from clients. I’m not sure it’s a particularly big deal in the real market.”

The response from Dentsu via email:

We regret that we are not able to provide specific details in answer to any questions related to the transactions or business of an individual client.

We can say, however, that there were some inappropriate operations related to digital media business transactions which have already been reported to the clients concerned. We are currently in consultation with them regarding any further steps that may be required.

Ripping off adnews

http://www.adnews.com.au/news/.....ng-scandal

Hi adnews,

Indeed not, Robin in our Asia bureau has been working on this one for a couple of days, probably from the same tip off. Difficult to write 800 words on it in 10 minutes… Unlike others we don’t follow mindlessly, and where we use other’s work we acknowledge and link. We also don’t make false claims about exclusives and having broken news we didn’t.

Cheers,

Alex – editor, Mumbrella

But isn’t the fact that AdNews reported this scandal first mean they did actually break the story, or do you have another definition for “breaking news” that we are not aware of. Why can’t you just acknowledge when someone else has done a good job rather than this bitchiness, which none of the other trade publications seem to indulge in? It’s not a great look.

Hi No Prize,

They sent their version of the story out first so technically did ‘break’ it to their audience, granted. No-one’s denying that. What we didn’t do was ‘rip off’ the story – we had all the same information and more and have not repurposed anything they put out, otherwise we’d have linked back. That’s why I challenged the first comment (which of course we didn’t have to approve, but do in the name of transparency).

And as for bitchiness, you may remember other industry publications piling in with attacks on Mumbrella when we had the temerity to call out sexism issues in the industry earlier this year – rather than addressing the issues at hand.

As I said before I’m always happy to acknowledge good work done by others where I feel it’s merited, but I’ll also defend our work from anyone accusing us of ‘ripping off’ work.

Cheers,

Alex – editor, Mumbrella

Is the top comment actually from someone at Adnews?

– If so: Far out, get over yourselves Adnews? (Is it an ad news IP address, or incogneto…?)

If not from Adnews: Far out whoever is the troll, grow the fck up!

To mumbrella: keep up the great work. Good read that Robin, nice work pal!

Hey Guys relax – let share some love here.

Journalists,

This is quite can interesting and important article.

Can we just focus on the story please?

hahhaaaaaaaa

Technically Mumbrella finished second across the line. Anything else is just a whiney excuse. As Zuckerberg says “You know, you really don’t need a forensics team to get to the bottom of this. If you guys were the inventors of Facebook, you’d have invented Facebook.”

Unfortunately this sort of price gouging is rife throughout almost every industry. Greed is just a product of rampant capitalism.

Hopefully Toyota and any other fleeced clients litigate Denstu in to oblivion.