HT&E’s revenue slips slightly as company says ‘difficult decisions’ are paying off

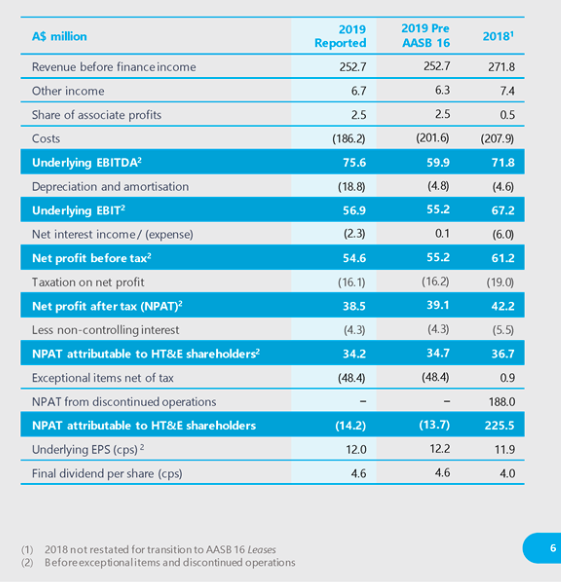

Here, There and Everywhere (HT&E), the parent company of Australian Radio Network (ARN), has delivered full-year revenue of $252.7m, down 7% from 2018’s $271.8m.

Despite the decline, chairman Hamish McLellan said HT&E is delivering great results in a tough cyclical advertising market, and that its previous “difficult decisions” are paying off.

“The company is highly profitable, cash generative with a new lean corporate structure that leaves it poised to capture upside in any recovering ad market,” he said.