Pureprofile posts $5.37m loss in half-year results and notes ‘ongoing challenges’ with ad market

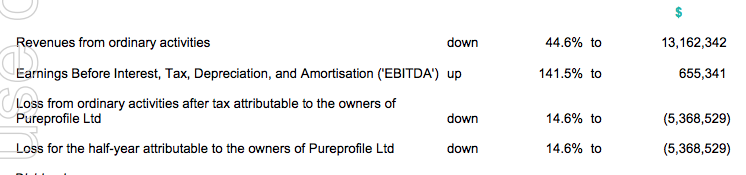

Consumer research, data and insights company Pureprofile has revealed a loss of $5.368m for the six months to 31 December, 2019.

Throughout the six months, the group said it had realised savings by simplifying the business, an executive team restructure, automation, technology rationalisation and the relocation of its UK office, however noted it was facing “ongoing challenges within the advertising industry”.

The business’ cost-reducing exercises saved $1.8m.

When you go public, you lose your way. Because, in your head,you’re not playing with your money- you’re playing with someone else’s. The moment you don’t treat your clients’ money like your own you will lose it and be fired. As indeed, you should be.

Pure Profile’s problem is debt – at $21 million, that’s a servicing cost alone of 2 million or more a year. A 44% drop income means half the company – has to go. Or be placed on contract agreements.

The good thing the company has done is get back to basics . Data and analysis. It may be unsexy but what is unsexy is usually essential and what brings in what every business needs: Cash.

If you think money is free, you are crazy. Nothing is free – not even the earth on which you rest your foot.

Pureprofile has made a mistake investing in the ad business. Advertising people have a competence – a basic instinct for survival that a data company does not have. It should dismantle this part of its operations- take the loss – and reinvest in its core which is data. There is big demand for marrying data held on web and transaction servers and generating meaningful insights from them – still.

htttps://mumbrella.com.au/pureprofile-posts-5-37m-loss-in-half-year-results-and-notes-ongoing-challenges-with-ad-market-619580