Tax Inquiry: Live blog – Google, Apple, Microsoft and News Corp front inquiry on tax avoidance

Today saw online giants Google, Apple and Microsoft, along with media company News Corp Australia appear before the Senate Economic References Committee which was looking at the issue of corporate tax avoidance.

Mumbrella live blogged the afternoon appearances, which included Google Australia managing director Maile Carnegie and News Corp Australia CEO Julian Clarke.

This live blog is now closed, however it covers the full two-and-a-half hours of testimony.

Live blog:

4.17pm – Senator Dastyari has just wrapped up the session with News Corp in order for another witness (from the Property Council) to appear.

4.17pm – Senator Dastyari has just wrapped up the session with News Corp in order for another witness (from the Property Council) to appear.

We’ll close off the blog here. But thank you to everyone who go involved in today’s live blog and stay tuned to the website where we’ll have reports on the tech trio Google, Apple and Microsoft plus separate coverage of News Corp later this afternoon.

4.14pm – News Corp’s boss says it does not use “secrecy jurisdictions” (read: tax havens). However, the company has admitted that seven companies, most associated with real estate online business REA ,operate in tax shelters in Luxemborg and Hong Kong. News says it has legitimate businesses in those places and again notes 98 per cent of News Corp Australia’s business comes from Australia.

“It is too easy to divert money through these places but we are not doing that,” said Clarke.

4.09pm – Things are getting testy now in the inquiry. Clarke just accused Senator Milne of not understanding the transaction.

Panuccio tells Milne: “The ATO has examined those transactions very carefully and have deemed that it didn’t run foul of Part 4A (of the tax code).”

4.05pm – Milne is now questioning News Corp CFO Susan Panuccio with the senator testing the accuracy of the SMH’s report on Monday: “Was $4.5bn repatriated last year?”

4.05pm – Milne is now questioning News Corp CFO Susan Panuccio with the senator testing the accuracy of the SMH’s report on Monday: “Was $4.5bn repatriated last year?”

“No.. well yes $4.5bn was repatriated but it happened in two years… yes it was a reduction in the equity value here but it was a movement of shares. Shares that belonged to the company that is now 21st Century Fox,” says Panuccio.

“There were no tax implications.”

3.59pm – Greens leader Christine Milne asking about the tax benefits News Corp gets from running national broadsheet The Australian at a loss.

3.59pm – Greens leader Christine Milne asking about the tax benefits News Corp gets from running national broadsheet The Australian at a loss.

“If it’s a choice I made about making a profit on a newspaper and paying tax or on the other side getting a tax benefit the choice is always to make a profit”, said Clarke.

3.54pm – “I read that stuff yesterday and it didn’t make any sense,” said Clarke. “They have clearly got it hopelessly wrong.” However, Clarke notes that he can only speak to the Australian arm of News Corp.

3.52pm – Julian Clarke now being asked about a report that Treasurer Joe Hockey personally approved a decision to shield companies sending billions of dollars offshore as part of apparent tax-dodging strategies from being named.

“I’m not sure I’m in a position to answer that question,” said Clarke.

3.47pm – Clarke is now taking aim at what he describes as the “unlevel playing field that we feel passionate about”. Focuses on Netflix and that it does not pay tax in Australia saying: “We all need to be able to compete on a level playing field.”

The News Corp CEO focuses on Netflix $7.99 pricing notes that it is cheaper than Foxtel’s Presto and Nine/Fairfax’s Stan: “The proof of that is that they have priced themselves below the other two players.”

3.41pm – Clarke: “98 per cent of our (News Corp) revenue is written in Australia…”. Now giving a history of some of their major corporation structure changes in recent years.

“We have been subject to relentless attack by Fairfax,” said Clarke referring to Michael West’s coverage on Monday. “These comments are intentionally misleading or they don’t have a clue and in the case of the author probably both. We are of course demanding a correction and will see if that is forthcoming.”

3.38pm – News Corp CEO Julian Clarke is now testifying before the committee. Begins by saying: “We want to pay… we must pay… the right amount of tax. No more and no less.”

3.38pm – News Corp CEO Julian Clarke is now testifying before the committee. Begins by saying: “We want to pay… we must pay… the right amount of tax. No more and no less.”

3.24pm – We are on a 10 minute break and then we are back with News Corp’s CEO Julian Clarke and CFO Susan Panuccio.

3.22pm – Sam Dastyari asking about the ATO audits of these companies. King responds: “They have not given us an estimated end date.”

3.22pm – Sam Dastyari asking about the ATO audits of these companies. King responds: “They have not given us an estimated end date.”

The Labor senator now wrapping up and thanks the trio for their appearance, before the inquiry saying: “There are some legitimate community concerns about how you are structured… when you look at the structures in Singapore, Bermuda and Ireland. It is pretty concerning that some of you would come to the inquiry without basic information.”

3.14pm – Christine Milne asks Maile Carnegie about Google Maps, which was developed in Australia, and how much of the revenue from that was booked in Australia. Carnegie says she will have to take the question on notice.

3.12pm – Canavan now questioning the trio on transfer pricing – basically where prices are increased to minimise the revenue and profits for the multinationals in Australia.

King responds: “The economic activity that we undertake in Australia is very very clear the wages for our people, the buildings etc. the value our people create for the business in Australia.

“That is the first part of the business and then that is worked up the product stake for each of our product.”

3.05pm – Senator Matt Canavan now questioning Apple and Google about how if he buys an Australian song artist in Australia how much of the iTunes revenue goes overseas. King unable to say how much.

3.05pm – Senator Matt Canavan now questioning Apple and Google about how if he buys an Australian song artist in Australia how much of the iTunes revenue goes overseas. King unable to say how much.

Google is clearer about where its revenue is booked. On a question about where the revenue from a consumer in Australia clicking on an ad in Australia gets lodged she responds: “All of that revenue gets booked in Singapore… This is the way the global tax system works. If the government chooses to change that system then we will abide by that.”

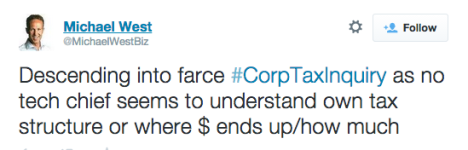

2.58pm – The SMH’s Michael West, who reported on the tax allegations against News Corp Australia yesterday, has tweeted this interesting precis of events thus far:

2.53pm – Apple back under the grill. Asked about what percentage of its $6bn of revenue goes overseas King is unable to answer, responding that he has to take the question on notice.

2.53pm – Apple back under the grill. Asked about what percentage of its $6bn of revenue goes overseas King is unable to answer, responding that he has to take the question on notice.

“I find it extraordinary that you can’t answer that,” said Xenophon who says he is willing to call the executives again before the inquiry.

Google is declining to specify its revenue with Carnegie arguing she would be breaching US disclosure laws. Agrees to take question on notice.

2.49pm – Senator Xenophon now questioning Apple’s Tony King on if he has ever been to Ireland. He responds: “no, never for business”.

2.49pm – Senator Xenophon now questioning Apple’s Tony King on if he has ever been to Ireland. He responds: “no, never for business”.

Xenophon argues Apple has shifted $9bn in revenue to its parent company in Ireland, a country which he notes he has never been to for business.

“All of our costs and our revenue are clearly accounted for,” said King, when questioned about Apple’s tax minimisation.

He has now started asking Maile Carnegie if she has ever been to Bermuda which has a zero per cent tax rate.

2.35pm – Christine Milne now grilling Google on what is a “double Irish sandwich” (background on this here). Milne says we are seeing a structure where Google is maximising its costs to minimise its revenue costs to avoid tax in Australia.”

2.35pm – Christine Milne now grilling Google on what is a “double Irish sandwich” (background on this here). Milne says we are seeing a structure where Google is maximising its costs to minimise its revenue costs to avoid tax in Australia.”

Under questioning Carnegie concedes: “The revenue that comes from Australia is taxed in Singapore.” Milne then asks about the relationship between Google Australia and its divisions in Singapore and Ireland. She notes that Singapore and Ireland are low tax jurisdictions.

On the question of who determines Google’s costs Carnegie responds: “The cost is determined by an external party who determines the costs.”

2.29pm – News out of inquiry: Google, Apple and Microsoft all confirm the Australian Tax Office is auditing their tax arrangements at the moment. This is new with Maile Carnegie resisting confirming this until Dastyari informed her she had to respond as the committee was able to ask her this under parliamentary privilege.

“We have never had any negative assessments to the best of my knowledge” said King. “We are cooperating fully with the ATO with their audit.”

2.21pm – Greens Senator Christine Milne is now grilling Tony King about their tax activities off-shore. Things are getting tense, she responded to an answer about arms length pricing: “Come on Mr King you haven’t come here to tell us that.” She is accusing them of fixing their pricing globally to avoid tax.

2.21pm – Greens Senator Christine Milne is now grilling Tony King about their tax activities off-shore. Things are getting tense, she responded to an answer about arms length pricing: “Come on Mr King you haven’t come here to tell us that.” She is accusing them of fixing their pricing globally to avoid tax.

“It is ridiculous to consider you as a separate entity when you are part of a global operation,” said Senator Milne.

2.13pm – Maile Carnegie responds that Google has a “simple structure” saying they use an arm length structure to determine what the profit and revenue they have.

“Fundamentally Google does not structure itself on tax, we structure ourselves on what is competitive,” says Carnegie.

“We structure ourselves to be competitive… We have competition sitting at this table and around the world.”

2.08pm – Senator Dastyari kicks off the questioning with a statement that the Australian public does not accept that the structures these companies have created are legitimate. The structures he says that have been created in Ireland etc. are seen as designed to minimise the tax obligations in Australia: “My question is what is the morality of these structures?”

2.08pm – Senator Dastyari kicks off the questioning with a statement that the Australian public does not accept that the structures these companies have created are legitimate. The structures he says that have been created in Ireland etc. are seen as designed to minimise the tax obligations in Australia: “My question is what is the morality of these structures?”

2.03pm – Bill Sample, Corporate Vice President, Worldwide Tax for Microsoft is giving an explanation of the software company’s contribution to the Australian economy.

2.03pm – Bill Sample, Corporate Vice President, Worldwide Tax for Microsoft is giving an explanation of the software company’s contribution to the Australian economy.

1.59pm – Carnegie says Google is against unilateral tax reform by the Australian government without working with the multilateral body the Organisation for Economic Co-operation and Development (OECD). She is also focusing on R&D tax credits. You can read more about Google’s views on the need for more help for start ups here.

1.56pm – Carnegie explains to the inquiry how the intellectual property from which Google makes its revenue has been developed outside Australia and argues that therefore the tax should be paid at its headquarters.

1.52pm – Maile Carnegie now speaking acknowledges that a lot of people ask why Google doesn’t pay more tax in Australia on its revenues.

1.52pm – Maile Carnegie now speaking acknowledges that a lot of people ask why Google doesn’t pay more tax in Australia on its revenues.

1.49pm – Ok we’re off and running with Maile Carnegie from Google, Bill Sample from Microsoft and Tony King from Apple appearing.

1.49pm – Ok we’re off and running with Maile Carnegie from Google, Bill Sample from Microsoft and Tony King from Apple appearing.

First off is King who tells the inquiry that it is “transparent and open with the tax office”.

1.46pm – We’re still waiting for the inquiry to start as they are running a bit behind schedule but it is due to start shortly.

1.44pm – Senator Nick Xenophon now giving a press conference. Tells journalists: “It is clearly unacceptable that billions of dollars are not being paid to the Commonwealth to fund government services as a result of these clever arrangements.”

1.44pm – Senator Nick Xenophon now giving a press conference. Tells journalists: “It is clearly unacceptable that billions of dollars are not being paid to the Commonwealth to fund government services as a result of these clever arrangements.”

1.38pm – We’re still waiting for the inquiry to start but Dastyari is giving a press conference outside the inquiry complaining about the $60bn of tax funds being sent overseas.

1.29pm – You can expect Labor senator Sam Dastyari to play a key role in this afternoon’s proceedings.

The NSW senator penned this opinion piece on the issue of tax avoidance and why companies should be named and shamed over the issue (citing Starbucks in the UK as a case study) this morning for the SMH.

1.23pm – If you want to follow things on social media the hashtag is apparently #CorpTaxInquiry.

The hashtag is already trending across Australia (who knew we were all such tax nerds?) and we’ll be keeping an eye on what’s said in the social sphere today and include it here as well.

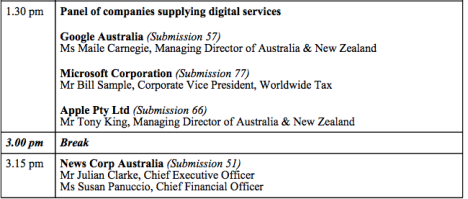

1.15pm – Good afternoon all Nic Christensen, deputy editor of Mumbrella, here to take you through the next two hours. First up at 1.30pm we have the bosses of Google, Apple and Microsoft then at 3.15pm News Corp Australia.

12.00pm – Welcome to the Mumbrella live blog covering this afternoon’s Senate Economic References Committee hearings on tax avoidance. This page will be updated from 1.15pm.

For those interested in background on the inquiry can we recommend some of the following reading:

– Google to front tax inquiry over tax ‘dodge’ – The Australian

– Companies fronting the Senate tax avoidance inquiry this week – Sydney Morning Herald (A good wrap up of some of the submissions to the committee from the various players)

– Rupert Murdoch’s US empire siphons $4.5b from Australian business virtually tax-free – Sydney Morning Herald (this article yesterday drew a fierce response from News Corp Australia)

Note: You can also listen to audio of the Senate Economic References Committee here and also find a link here to the Google, Apple, Microsoft and News Corp Australia’s submissions to the committee.

Quick run a story about dole bludgers and greenies

we all know they cost way more than these tax avoiding scum

User ID not verified.

Sounds like a taxing time for the 3 representatives…

User ID not verified.

Might need to do a quick fact check, Google Australia does not have a CEO, her title is Country Director AUNZ

User ID not verified.

Maile is not the CEO or the MD, her title is Country Director

User ID not verified.

Tax avoidance by these multinationals is the biggest scam ever perpetrated on the Australian tax payer. It’s downright insulting. If Abbott doesn’ t step up and put an end to this outrage – and get back the Billions we’re owed – instead of penny pinching the average Aussie, the Coalition is gone – and good damn ridance.

User ID not verified.

Thanks Greg,

Will correct. It changed a year or so ago. My mistake.

Cheers

Nic – Mumbrella

If all the multinationals paid their fair share of tax, there would be no budget deficit, there would be no need to raise the pension age, and no need to raise the GST. Again, it’s the average Australian that is being penalised because of the actions of the rich few.

User ID not verified.

The Greens, Labor and other miscellany do this for their usual bitter purposes, so it’s a shame it’s them running this show. But it’s a show worth running.

These disgraceful, amoral organisations are parasites on Australia. Beneath contempt.

So how have the other villains in the piece gone unscathed? The scumbag accountancy firms, ‘professional services’ firms, law firms who have orchestrated this blatant theft from Australian taxpayers? Time to name and shame them too.

User ID not verified.

Yes Maile the tax rate in Bermuda is zero. You didn’t know?

User ID not verified.