Ad spend dropped to 10 year low in February, says SMI

February saw the softest advertising demand in almost ten years, says the Standard Media Index (SMI).

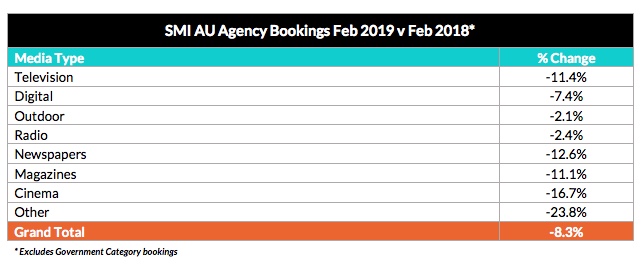

While February 2018 experienced a record high, February 2019 saw a decline of 8.3% to $482.9 million, the biggest drop recorded in the SMI database since April 2009.

February’s SMI numbers

Is ad spend really down or is it just the ad spend tracked by this particular methodology that is down?

SMI only publishes verifiable data, sourced directly from the media Agency payment systems. Every $1 paid by our media Agency partners to media is added to our database. As Mumbrella noted, such is the strength of our Agency market there’s only ever been 5 months of negative demand, so we’re also hopeful the trend will turn soon.

… aggregating weekly data so that some months have four weeks and some months have five weeks.