How Southern Cross Austereo’s rebranded digital stations transformed its sales strategy

In June last year, Southern Cross Austereo sent out a press release announcing the realignment of its digital radio stations under the Hit and Triple M brands. Mumbrella’s Zoe Samios chats with SCA’s sales boss Brian Gallagher to understand how the rebrand kickstarted a new direction for the company’s sales strategy.

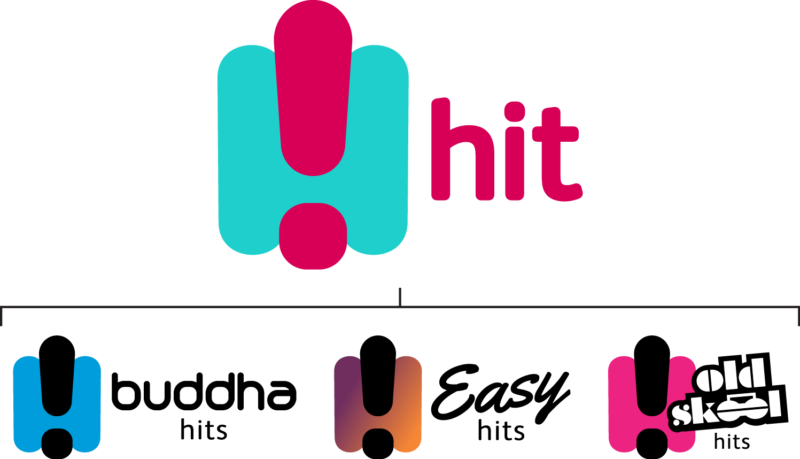

It seemed simple at first: Southern Cross Austereo had rebranded its digital networks. It was an unsuspecting, subtle rebrand – an attempt to build brand awareness across its digital stations.

SCA’s rebrand has since transformed into a complete realignment of Hit Network and Triple M, ultimately reshaping how the business sells advertising and measures total audience.

Several years ago, SCA won a large portion of the digital audio broadcast spectrum in metro markets. It was seen by many as a positive win, suggesting the company saw radio moving towards platforms such as mobile and voice activated devices.

Calling a station Buddha continues to remain highly offensive – substitute Buddha for say Mohammad and see how that works.

It’s just as it’s offensive naming a car brand Mazda after an unaffiliated deity, and perhaps even calling a sporting goods brand Nike…

I agree , Christain radio, Amish radio, Jewish radio, Mohammad radio – all sounds a bit odd . Is the playlist sensetive? What about platforms?

AM, FM, DAB, minarets?

I had enjoyed Old Skool for a long time, but recently the sheer number of ads now running is insane. I get the need for monetisation but it now seems like overkill.