Marketers increasing investment ‘across a range of digital advertising environments’ as internet spend ticks over $15b

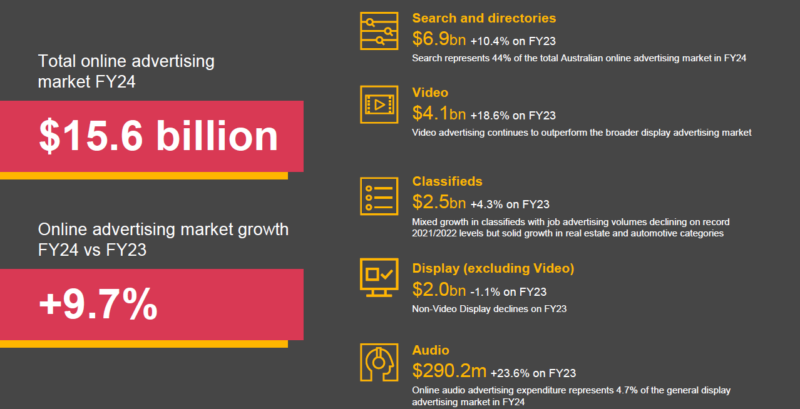

Internet advertising spend in Australia has seen a year-on-year growth of 9.7% for the financial year ending 30 June 2024.

As confirmed in the Interactive Advertising Bureau’s (IAB) Australia Internet Advertising Revenue Report (IARR) released on Monday, the figure has reached $15.6 billion.

According to the report, video advertising grew 18.6% to reach $4.1 billion, search & directories increased 10.4% to reach $6.9 billion, classifieds advertising revenue grew 4.3% year on year to $2.5 billion, while general display (excluding video) advertising fell by 1.1% year on year to $2 billion.