REA Group revenue up 13% for FY21 as residential property market thrives

News Corp’s REA Group Ltd (REA) revealed a 13% revenue in increase for the financial year ending 30 June 2021, as total revenue reached $938 million.

Off the back of strong growth in the Australian residential market, the Melbourne-headquartered business reported a 19% increase in Earnings Before Interest, Taxes, Depreciation, and Amortisation (EBIDTA) including associates to $565 million.

Net Profit After Tax (NPAT) was up 18% year-on-year to $318 million. REA Group’s balance sheet included $414m in debt and a cash balance of $169 million.

Revenue excluding acquisitions was up 11%, with REA Group having acquired an ownership stake in Indian digital real estate platform Elara Technologies, which operates brands like Housing.com, PropTiger.com and Makaan.com.

In June, REA Group revealed it had taken a 34% stake in Simpology, and on 1 July it completed a $224 million transaction to acquire 100% of the shares in Mortgage Choice Limited.

REA Group’s Board will pay a final dividend of 72 cents per share fully franked. Including the interim dividend announced in February, this means a 131 cent per share total dividend for FY21, a 19% increase on FY20.

REA Group CEO, Owen Wilson, commented: “This has been a defining year for REA, successfully navigating the pandemic to deliver an excellent financial result and emerge an even stronger business.

“I am very proud of our team’s ability to respond to the changing needs of our customers and consumers during the pandemic, while also accelerating our growth strategy through a number of pivotal investments.

“Our flagship site realestate.com.au delivered stellar results, extending its position as the clear market leader in digital real estate and it is now Australia’s eight largest online brand overall.”

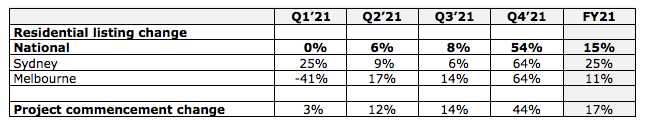

Revenue was also up 13% across REA Group’s Australian brands realestate.com.au, flatmates.com.au and realcommercial.com.au to $870 million. In terms of national listings, there was 15% year-on-year growth, reflecting the ongoing strength of the Australian residential property market.

Wilson added: “The delivery of highly personalised consumer experiences has underpinned our audience growth, allowing REA to continue to provide our customers with qualified leads to help them grow their businesses.

“This included a strong 55% year-on-year increase in buyer enquiries during FY21.”

In its financial report to the ASX, REA Group admitted that COVID continues to cause market volatility and could negatively impact the group’s performance in FY22, but remained positive that markets recover quickly after lockdowns.

“REA is entering the new financial year with strong momentum, despite ongoing lockdowns. This momentum, coupled with our strategic investments and exciting product roadmap, provides an excellent platform for our continued growth,” Wilson added.