SCA revenue drops 8.2% as debt rises

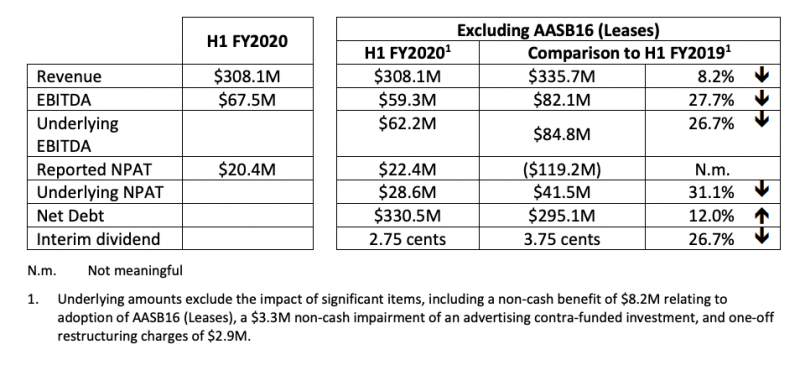

Group revenue for Southern Cross Austereo (SCA) dropped 8.2% for the first half of the 2020 financial year, falling to $308.1m from $335.7m for the same period the year prior.

The results, which are in line with the trading update provided by the business in late 2019, also see its debt increase by 12.0%, largely due to the acquisition of Redwave Media, which has grown SCA’s national footprint to 96 stations. Redwave is expected to add a revenue of $2m in the second half of FY20.

It looks like SCA’s profits have really taken a HIT.

Boomtown did NOT increase regional revenue – it was actually the regional sales staff busting themselves to make budget – after they have had their contracts “revised” twice in 18 months. This resulted in heavily reduced commissions to the point where many were writing big amounts and only taking home meager commissions… Dozens of long term sales staff have exited as many were earning less now than they were 5-6 years ago BUT writing more revenue… very sad.

You must be good with a hammer Terry, you nailed it.

More cost cutting me thinks….staff!!!