Streem outlines challenges ahead for media sector in 2023

Media monitoring provider Streem has released its latest State of the Australian Media Report, outlining key issues and opportunities for the industry.

“With a revitalised national cultural policy, record-breaking content deals, and the continued rise of technological developments such as artificial intelligence in the media, this report is designed to ensure communications professionals are best-positioned for the year ahead,” Streem’s communications lead, Jack McLintock said.

“With a new government comes new policies, and the media sector is no exception to this,” stated the report.

Since coming into power, Minister for Communications Michelle Rowland, has made it clear that the Albanese Government has strong views on media and communications policy and its direction.

Public broadcaster, the ABC is set to receive a higher degree of funding certainty, with the next five-year funding period commencing this year. Add to this the new National Cultural Policy, Revive, unveiled by Arts Minister Tony Burke in late January, which includes content quotas for streaming services, and it’s clear the Albanese Government has big plans for the communications and arts sectors.

While a Royal Commission into media ownership was ruled out early into the term of the new government the report states that “more changes can be expected from the Albanese Government in the coming months, as it takes a close look at anti-siphoning rules and other key aspects of the Australian media landscape”.

Indeed, number two on the report’s list is the News Media Bargaining Code, which was set to “herald a new era for Australia’s news producers”. Except, that hasn’t happened.

Despite broad industry pressure, Google and Facebook (Meta), have remained selective in their deal making.

“Many smaller news organisations have not yet been successful in securing agreements with the two digital giants.

A review into the code’s first year of operation was published in December last year, in which it was found that the code was generally “successful” but there were five recommendations made in the report and those will no doubt be on the agenda later this year.

Alongside this review, industry chatter around the longevity of the deals has picked up, with speculation centering on whether or not Meta will renew their deals at the end of their three-year term, “as the company no longer views news as central to the success of its digital platform”.

The report added: “A reduction in revenue delivered to publishers and broadcasters as a result of deals with digital platforms lapsing would significantly impact journalism in Australia, and is a key area to watch as 2023 unfolds.”

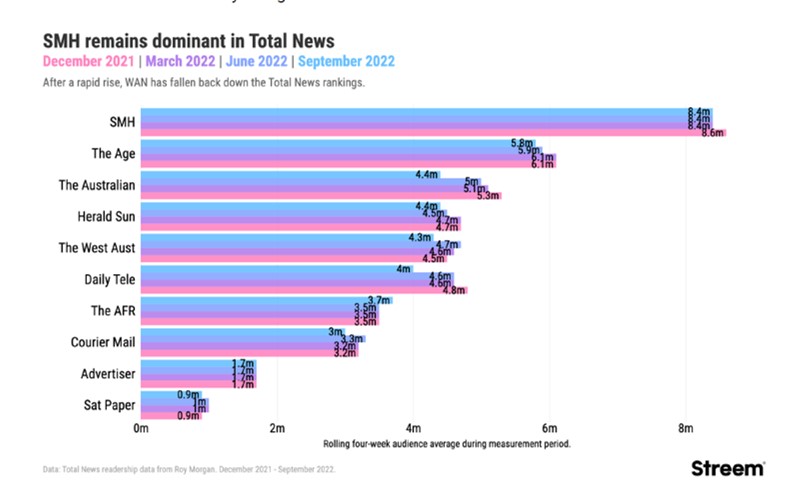

However, it’s not all doom and gloom for news businesses. According to the report, the latest set of Total News data, capturing the readership of Australia’s news brands, shows online consumption is growing at a rate that largely offsets the continuing decline of print news.

Data released in November 2022 reveals that while print readership has declined 12% year-on-year, the broadly stable level of online news consumption means that news readership as a whole fell by only 0.5% compared to the year prior.

The Sydney Morning Herald remains the top news brand, with 8.4 million readers across print and online, although this represents a 2.3% decline for the Nine-owned masthead. Of the top ten publications, The Australian Financial Review, also owned by Nine was the only one to grow its audience year-on-year, up from 3.5 million readers a year ago to 3.7 million in this most recent dataset.

Total News Readership Data Roy Morgan December 2021- September 2022.

The report notes that the commercial free to air television sector will continue to face challenging market conditions in 2023. Communications Minister Rowland has made a review of anti-siphoning legislation, which governs the free access of major sporting events, one of her department’s first priorities.

“The review will aim to chart a path towards reforming the decades-old suite of rules for the digital era, and has already prompted strong engagement from interested parties.”

The closing months of 2022 saw networks and subscription partners outlay huge amounts of money to lock down major sporting event rights well into the next decade.

Seven West Media (SWM) and Foxtel secured the AFL until 2031, and then in early January backed that up by extending the cricket broadcast rights, again through to 2031, for $1.5 billion. Crucially for SWM, both rights agreements will allow them to stream their component of the rights on their Broadcast Video On Demand (BVOD) service, 7plus.

BVOD has continued to grow rapidly, boosted by major events such as the Olympics (Seven previously and now with Nine) and the Australian Open (on Nine).

The FTA networks are leveraging the growth in audience on BVODs to create a ‘Total TV’ figure, “which it claims demonstrates a stable TV audience, rather than a declining one”.

The report continues: “The drop in free to air TV audiences is faster than the growth of SVOD services, and is not being made up by the growth of BVOD services.

“Although subscriber growth hasn’t slowed in Australia, foreign streaming giants will now be mindful of the new Australian content requirements detailed in the Albanese Government’s ‘Revive’ policy, which may trigger a rethink for international services looking to enter the Australian market.”

Finally, the challenging financial conditions, both domestically and abroad, may have slowed the roll of any significant media industry M&A activity, including stifling an expected Foxtel IPO. But with the oncoming financial storm, “expect to see as much speculation as ever about potential industry consolidation”.

The now-abandoned re-merger of Fox and News Corp being a recent example of this line of thinking.