TV networks stop releasing adspend data as push grows for another licence fee reduction

Australia’s television networks have quietly dropped their decade-long practice of releasing details of advertising spend across national and regional markets for each of the major broadcasters.

The data – which was previously published every six months – had been the outside world’s main means of getting a snapshot of the networks’ individual sales performances and comparative advertising share.

It was provided by the TV networks and audited by KPMG.

The data for the final six months of the calendar year was previously released late each January by industry body Free TV Australia. But this year the data did not emerge at the normal time.

In February, the television industry’s new marketing body Think TV announced the launch of a new “Total TV” headline number, which also covers spend on SBS and Foxtel.

According to Think TV’s new metric, total advertising spend on the television industry in the final six months of 2016 was $2.23bn, which it said was a decline of 2.72% on the same period a year before.

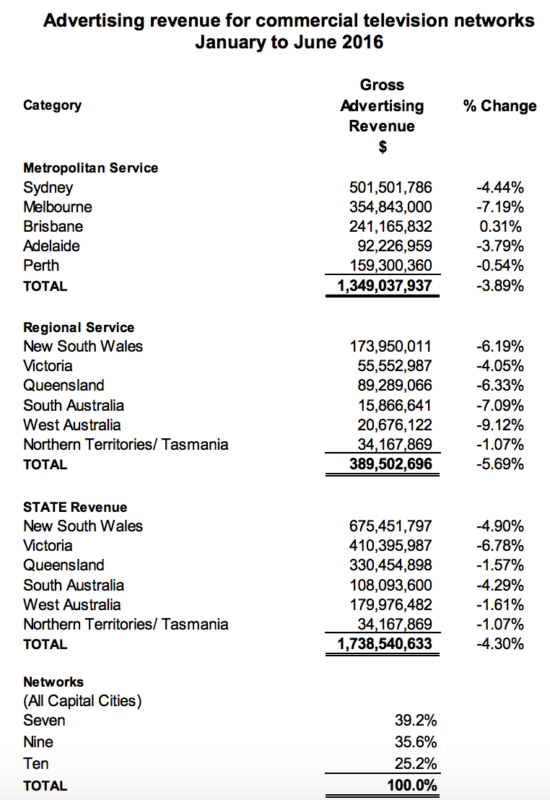

In the last numbers released by Free TV covering the financial year ended last June, total annual adspend with the big three networks and their regional affiliates was $3.7bn, including $1.7bn in the final half.

In February, Seven West Media said that the free to air market had declined by 4.5%.

The last set of Free TV data:

Source: Free TV Australia

The new data from Think TV:

Source: Think TV

On previous occasions, internal politics have threatened to derail Free TV Australia’s release of the detailed numbers, which are pored over by financial analysts wanting to know how advertising share was moving between the big three networks. In 2010, Ten temporarily withdrew from the system, hinting that Nine and Seven were manipulating the numbers to make their share look better.

The axing of the data leaves the market with no single source of third-party information on comparative advertising share performance between networks. The only publication to pick up on the implications of the move at the time was Crikey.

Standard Media Index (SMI) is the main source of data on adspend across the market, but is based on media agency spending, so does not include direct advertisers, who are particularly influential in regional markets.

Because the new number includes pay TV operator Foxtel, it means there is no longer a straightforward benchmark of how the free to air networks are travelling.

The move comes at a time when Australia’s free to air networks have been campaigning for reductions in their licence fees, which are based on paying a percentage of their revenues to the government in exchange for the right to use the public airwaves.

Over the past few years, Free TV Australia successfully argued that networks were paying too much, leading to a series of reductions from 9% of advertising revenues less than five years ago, to just 3.375% in November.

Minister for communications Mitch Fifield is currently being lobbied for a further reduction, to be announced as early as next week’s Budget.

However, the Free TV data tended to contradict the argument that TV networks were suffering dramatic revenue declines, showing that revenues have broadly been stable or even improved since the GFC.

Free TV Australia had not responded to Mumbrella’s questions at the time of posting, while Think TV pointed towards February’s press release but declined to say anything further.

That goes against the whole notion of ThinkTV helping TV become more transparent for the market and makes one question what they are trying to hide from the industry.

Tim, I thought Ebiquity and Nielsen also provide expenditure numbers for the networks broken down by categories, advertisers, etc?