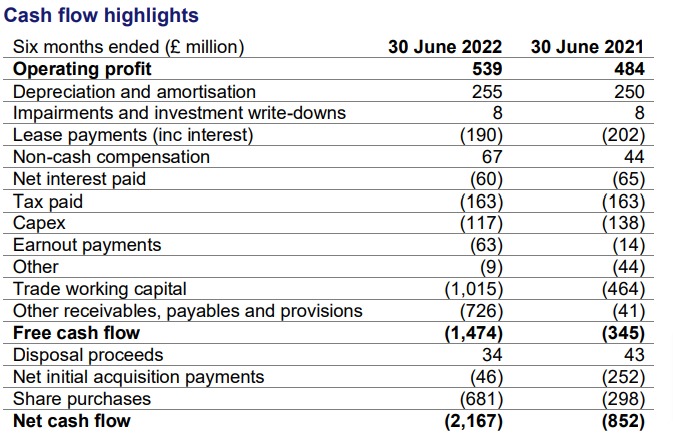

WPP’s first-half profit before tax grew 6.1% to 419 million pounds (AU$731 million) from last year’s 394 million pounds (AU$687 million) . The company said its performance in the first half of 2022 has been strong.

[click to enlarge]

Be a member to keep reading

Join Mumbrella Pro to access the Mumbrella archive and read our premium analysis of everything under the media and marketing umbrella.

Become a member

ADVERTISEMENT