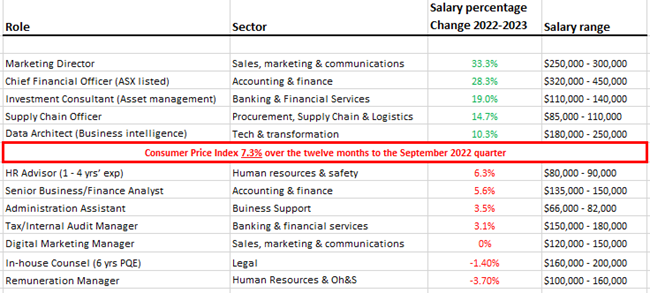

Workers who take a lower percentage of pay rise than the household inflation rate are taking a ‘real term’ pay cut, Robert Walters Salary Survey found.

Over the twelve months to the September 2022 quarter, Consumer Price Index (CPI) rose to 7.3%.

[click to enlarge]

Be a member to keep reading

Join Mumbrella Pro to access the Mumbrella archive and read our premium analysis of everything under the media and marketing umbrella.

Become a member

ADVERTISEMENT