Australia’s global ad spend growth to fall below global forecasts: Dentsu

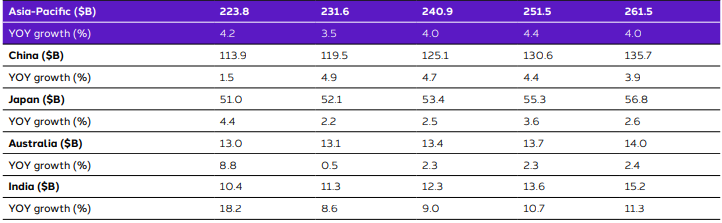

Dentsu has released its annual global ad spend forecasts, foreshadowing a “challenging macroeconomic background” and another year of moderate year-on-year (YOY) growth for 2024.

Globally, dentsu has forecast ad spend to grow by 4.6% YOY in 2024, ahead of just 2.7% YOY growth in 2023. The advertising group attributed much of the growth to media price inflation in 2023, with ad spend at constant prices actually declining by 0.7%.