BVOD spend improves while total TV revenue staggers in 2022: ThinkTV

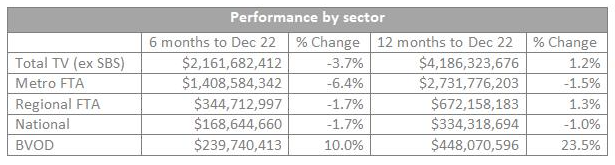

The total Australian TV advertising market recorded $4.1 billion in revenue in the year ending December, resulting in a humble 1.2% increase compared to the prior year, according to figures released by ThinkTV.

This total TV figure includes metropolitan free-to-air, regional free-to-air, subscription TV and Broadcaster Video on Demand (BVOD) and excludes SBS. The market witnessed far greater growth at the end 2021, recording a 19.9% yearly increase.

Two sectors that witnessed growth in the 12 months to December 2022 were Regional FTA ($672 million) and BVOD ($448 million), resulting in a 1.3% and 23.5% increase respectively. BVOD platforms examined included 7plus, 9Now, 10 Play, Foxtel Go, Foxtel Now and Kayo.

In the six months leading to December 2022, TV advertising revenue was $2.1 billion, down 3.7% when compared to the same period ending December 2021.

Linear viewership has been experiencing a decline in recent times, as evidenced by the launches of Australian Idol, Australian Survivor and Married At First Sight which all reported softer opening night performance compared to previous years.

As a result, advertisers are opting more into campaigns that are delivered across all channels in the TV ecosystem as opposed to linear only. For example, personal care brand Dove recently partnered with Seven Network recently via PHD, which included a 31% allocation of audience to BVOD on 7plus.

Dove campaign

Sydney trading director at UM Australia, Lorena Danes, said media agencies are adjusting the way they are spending money from this trend, but there are more elements at play behind the recorded linear figure.

“The cost of linear is still quite expensive, because the demand is there and inflation is increasing, so the spend in linear necessarily isn’t going down as much,” she told Mumbrella.

“It’s more that more money is going into screens in order to account for the digital side going up. Within a screens budget, we’re tending to see it shift from what traditionally used to be maybe an 80/20 to now being closer to like a 60/40 [split], depending on the client.

“BVOD is an interesting one: a 23.5% increase in 12 months to December 2022 is incredible, that’s a very strong increase year-on-year. We expect that to continue – probably not at that level – but it will definitely continue to increase whilst Metro and Regional probably will remain flat, just because the demand is still there from advertisers to be within the linear television space. ”

ThinkTV CEO Kim Portrate said: “Total TV had a solid year, despite the last six months reflecting broader macro-economic conditions felt by all sectors of the industry.

“Audience viewing habits continue to shift and Australian broadcasters are expanding the way they cater to these changes. The growth of streaming viewership, and the introduction of FAST channels, are two great examples of innovations in the BVOD space in the last 12 months. Advertisers are clearly taking note with revenue once again increasing for BVOD, Australia’s fastest growing media channel.”