‘It’s getting worse – financial marketers are expected to do even more’ reveals damning new survey

Financial marketers are now under pressure to juggle an increased number of objectives within their roles, according to Australia’s largest-ever survey of both consumers and industry professionals.

The findings, unveiled at Mumbrella’s Finance Summit, also revealed that customers don’t trust financial services companies and that those businesses are failing to meet the needs of modern consumers and how they use technology.

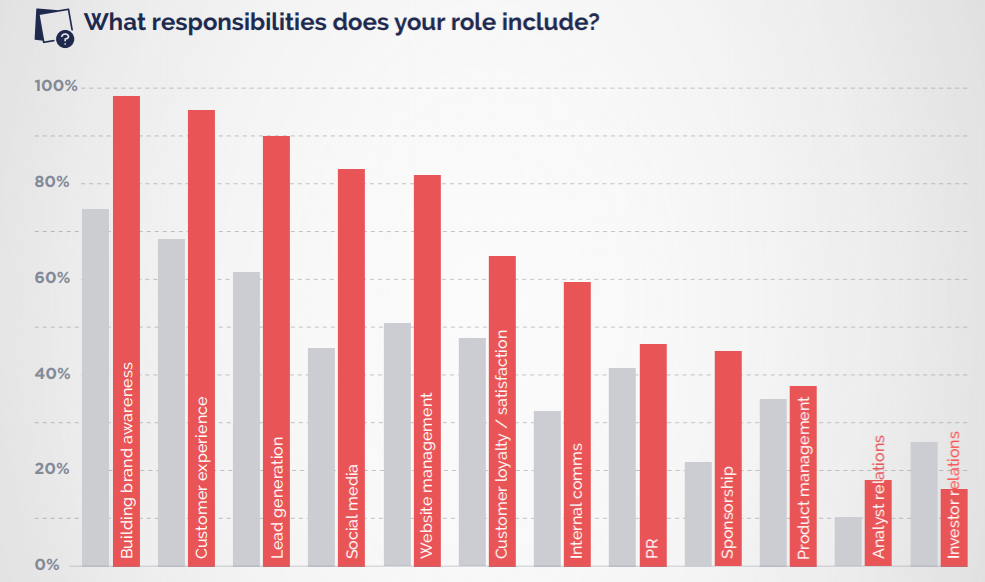

A snippet of the research from Yell Creative and YouGov